1120 Schedule K Form 2011

What is the 1120 Schedule K Form

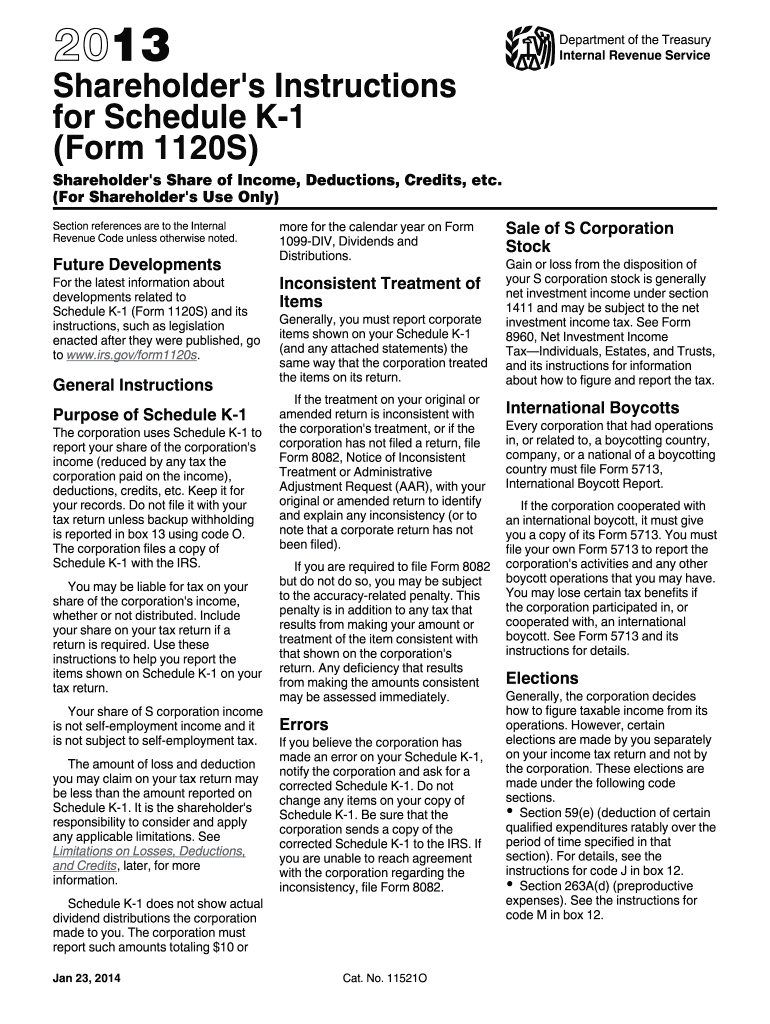

The 1120 Schedule K Form is a crucial tax document used by corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically designed for S corporations to provide detailed information about the income and expenses of the business, which is then passed through to shareholders for reporting on their individual tax returns. The Schedule K includes various sections that outline the corporation's financial activities, ensuring transparency and compliance with federal tax regulations.

How to use the 1120 Schedule K Form

Using the 1120 Schedule K Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax records. Next, fill out the form by entering the corporation's income, deductions, and credits as required. It is essential to follow the IRS instructions carefully to avoid errors. Once completed, the form should be submitted alongside the corporation's tax return, typically Form 1120S, by the designated filing deadline.

Steps to complete the 1120 Schedule K Form

Completing the 1120 Schedule K Form requires attention to detail. Here are the key steps:

- Begin by entering the corporation's name, address, and employer identification number (EIN) at the top of the form.

- Report the total income received by the corporation during the tax year in the appropriate section.

- List all deductions, including business expenses, on the form to calculate the net income.

- Include any credits the corporation is eligible for, which can reduce the overall tax liability.

- Review the form for accuracy, ensuring that all numbers are correct and that it aligns with supporting documentation.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1120 Schedule K Form

The 1120 Schedule K Form is legally binding when completed and submitted according to IRS regulations. It is essential for corporations to ensure that the information provided is accurate and truthful, as discrepancies can lead to penalties or audits. The form serves as a formal declaration of the corporation's financial status and must be filed within the specified deadlines to maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 Schedule K Form are critical to avoid penalties. Generally, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request an extension, but it is important to note that this does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The 1120 Schedule K Form can be submitted to the IRS through various methods. Corporations can file electronically using IRS-approved e-filing software, which is often the most efficient and secure method. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether it includes a payment. In-person submissions are generally not accepted, making electronic and mail options the preferred methods for compliance.

Quick guide on how to complete 1120 schedule k 2010 2011 form

Effortlessly Prepare 1120 Schedule K Form on Any Device

Managing documents online has gained traction among organizations and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle 1120 Schedule K Form on any platform through airSlate SignNow Android or iOS applications and enhance any document-based process today.

Easily Edit and eSign 1120 Schedule K Form

- Obtain 1120 Schedule K Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1120 Schedule K Form and ensure exceptional communication throughout your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 schedule k 2010 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 1120 schedule k 2010 2011 form

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the 1120 Schedule K Form?

The 1120 Schedule K Form is a necessary document used by corporations to report their income, deductions, and credits for tax purposes. This form must be submitted along with the corporate tax return, providing a detailed overview of the corporation’s financial status.

-

How can airSlate SignNow help with the 1120 Schedule K Form?

airSlate SignNow simplifies the process of completing the 1120 Schedule K Form by allowing users to electronically sign and send documents securely. The platform's user-friendly interface ensures that businesses can efficiently manage their tax forms without unnecessary complications.

-

Is there a cost associated with using airSlate SignNow for the 1120 Schedule K Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, ensuring a cost-effective solution for handling the 1120 Schedule K Form. There are flexible options, allowing users to choose a plan that suits their requirements and budget.

-

What features does airSlate SignNow offer for managing tax documents like the 1120 Schedule K Form?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and document tracking. These tools streamline the process of preparing and submitting the 1120 Schedule K Form, making compliance easy and efficient.

-

Can I integrate airSlate SignNow with other accounting software to assist with the 1120 Schedule K Form?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing for a seamless workflow when managing the 1120 Schedule K Form. This ensures that your financial data is consistently aligned and easily accessible across platforms.

-

What are the benefits of using airSlate SignNow for the 1120 Schedule K Form compared to traditional methods?

Utilizing airSlate SignNow for the 1120 Schedule K Form provides several advantages, including faster processing times, reduced paperwork, and improved security. By going digital, businesses can save time and resources while ensuring their documents are safely signed and stored.

-

Is airSlate SignNow user-friendly for someone unfamiliar with the 1120 Schedule K Form?

Yes, airSlate SignNow is specifically designed to be user-friendly, making it accessible even for individuals unfamiliar with the 1120 Schedule K Form. The straightforward interface and helpful resources help guide users through the process seamlessly.

Get more for 1120 Schedule K Form

- Living trust for individual who is single divorced or widow or widower with children georgia form

- Living trust for husband and wife with minor and or adult children georgia form

- Amendment to living trust georgia form

- Living trust property record georgia form

- Financial account transfer to living trust georgia form

- Assignment to living trust georgia form

- Notice of assignment to living trust georgia form

- Revocation of living trust georgia form

Find out other 1120 Schedule K Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT