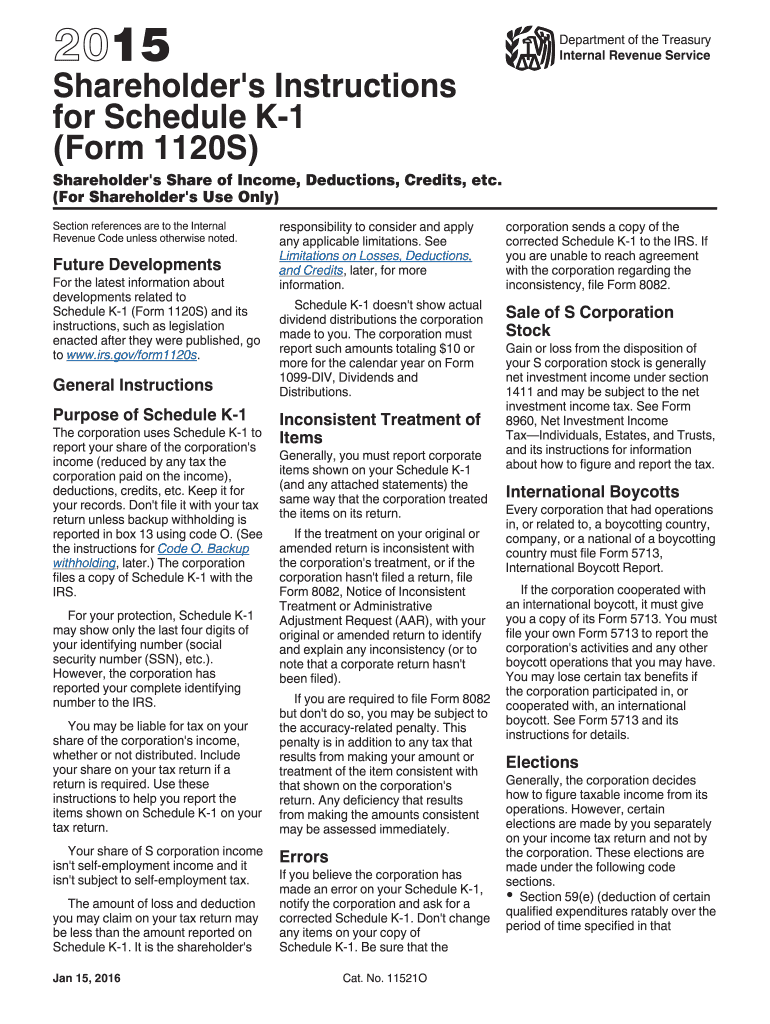

K 1 Form 2015

What is the K-1 Form

The K-1 Form, officially known as Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is necessary for individual tax returns. The K-1 Form is crucial for ensuring that all income is accurately reported to the IRS, allowing for proper taxation based on each individual's share of the entity's earnings.

How to use the K-1 Form

To effectively use the K-1 Form, individuals must first receive it from the entity in which they have an interest, such as a partnership or S corporation. Once received, the information on the K-1 must be reviewed carefully. Taxpayers will need to report the amounts listed on the K-1 on their personal tax returns, typically using Form 1040. It is important to ensure that the income reported on the K-1 matches what is reported by the entity to avoid discrepancies with the IRS.

Steps to complete the K-1 Form

Completing the K-1 Form involves several key steps:

- Gather necessary information about the partnership or S corporation, including the entity's name, address, and taxpayer identification number.

- Fill in the partner's or shareholder's information, including their name, address, and ownership percentage.

- Report the income, deductions, and credits as provided by the entity. This may include ordinary income, capital gains, and other specific items.

- Ensure all amounts are accurate and reflect the entity's financial statements.

- Distribute the completed K-1 Form to the appropriate parties, ensuring that each partner or shareholder receives their copy for tax reporting.

Legal use of the K-1 Form

The K-1 Form must be used in compliance with IRS regulations. It is legally required for partnerships and S corporations to issue K-1 Forms to their partners and shareholders by the tax filing deadline. Recipients of the K-1 Form must include the reported amounts on their individual tax returns. Failure to accurately report this information can lead to penalties and interest charges from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the K-1 Form are critical for compliance. Partnerships and S corporations must provide K-1 Forms to their partners and shareholders by March 15 each year. This allows individuals to incorporate the information into their tax returns, which are typically due on April 15. If the entity requests an extension, the K-1 Forms must still be sent to recipients by the extended deadline, ensuring that all parties have the necessary information for timely filing.

Who Issues the Form

The K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing the K-1 Form to its partners or shareholders. It is essential for these entities to maintain accurate records of their financial activities to ensure that the information reported on the K-1 is correct and in compliance with IRS guidelines.

Quick guide on how to complete 2015 k 1 form

Discover the simplest method to complete and endorse your K 1 Form

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior approach to finish and endorse your K 1 Form and related forms for civic services. Our intelligent electronic signature solution equips you with all the tools necessary to manage your documentation efficiently and in compliance with official standards - robust PDF editing, organizing, securing, signing, and sharing functionalities all available within a user-friendly interface.

Only a few steps are needed to complete and endorse your K 1 Form:

- Upload the fillable template to the editor using the Get Form button.

- Verify what details you need to enter in your K 1 Form.

- Move through the fields with the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill the blanks with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Redact sections that are no longer relevant.

- Select Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed K 1 Form in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your templates when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2015 k 1 form

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the 2015 k 1 form

How to make an eSignature for the 2015 K 1 Form in the online mode

How to create an eSignature for the 2015 K 1 Form in Google Chrome

How to make an electronic signature for signing the 2015 K 1 Form in Gmail

How to create an electronic signature for the 2015 K 1 Form from your smartphone

How to generate an eSignature for the 2015 K 1 Form on iOS devices

How to generate an electronic signature for the 2015 K 1 Form on Android OS

People also ask

-

What is a K 1 Form and why is it important?

A K 1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is essential for ensuring accurate tax reporting for individuals involved in these entities. Understanding the K 1 Form helps you comply with tax regulations and allows you to effectively manage your financial obligations.

-

How can airSlate SignNow help me with my K 1 Form?

airSlate SignNow simplifies the process of sending and signing your K 1 Form electronically. With its user-friendly interface, you can quickly prepare, send, and eSign your K 1 Form, ensuring that it signNowes your partners or stakeholders efficiently. This streamlines your workflow and reduces the time spent on document management.

-

Is airSlate SignNow a cost-effective solution for managing K 1 Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your K 1 Forms. With competitive pricing plans, businesses can access premium features that enhance document management without breaking the bank. This allows you to focus on your core business operations while efficiently handling your K 1 Form requirements.

-

What features does airSlate SignNow offer for K 1 Form management?

airSlate SignNow provides a range of features tailored for K 1 Form management, including customizable templates, secure eSigning, and real-time tracking. These features ensure that you can create and manage your K 1 Form seamlessly, while maintaining compliance and security. Additionally, the platform supports document collaboration, making it easy for all parties involved.

-

Can I integrate airSlate SignNow with other tools for K 1 Form handling?

Absolutely! airSlate SignNow integrates with various tools such as CRM systems, accounting software, and cloud storage services. This allows you to streamline your workflow and ensure that your K 1 Form is easily accessible alongside other important documents. By integrating these tools, you enhance productivity and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for my K 1 Form?

Using airSlate SignNow for your K 1 Form offers numerous benefits, including increased efficiency, enhanced security, and easy accessibility. The platform enables you to send, sign, and store your documents securely in the cloud, which minimizes the risk of loss or tampering. Additionally, the electronic signature feature expedites the approval process, ensuring timely compliance.

-

Is there customer support available for issues related to K 1 Forms?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any issues related to your K 1 Form. Whether you have questions about document preparation, eSigning, or integrating with other software, their support team is readily available to help. This ensures that you can resolve any issues quickly and maintain a smooth document management process.

Get more for K 1 Form

- Application for permission for attorney to appear pro hac vice in a court case form

- One dayone trialjuror application for reimbursement and request for social security number form

- Request for adjudicationcomplex litigation docket cld form

- Conservatorship petition hearing date form

- Florida supreme court approved family law form 12903d answer to counterpetition family law form 12903d answer to

- De 315 order determining succession to real property estates of form

- Civ 561 service instructions for writ of execution state of form

- Dr 721 instructions for response state of alaska form

Find out other K 1 Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF