Internal Revenue Service Shareholder's Instructions for 2020

What is the Internal Revenue Service Shareholder's Instructions For

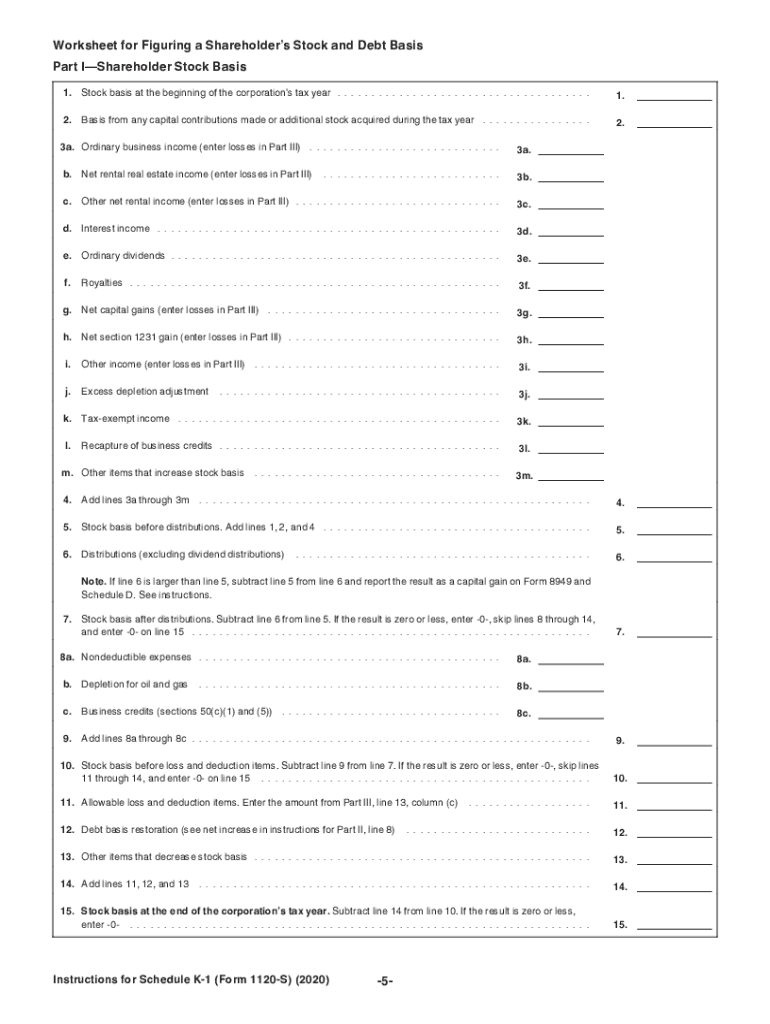

The Internal Revenue Service (IRS) Shareholder's Instructions for Form 1120S K-1 (2017) is a crucial document for S corporations and their shareholders. This form provides detailed information about each shareholder's share of the corporation's income, deductions, and credits. It is essential for accurate tax reporting, as shareholders use the information on the K-1 to complete their individual tax returns. The form outlines the shareholder's portion of the corporation's earnings and losses, ensuring compliance with federal tax regulations.

Steps to complete the Internal Revenue Service Shareholder's Instructions For

Completing the IRS Shareholder's Instructions for Form 1120S K-1 involves several key steps:

- Gather necessary information, including the corporation's EIN, the shareholder's tax identification number, and financial details from the corporation's tax return.

- Fill out the form accurately, ensuring that each section reflects the correct amounts for income, deductions, and credits allocated to the shareholder.

- Review the completed form for any errors or omissions, as inaccuracies can lead to compliance issues.

- Provide a copy of the K-1 to each shareholder by the IRS deadline, ensuring they have the information needed for their personal tax returns.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IRS Shareholder's Instructions for Form 1120S K-1 is essential for compliance. Generally, the S corporation must file its Form 1120S by the fifteenth day of the third month after the end of its tax year. For calendar year filers, this means the due date is March 15. Additionally, the corporation must provide the K-1 forms to shareholders by this same date, allowing shareholders adequate time to prepare their individual tax returns.

Legal use of the Internal Revenue Service Shareholder's Instructions For

The legal use of the IRS Shareholder's Instructions for Form 1120S K-1 hinges on its accuracy and timely submission. The information contained within this form is legally binding and must reflect the true financial position of the S corporation and its shareholders. Failure to comply with IRS regulations regarding the K-1 can result in penalties for both the corporation and the individual shareholders. It is crucial that all parties involved understand their responsibilities in the preparation and submission of this form.

Required Documents

To complete the IRS Shareholder's Instructions for Form 1120S K-1, several documents are necessary:

- The corporation's Form 1120S, which provides the overall financial picture.

- Shareholder agreements or records that specify ownership percentages.

- Financial statements that detail income, deductions, and credits applicable to the shareholders.

- Any additional documents that support the reported amounts, such as receipts or invoices for deductions.

Examples of using the Internal Revenue Service Shareholder's Instructions For

Examples of using the IRS Shareholder's Instructions for Form 1120S K-1 can help clarify its application. For instance, if an S corporation earns $100,000 in income and has three shareholders with equal ownership, each shareholder would receive a K-1 reflecting $33,333 of income. Conversely, if one shareholder incurred significant business expenses, their K-1 might show a lower income or even a loss, depending on the corporation's overall financial situation. These examples illustrate how the K-1 reflects the unique financial circumstances of each shareholder.

Quick guide on how to complete internal revenue service shareholders instructions for

Complete Internal Revenue Service Shareholder's Instructions For effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Internal Revenue Service Shareholder's Instructions For across any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

The simplest way to alter and electronically sign Internal Revenue Service Shareholder's Instructions For without any hassle

- Locate Internal Revenue Service Shareholder's Instructions For and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Internal Revenue Service Shareholder's Instructions For and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service shareholders instructions for

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service shareholders instructions for

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 1120s K 1 2017 form, and why is it important?

The 1120s K 1 2017 form is crucial for S corporations, as it reports each shareholder's share of income, deductions, and credits. Understanding this form is essential for accurate tax filings and ensuring compliance with IRS requirements, which helps prevent potential penalties.

-

How can airSlate SignNow simplify the signing of the 1120s K 1 2017 form?

airSlate SignNow streamlines the process of signing the 1120s K 1 2017 form by allowing multiple parties to eSign documents easily and securely. This ensures that all necessary signatures are collected in a timely manner, eliminating delays and increasing efficiency.

-

What features does airSlate SignNow offer for handling the 1120s K 1 2017 documents?

AirSlate SignNow provides features like customizable templates, in-app messaging, and cloud storage for your 1120s K 1 2017 documents. These tools empower users to manage complex paperwork effectively and maintain organized records for tax purposes.

-

Is there a pricing plan suitable for small businesses using the 1120s K 1 2017 form?

Yes, airSlate SignNow offers flexible pricing plans designed to meet the needs of small businesses managing the 1120s K 1 2017 form. These cost-effective solutions provide access to essential eSignature tools without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my 1120s K 1 2017 process?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and business applications, making it easier to incorporate the 1120s K 1 2017 form into your existing workflow. This integration helps streamline data entry and improves overall efficiency when managing forms.

-

What are the benefits of using airSlate SignNow for the 1120s K 1 2017 eSigning process?

Using airSlate SignNow for the 1120s K 1 2017 eSigning process offers numerous benefits, including increased security, faster turnaround times, and the ability to track document status in real-time. These advantages not only save time but also enhance the overall user experience.

-

How does airSlate SignNow ensure the security of my 1120s K 1 2017 documents?

AirSlate SignNow employs advanced encryption protocols and complies with industry standards to protect your 1120s K 1 2017 documents. This commitment to security guarantees that sensitive information remains safe during the eSigning process.

Get more for Internal Revenue Service Shareholder's Instructions For

- M 6025 notice to employers and other preparers of 2022 wage and tax statements m 6025 notice to employers and other preparers form

- Revenuedelawaregovpersonal income tax forms2020 2021 personal income tax forms division of revenue

- Delaware declaration of estimated form 400 es fiduciary income tax 3e

- Form mv 21 a lien entry form

- 2023 2024 form 921 application for homestead exemption

- Oklahomagovcontentdam2023 form 901 business personal property rendition oklahoma

- 2023 form 952 application for manufactured home personal property exemption

- Oklahoma corporate income tax return form and schedules

Find out other Internal Revenue Service Shareholder's Instructions For

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online