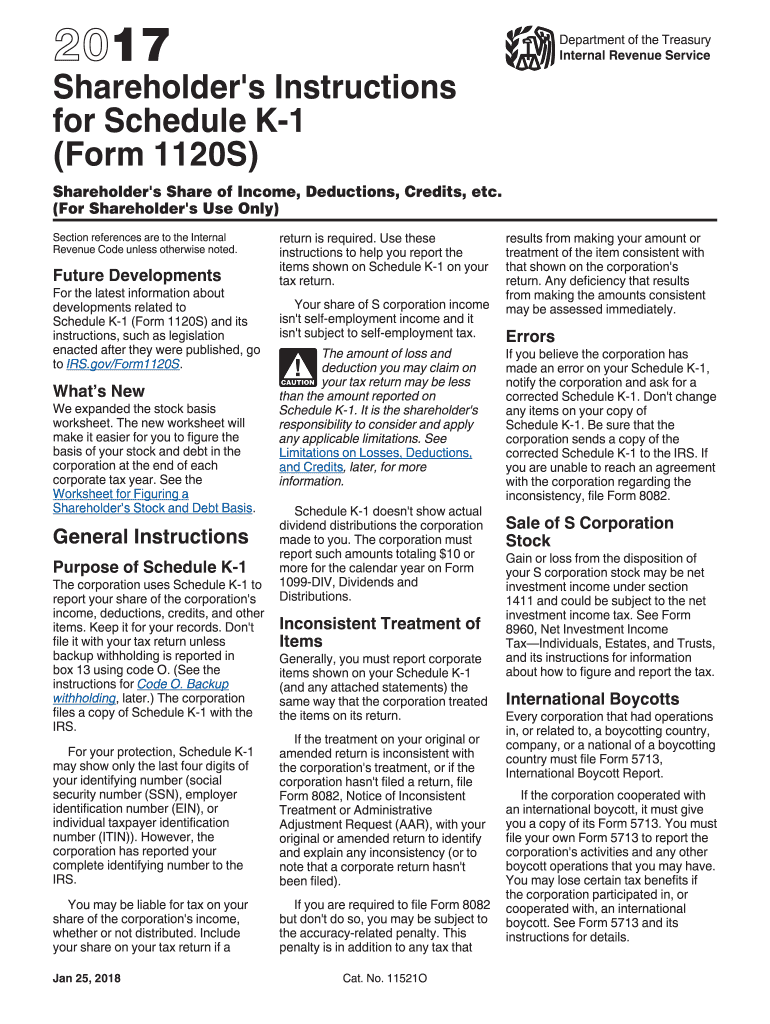

K 1 Form 2017

What is the K-1 Form

The K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is then reported on their individual tax returns. The K-1 Form is essential for ensuring accurate tax reporting and compliance with IRS regulations.

How to Use the K-1 Form

To use the K-1 Form, individuals must first receive it from the partnership or corporation in which they hold an interest. Once received, the information on the form must be carefully reviewed and transferred to the appropriate sections of the individual tax return. It is crucial to ensure that all reported amounts align with personal records to avoid discrepancies during tax filing.

Steps to Complete the K-1 Form

Completing the K-1 Form involves several key steps:

- Gather necessary information about the entity, including its name, address, and tax identification number.

- Input the partner’s or shareholder's identifying information, such as name and Social Security number.

- Report income, losses, and deductions as outlined on the form, ensuring accuracy in each section.

- Review the completed form for any errors or omissions before submission.

Legal Use of the K-1 Form

The K-1 Form must be used in compliance with IRS guidelines. It is legally binding, and any inaccuracies can lead to penalties or audits. Each entity is responsible for providing accurate K-1 Forms to its partners or shareholders, and recipients must report the information correctly on their tax returns to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the K-1 Form can vary based on the type of entity issuing the form. Generally, partnerships and S corporations must provide K-1 Forms to their partners and shareholders by March 15. Recipients should ensure that they receive their forms in time to include the information in their tax filings, which are typically due on April 15.

Who Issues the Form

The K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing the form to its partners or shareholders. It is important for these entities to maintain accurate records and ensure timely distribution of the K-1 Forms to facilitate proper tax reporting by recipients.

Quick guide on how to complete 2017 k 1 form

Uncover the simplest method to complete and endorse your K 1 Form

Are you still spending time preparing your formal paperwork on paper instead of doing it online? airSlate SignNow provides a superior approach to complete and endorse your K 1 Form and similar forms for public services. Our advanced electronic signature solution equips you with everything necessary to handle documents swiftly and in compliance with official standards - comprehensive PDF editing, managing, safeguarding, signing, and sharing tools right at your fingertips within an intuitive interface.

Only a few steps are needed to complete and endorse your K 1 Form:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to fill in your K 1 Form.

- Move through the fields with the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the blanks with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Click on Sign to create a legally binding electronic signature with any method you prefer.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed K 1 Form in the Documents directory within your profile, download it, or transfer it to your chosen cloud storage. Our solution also offers flexible file sharing. There's no need to print your templates when you need to submit them to the appropriate public office - do it using email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 k 1 form

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Which private college form should I fill out as I expect to get a 155 in the JEE Mains 2017?

Before trying to fill out private college forms, have a through knowing on filling up JOSAA, hope you will land up around +/- 25k rank in jee main, so you could easily get into iiit kanjeepuram and iiit Sri City, compared to last year data.

-

How do I fill out the online exam form for the IPCC in November 2017 from Kathmandu?

You can visit http://icaiexams.icai.orgLast date is 25th of August, 2017

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the 2017 k 1 form

How to make an electronic signature for your 2017 K 1 Form in the online mode

How to make an eSignature for the 2017 K 1 Form in Chrome

How to generate an eSignature for putting it on the 2017 K 1 Form in Gmail

How to generate an eSignature for the 2017 K 1 Form from your smart phone

How to create an electronic signature for the 2017 K 1 Form on iOS

How to create an eSignature for the 2017 K 1 Form on Android OS

People also ask

-

What is a K 1 Form and why is it important?

The K 1 Form is a tax document issued by partnerships and S corporations to report income, deductions, and credits to their partners or shareholders. It plays a crucial role in ensuring accurate tax reporting for individuals involved in these entities. Understanding the K 1 Form is essential for compliance with IRS regulations and to avoid any potential tax liabilities.

-

How does airSlate SignNow facilitate the signing of K 1 Forms?

airSlate SignNow provides a user-friendly platform that allows businesses to easily send and eSign K 1 Forms electronically. With its intuitive interface, users can upload their K 1 Forms, add signers, and track the signing process in real-time, ensuring a seamless experience. This eliminates the hassle of paper documents and speeds up the turnaround time for important tax filings.

-

Can I store my K 1 Forms securely using airSlate SignNow?

Yes, airSlate SignNow offers secure cloud storage for your K 1 Forms. All documents are encrypted and stored with robust security measures, ensuring that sensitive tax information remains confidential. This allows you to access your K 1 Forms anytime, anywhere, without worrying about data bsignNowes.

-

What are the pricing options for using airSlate SignNow for K 1 Forms?

airSlate SignNow offers flexible pricing plans to cater to various business needs, including options for individuals and teams. The cost-effective solution includes features specifically designed for managing documents like K 1 Forms, ensuring you get the best value for your investment. You can choose a plan that fits your frequency of use and the number of documents you handle.

-

Does airSlate SignNow integrate with accounting software for K 1 Forms?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage K 1 Forms alongside your financial data. This integration streamlines your workflow, allowing for efficient data transfer and reducing the chances of errors when preparing tax documents.

-

What features does airSlate SignNow offer for managing K 1 Forms?

airSlate SignNow includes a variety of features designed specifically for managing K 1 Forms, such as customizable templates, automated reminders, and real-time tracking. These tools enhance efficiency and ensure that all signers complete the necessary steps promptly. Additionally, the platform supports in-person signing for added convenience.

-

Is it easy to use airSlate SignNow for K 1 Forms, even for non-tech savvy users?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to manage K 1 Forms, regardless of their technical expertise. The intuitive interface guides users through the process of uploading, sending, and signing documents, ensuring a smooth experience. Comprehensive support resources are also available to assist users as needed.

Get more for K 1 Form

Find out other K 1 Form

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free