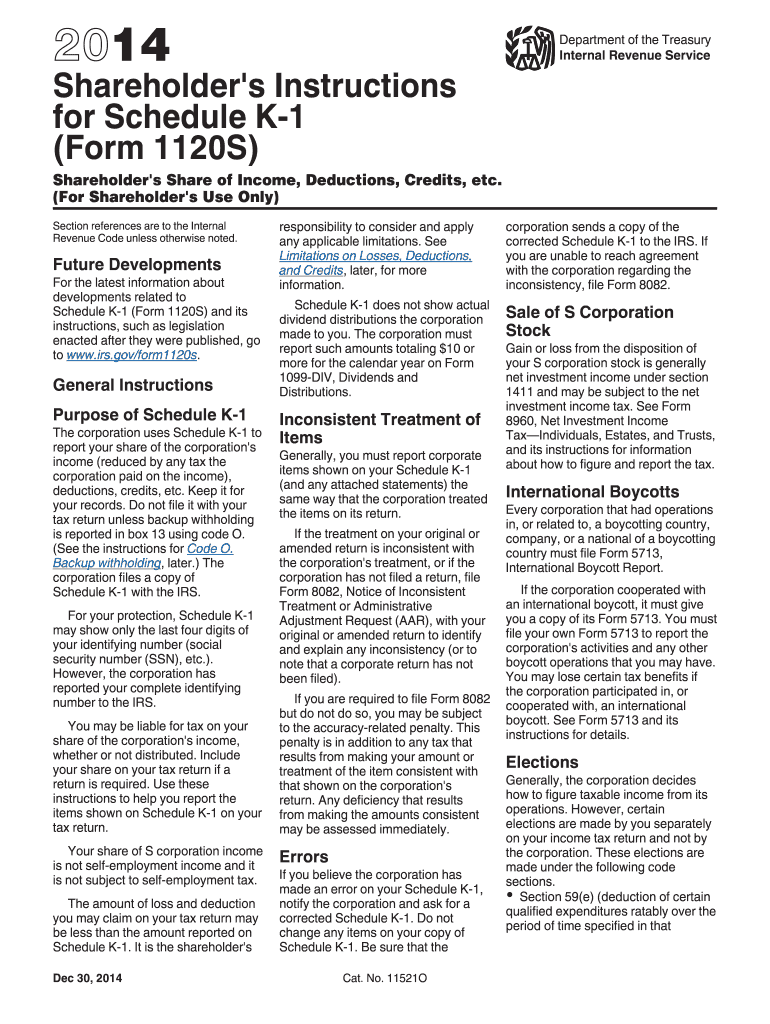

Irs K 1 Form 2014

What is the IRS K-1 Form

The IRS K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is then reported on their individual tax returns. The form is essential for ensuring that all income is accurately reported to the IRS and that partners or shareholders receive proper credit for their share of the earnings.

How to Use the IRS K-1 Form

Using the IRS K-1 Form involves several steps. First, the entity must prepare the form, detailing each partner's share of income, deductions, and credits. Once completed, the K-1 is distributed to each partner or shareholder. Recipients must then include the information from the K-1 on their personal tax returns, specifically on Schedule E (Supplemental Income and Loss). It is important to review the K-1 for accuracy, as any discrepancies can lead to issues with the IRS.

Steps to Complete the IRS K-1 Form

Completing the IRS K-1 Form requires careful attention to detail. Here are the steps involved:

- Gather necessary financial information from the partnership or S corporation.

- Fill out the entity's identifying information, including name, address, and tax identification number.

- Report each partner's share of income, deductions, and credits in the appropriate sections of the form.

- Ensure all calculations are accurate and reflect the entity's financial records.

- Distribute the completed K-1 forms to all partners or shareholders by the deadline.

Legal Use of the IRS K-1 Form

The IRS K-1 Form is legally binding and must be completed accurately to comply with federal tax regulations. Each partner or shareholder is responsible for reporting the information on their tax returns. Failure to report K-1 income can result in penalties and interest charges from the IRS. Additionally, it is crucial for the entity to ensure that the K-1 is filed correctly to avoid any legal complications.

Who Issues the IRS K-1 Form

The IRS K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing the form to its partners or shareholders. The form must be provided to recipients by the tax filing deadline, ensuring that they have the necessary information to accurately report their income on their personal tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the IRS K-1 Form vary depending on the type of entity. Typically, partnerships and S corporations must provide K-1 forms to their partners or shareholders by March 15. However, if the entity has filed for an extension, the deadline may be extended to September 15. It is essential for both the issuing entity and the recipients to be aware of these deadlines to ensure compliance with IRS regulations.

Quick guide on how to complete 2014 irs k 1 form

Effortlessly Prepare Irs K 1 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It presents an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly, without any hold-ups. Handle Irs K 1 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

A Simple Way to Edit and eSign Irs K 1 Form

- Locate Irs K 1 Form and select Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Irs K 1 Form to ensure excellent communication throughout any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs k 1 form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Irs K 1 Form and why is it important?

The Irs K 1 Form is a key tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It's essential for ensuring proper tax compliance and accurate reporting of your income. By understanding the Irs K 1 Form, you can effectively manage your tax obligations and avoid potential penalties.

-

How can airSlate SignNow assist with the Irs K 1 Form?

airSlate SignNow simplifies the process of sending and eSigning the Irs K 1 Form, making it easy for businesses and individuals to manage their tax documents securely. With our platform, you can expedite the signing process, ensuring that all necessary parties can access and sign the document without delays. This efficiency helps streamline your tax preparation efforts.

-

Is there a cost associated with using airSlate SignNow for the Irs K 1 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs when working with documents such as the Irs K 1 Form. Our plans are designed to be cost-effective, allowing businesses to choose options that suit their budget while benefiting from our robust features. You can find a plan that meets your requirements without compromising on functionality.

-

What features does airSlate SignNow offer for handling the Irs K 1 Form?

airSlate SignNow provides several features to optimize the management of the Irs K 1 Form, including customizable templates, secure eSigning, and document tracking. These features enhance the user experience by ensuring that the form is filled out correctly and signed promptly. Additionally, you can easily store and retrieve your documents in a compliant manner.

-

Can I integrate airSlate SignNow with other software for the Irs K 1 Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, which can streamline your workflow when dealing with the Irs K 1 Form. Whether you need to connect with accounting software, CRM tools, or other document management systems, our integrations make it easy to enhance productivity across platforms.

-

What are the benefits of using airSlate SignNow for tax documents like the Irs K 1 Form?

Using airSlate SignNow for tax documents such as the Irs K 1 Form enhances efficiency and reduces the likelihood of errors. Our platform ensures that your documents are securely signed and filed, helping you maintain compliance with IRS regulations. Additionally, the time saved on document management allows you to focus more on your core business activities.

-

Is airSlate SignNow compliant with regulations regarding the Irs K 1 Form?

Yes, airSlate SignNow is designed to comply with relevant regulatory requirements when it comes to signing the Irs K 1 Form and other tax documents. We prioritize the security of your data and ensure that our eSignature solutions meet industry standards for legal compliance. Choosing airSlate SignNow provides peace of mind for handling sensitive tax information.

Get more for Irs K 1 Form

- Application for interim instructional services form

- Preschool child find questionnaire form

- Authorization form to release confidential information

- Release of information early childhood development maryland

- Student records review and update verification certification form

- Apprenticeship programs florida department of education form

- Partner agency referral tips form

- North carolina dietetic association ncdamemberclicksnet ncda memberclicks form

Find out other Irs K 1 Form

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online