Shareholder's Instructions for Schedule K 1 Form 1120 S 2024-2026

Understanding the Shareholder's Instructions for Schedule K-1 Form 1120-S

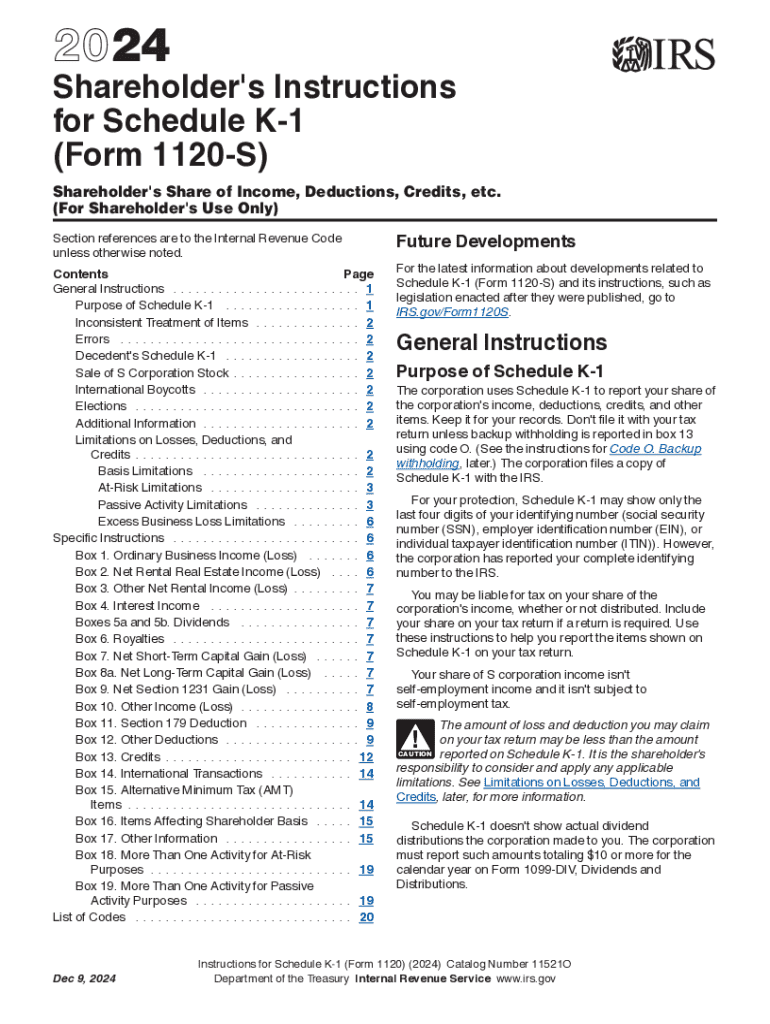

The Shareholder's Instructions for Schedule K-1 Form 1120-S provide essential guidance for shareholders of S corporations. This form is crucial for reporting income, deductions, and credits that shareholders need to include on their personal tax returns. The instructions outline the specific information required, including how to report various types of income, such as ordinary business income, rental income, and capital gains. Understanding these instructions helps ensure accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Shareholder's Instructions for Schedule K-1 Form 1120-S

Completing the Shareholder's Instructions for Schedule K-1 Form 1120-S involves several key steps:

- Gather necessary financial documents, including the corporation's financial statements and prior year tax returns.

- Review the K-1 form to identify the sections that apply to your share of income, deductions, and credits.

- Fill out the form accurately, ensuring that all figures correspond to the corporation's records.

- Consult the instructions for specific line items to ensure compliance with IRS requirements.

- Submit the completed K-1 to the IRS along with your personal tax return.

Filing Deadlines and Important Dates

Timely filing of the Schedule K-1 Form 1120-S is essential to avoid penalties. The IRS requires that S corporations file their tax returns by March 15 for the previous tax year. Shareholders typically receive their K-1 forms shortly after the corporation files its return. It is important for shareholders to keep track of these deadlines to ensure they can accurately report their income on their personal tax returns by the April 15 deadline.

IRS Guidelines for Schedule K-1 Form 1120-S

The IRS provides specific guidelines for completing and filing Schedule K-1 Form 1120-S. These guidelines include detailed instructions on how to report different types of income, deductions, and credits. Shareholders must adhere to these guidelines to ensure compliance and avoid potential audits. The IRS also emphasizes the importance of maintaining accurate records to support the information reported on the K-1.

Who Issues the Schedule K-1 Form 1120-S

Schedule K-1 Form 1120-S is issued by S corporations to their shareholders. The corporation is responsible for preparing the K-1 and providing it to each shareholder. This form details each shareholder's share of the corporation's income, deductions, and credits for the tax year. It is crucial for shareholders to receive this form in a timely manner to facilitate accurate tax reporting.

Legal Use of the Shareholder's Instructions for Schedule K-1 Form 1120-S

The Shareholder's Instructions for Schedule K-1 Form 1120-S serve a legal purpose in the tax reporting process. Shareholders must use the information provided on the K-1 to report their share of the S corporation's income on their personal tax returns. Accurate completion of the K-1 is essential for compliance with federal tax laws, and failure to do so can result in penalties or additional tax liabilities.

Create this form in 5 minutes or less

Find and fill out the correct shareholders instructions for schedule k 1 form 1120 s

Create this form in 5 minutes!

How to create an eSignature for the shareholders instructions for schedule k 1 form 1120 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2024 K1 form?

The 2024 K1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information to partners or shareholders about their share of the entity's income. Understanding the 2024 K1 form is essential for accurate tax filing.

-

How can airSlate SignNow help with the 2024 K1 form?

airSlate SignNow simplifies the process of sending and eSigning the 2024 K1 form. With our user-friendly platform, you can easily prepare, send, and track your K1 forms, ensuring that all parties can sign electronically and securely. This streamlines your workflow and saves valuable time during tax season.

-

What are the pricing options for airSlate SignNow when handling the 2024 K1 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring the 2024 K1 form. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can start with a free trial to explore our services before committing.

-

Are there any integrations available for managing the 2024 K1 form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the 2024 K1 form. These integrations allow for automatic data transfer, reducing manual entry errors and enhancing efficiency. You can connect with popular platforms to streamline your document management.

-

What features does airSlate SignNow offer for the 2024 K1 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the 2024 K1 form. These tools help ensure that your documents are completed accurately and efficiently. Additionally, our platform supports collaboration among multiple users, making it ideal for partnerships.

-

Can I access the 2024 K1 form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to access and manage the 2024 K1 form on the go. Whether you’re in the office or away, you can easily send, sign, and track your documents from your smartphone or tablet, ensuring flexibility and convenience.

-

What are the benefits of using airSlate SignNow for the 2024 K1 form?

Using airSlate SignNow for the 2024 K1 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed quickly and securely, minimizing delays in the tax filing process. Additionally, you can easily store and retrieve your forms whenever needed.

Get more for Shareholder's Instructions For Schedule K 1 Form 1120 S

- Tank facility statement form

- Establishment board of form

- Private patrol operator license application packet bureau of bsis ca form

- Weighmaster license application form cdfa ca

- Weighmaster license application california department of form

- Ct nrp 2 2009 form

- Si 2oo 2012 form

- California form association

Find out other Shareholder's Instructions For Schedule K 1 Form 1120 S

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now