K 1 Form 2018

What is the K-1 Form?

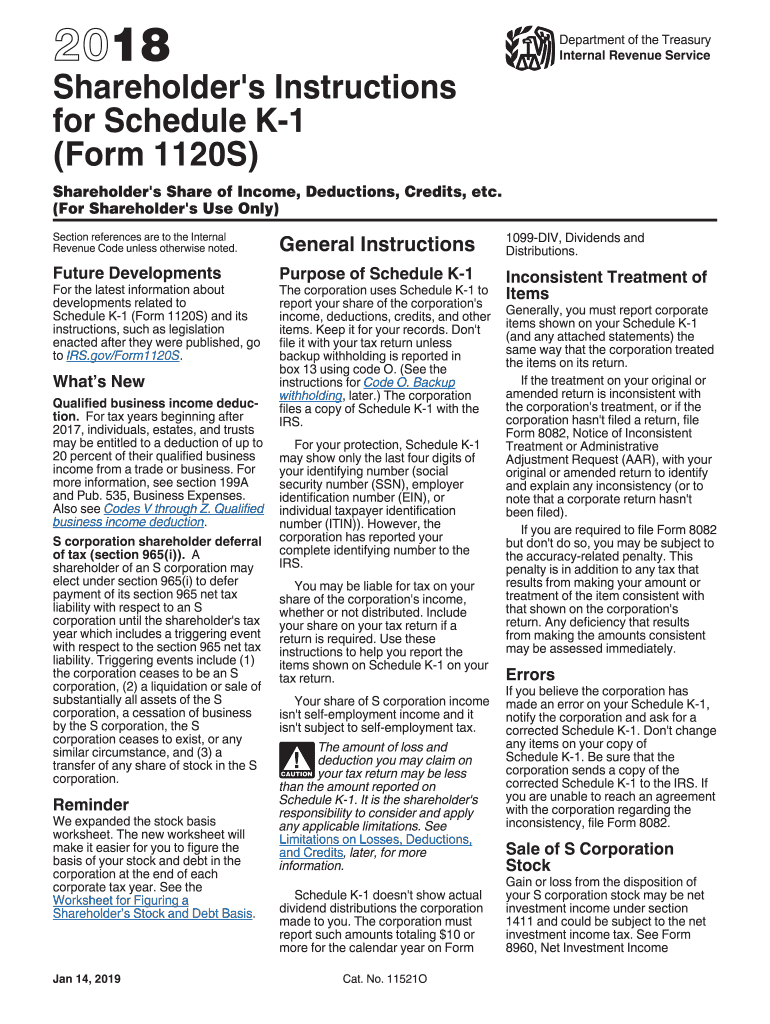

The K-1 Form, specifically the 1120S K-1 for the year 2017, is a tax document used to report income, deductions, and credits from an S corporation to its shareholders. This form provides each shareholder with their share of the corporation's income, which they must report on their personal tax returns. The K-1 Form is essential for ensuring that shareholders accurately report their income and comply with IRS regulations.

Steps to Complete the K-1 Form

Completing the K-1 Form involves several key steps:

- Gather necessary financial information from the S corporation, including income, deductions, and credits.

- Fill out the K-1 Form accurately, ensuring that all fields are completed, including the shareholder's name, address, and tax identification number.

- Report the corporation's income on the K-1, including ordinary business income, rental income, and other types of income.

- Include any deductions or credits that the shareholder is entitled to, as provided by the corporation.

- Review the completed form for accuracy before submitting it to the IRS and providing a copy to the shareholder.

Legal Use of the K-1 Form

The K-1 Form is legally required for S corporations to report income to their shareholders. It must be filed with the IRS along with the corporation's tax return. Shareholders must also use the K-1 information to report their share of the corporation's income on their individual tax returns. Using outdated or incorrect forms can lead to compliance issues, so it is crucial to use the correct version for the respective tax year.

Filing Deadlines / Important Dates

For the tax year 2017, the K-1 Form must be filed by the S corporation on or before March 15, 2018. Shareholders typically receive their K-1 Forms by this date, allowing them to include the information in their personal tax returns, which are due by April 15, 2018. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the K-1 Form. These guidelines include instructions on how to report various types of income, deductions, and credits. It is essential for both the S corporation and its shareholders to familiarize themselves with these guidelines to ensure accurate reporting and compliance. Failure to follow IRS instructions can result in penalties or audits.

Who Issues the Form

The K-1 Form is issued by S corporations to their shareholders. Each corporation is responsible for preparing and distributing the K-1 Forms to its shareholders, typically by the filing deadline. Shareholders should ensure they receive the form in a timely manner to facilitate accurate tax reporting.

Quick guide on how to complete 2015 k 1 2018 2019 form

Explore the simplest method to complete and sign your K 1 Form

Are you still spending time generating your official documents on paper instead of handling them online? airSlate SignNow provides an improved approach to finalize and sign your K 1 Form and associated forms for public services. Our intelligent eSignature platform equips you with all the tools required to handle paperwork swiftly and according to official standards - robust PDF editing, management, protection, signing, and sharing capabilities are all available at your fingertips through an easy-to-use interface.

Just a few steps are needed to fill out and sign your K 1 Form:

- Load the editable template into the editor by using the Get Form button.

- Identify what information you need to include in your K 1 Form.

- Move between the fields using the Next option to ensure you don’t overlook anything.

- Utilize Text, Checkbox, and Cross tools to fill in the fields with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize the important parts or Mask fields that are no longer relevant.

- Select Sign to generate a legally binding eSignature using your preferred method.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your completed K 1 Form in the Documents directory within your account, download it, or transfer it to your chosen cloud storage. Our platform also facilitates easy file sharing. There’s no need to print your forms when you can dispatch them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct 2015 k 1 2018 2019 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the 2015 k 1 2018 2019 form

How to generate an eSignature for your 2015 K 1 2018 2019 Form in the online mode

How to make an electronic signature for your 2015 K 1 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the 2015 K 1 2018 2019 Form in Gmail

How to make an eSignature for the 2015 K 1 2018 2019 Form right from your smartphone

How to make an eSignature for the 2015 K 1 2018 2019 Form on iOS devices

How to make an eSignature for the 2015 K 1 2018 2019 Form on Android devices

People also ask

-

What is the 1120s K-1 2017 form?

The 1120s K-1 2017 form is a tax document used by S-corporations to report the income, deductions, and credits allocated to shareholders. This form allows shareholders to report their share of the corporation's income on their personal tax returns. Understanding its implications can help streamline tax filings and compliance.

-

How can airSlate SignNow help with 1120s K-1 2017 forms?

airSlate SignNow provides a seamless solution for electronically signing and managing 1120s K-1 2017 forms. With user-friendly features, you can quickly send, receive, and store these vital documents securely. This enhances efficiency and ensures all parties have access to necessary tax documents.

-

Is there a cost to use airSlate SignNow for 1120s K-1 2017 processing?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including features for processing 1120s K-1 2017 forms. There are subscription options available, and some plans include free trials, allowing you to find the best fit for your business's budget and requirements.

-

What are the key features of airSlate SignNow for handling 1120s K-1 2017?

Key features of airSlate SignNow for managing 1120s K-1 2017 forms include secure electronic signatures, document tracking, and seamless integration with various applications. These functionalities enhance collaboration and simplify the signing process, ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with accounting software for 1120s K-1 2017?

Yes, airSlate SignNow integrates with popular accounting software, allowing for streamlined management of 1120s K-1 2017 forms. This integration helps automate tasks and ensures that your tax documents align with your overall accounting processes, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for my business with 1120s K-1 2017?

Using airSlate SignNow for 1120s K-1 2017 processing offers numerous benefits, including increased efficiency, enhanced security, and cost savings. By digitizing the signing process, you can reduce paperwork and ensure faster turnaround times on your tax documents, allowing you to focus on business growth.

-

Is airSlate SignNow compliant with tax regulations for 1120s K-1 2017?

Absolutely! airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your signing processes for the 1120s K-1 2017 forms adhere to legal standards. Our platform prioritizes security and compliance, giving you peace of mind while managing sensitive tax documents.

Get more for K 1 Form

- In kind donation record project healing waters fly fishing projecthealingwatersdenver form

- Thrivent financial for lutherans permission to disclose information

- Form d 1r fiu university graduate school

- St 100 pdffiller form

- Typical questions from granteescontractors form

- First flight certificate template form

- Software service agreement template form

- Copywriter contract template form

Find out other K 1 Form

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online