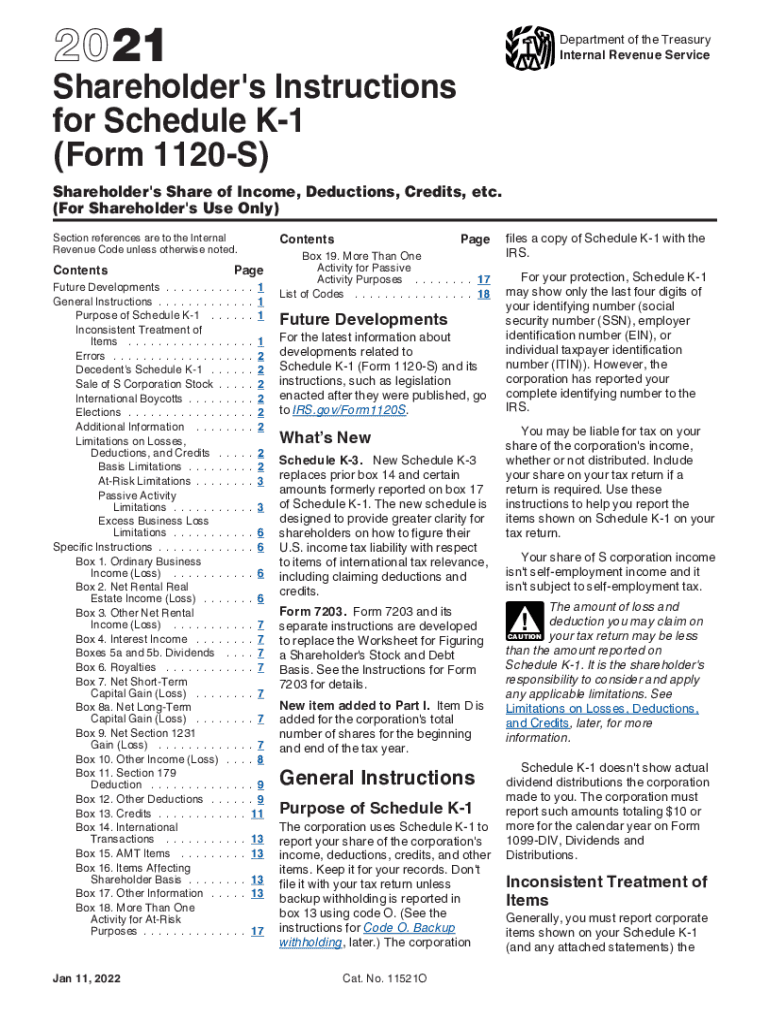

Shareholder's Instructions for Schedule K 1 Form 1120S 2021

What is the Shareholder's Instructions For Schedule K-1 Form 1120S

The Shareholder's Instructions for Schedule K-1 Form 1120S provides essential guidance for shareholders of S corporations. This form details each shareholder's share of the corporation's income, deductions, and credits. It is crucial for accurately reporting income on individual tax returns. The K-1 form helps shareholders understand their tax obligations and how the income from the S corporation affects their overall tax situation.

How to use the Shareholder's Instructions For Schedule K-1 Form 1120S

Using the Shareholder's Instructions for Schedule K-1 Form 1120S involves reviewing the information provided on the form and ensuring it aligns with your tax records. Shareholders should carefully read the instructions to understand how to report the income, deductions, and credits on their individual tax returns. The form also provides guidance on how to allocate various items of income and expenses, which is essential for accurate tax reporting.

Steps to complete the Shareholder's Instructions For Schedule K-1 Form 1120S

To complete the Shareholder's Instructions for Schedule K-1 Form 1120S, follow these steps:

- Review the information provided by the S corporation, including your share of income, deductions, and credits.

- Ensure that all amounts are accurately reflected on your individual tax return.

- Use the instructions to determine how to report various types of income and deductions.

- Consult with a tax professional if you have questions about specific entries or how they affect your tax liability.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule K-1 Form 1120S. These guidelines outline the necessary information that must be reported, including income types, deductions, and credits. It is important for shareholders to adhere to these guidelines to ensure compliance with tax laws and avoid potential penalties. The IRS also updates these guidelines periodically, so it is essential to refer to the most current version when preparing your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form 1120S are critical for both the S corporation and its shareholders. Typically, the S corporation must file its tax return by March 15 of each year. Shareholders should receive their K-1 forms shortly after the corporation files its return. It is essential for shareholders to file their individual tax returns by the April 15 deadline, ensuring that they include the information from the K-1 form to avoid delays or issues with the IRS.

Penalties for Non-Compliance

Non-compliance with the requirements for the Schedule K-1 Form 1120S can result in penalties for both the S corporation and its shareholders. If the S corporation fails to issue K-1 forms on time, it may face penalties from the IRS. Shareholders who do not report the income accurately may also incur penalties, including interest on unpaid taxes. It is crucial to ensure that all information is reported correctly and timely to avoid these consequences.

Quick guide on how to complete shareholders instructions for schedule k 1 form 1120s

Complete Shareholder's Instructions For Schedule K 1 Form 1120S effortlessly on any gadget

Digital document management has gained traction with both businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Shareholder's Instructions For Schedule K 1 Form 1120S on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign Shareholder's Instructions For Schedule K 1 Form 1120S with ease

- Find Shareholder's Instructions For Schedule K 1 Form 1120S and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Shareholder's Instructions For Schedule K 1 Form 1120S while ensuring outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct shareholders instructions for schedule k 1 form 1120s

Create this form in 5 minutes!

How to create an eSignature for the shareholders instructions for schedule k 1 form 1120s

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is K1 form for taxes?

The K1 form, or Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, and estates. It plays a crucial role during tax season, allowing individuals to report their share of income received from these entities. Understanding what is K1 form for taxes can help taxpayers accurately complete their tax returns and ensure compliance.

-

How does the K1 form affect my tax return?

The K1 form affects your tax return by reporting income, deductions, and credits that may impact your overall tax liability. Each partner or shareholder must include their respective K1 information on their personal tax returns. If you’re wondering what is K1 form for taxes, it’s essential to consult this document to reflect any income that’s not directly reported on a W-2.

-

Who receives a K1 form and when?

K1 forms are typically issued to partners in a partnership, shareholders in an S corporation, or beneficiaries of an estate or trust. These forms are generally provided after the entity completes its tax return, which is often after the April tax deadline. Knowing what is K1 form for taxes will help you anticipate receiving this crucial document for your tax preparation.

-

Can I file my taxes without the K1 form?

Filing your taxes without the K1 form can pose signNow issues, as it may lead to underreporting income. Since the K1 form details earnings from partnerships or S corporations, it's essential to include this information for an accurate tax return. Understanding what is K1 form for taxes is vital for ensuring your tax filings are complete and compliant.

-

What details are included in a K1 form?

A K1 form includes specific details such as the partner’s or shareholder’s share of income, deductions, credits, and other relevant financial information that needs to be reported. It typically outlines the entity's income for the tax year and the corresponding allocation to each individual. Familiarity with what is K1 form for taxes can help you navigate these details more effectively.

-

Are there penalties for not reporting K1 form income?

Yes, there can be penalties for not reporting income indicated on the K1 form, which may result in fines or audits from the IRS. It is crucial to include all sources of income, including those reported on K1 forms, to avoid any tax complications. Recognizing what is K1 form for taxes is key to ensuring that you report all income accurately.

-

How does airSlate SignNow help with K1 form documentation?

airSlate SignNow simplifies the management of K1 form documentation by providing a user-friendly platform for eSigning and securely sharing essential tax documents. Its cost-effective solution enables businesses to streamline document workflows, ensuring timely and accurate submission. By understanding what is K1 form for taxes, users can leverage airSlate SignNow for effective document management.

Get more for Shareholder's Instructions For Schedule K 1 Form 1120S

- Salary verification form for potential lease district of columbia

- District of columbia landlord tenant form

- Notice of default on residential lease district of columbia form

- Landlord tenant lease co signer agreement district of columbia form

- Application for sublease district of columbia form

- Inventory and condition of leased premises for pre lease and post lease district of columbia form

- Move out form

- Property manager agreement district of columbia form

Find out other Shareholder's Instructions For Schedule K 1 Form 1120S

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer