Form 8917

What is the Form 8917

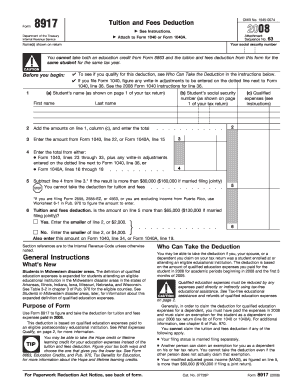

The Form 8917 is a tax form used by individuals in the United States to claim the Tuition and Fees Deduction. This deduction allows eligible taxpayers to reduce their taxable income based on qualified education expenses incurred during the tax year. The form is particularly beneficial for students or their parents who are paying for higher education costs, making it an essential tool for maximizing tax benefits related to education.

How to use the Form 8917

To effectively use the Form 8917, taxpayers must first determine their eligibility for the Tuition and Fees Deduction. This involves reviewing qualified expenses, which may include tuition, fees, and other related costs. Once eligibility is established, taxpayers should accurately fill out the form, providing necessary details about their education expenses and personal information. After completing the form, it should be attached to the taxpayer's federal income tax return when filing.

Steps to complete the Form 8917

Completing the Form 8917 involves several key steps:

- Gather all relevant documentation, including tuition statements and receipts for qualified expenses.

- Fill out personal information, including your name, Social Security number, and filing status.

- Report the total qualified education expenses on the form, ensuring accuracy to maximize potential deductions.

- Calculate the deduction amount based on the provided guidelines and enter it on your tax return.

Legal use of the Form 8917

The legal use of the Form 8917 requires adherence to IRS guidelines regarding eligibility and qualified expenses. Taxpayers must ensure that they are not claiming expenses that have been reimbursed or covered by other financial aid. Additionally, accurate reporting is essential to avoid potential penalties or audits. By following the IRS regulations, taxpayers can ensure that their use of the form is compliant and valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8917 align with the standard tax filing deadlines in the United States. Generally, individual taxpayers must file their federal income tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to ensure timely submission of their forms and avoid penalties for late filing.

Eligibility Criteria

To qualify for the Tuition and Fees Deduction using Form 8917, taxpayers must meet specific eligibility criteria. These include being a student enrolled at an eligible educational institution, having qualified education expenses, and meeting income limitations set by the IRS. It is important for taxpayers to review these criteria carefully to determine their eligibility before completing the form.

Quick guide on how to complete form 8917

Complete Form 8917 effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Form 8917 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 8917 with ease

- Obtain Form 8917 and then click Access Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Finish button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8917 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8917

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are form 8917 instructions?

Form 8917 instructions provide detailed guidelines on how to claim the tuition and fees deduction on your tax return. This form is essential for taxpayers seeking to maximize their education expenses. Understanding these instructions can help you take full advantage of potential tax savings.

-

How can airSlate SignNow help with managing form 8917 instructions?

airSlate SignNow simplifies the process of managing documents, including form 8917 instructions. With our platform, users can easily create, send, and sign documents digitally, ensuring you have all necessary instructional materials at your fingertips for tax season. This streamlines your workflow and keeps everything organized.

-

Is there a cost associated with using airSlate SignNow for eSigning form 8917 instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. We provide a cost-effective solution that enhances your ability to manage forms like form 8917 instructions without breaking the bank. You can choose a plan that suits your volume of document management.

-

Can I integrate airSlate SignNow with other applications for form 8917 instructions?

Absolutely! airSlate SignNow can be integrated with many popular applications like Google Drive, Dropbox, and Salesforce. This ensures efficient management of your form 8917 instructions alongside other critical business processes, allowing for seamless collaboration and document handling.

-

What features does airSlate SignNow offer for handling form 8917 instructions?

airSlate SignNow includes features like customizable templates, real-time collaboration, and electronic signatures, making it optimal for handling form 8917 instructions. These features ensure that your documents are not only correctly filled out but also securely signed and stored for future reference.

-

How secure is airSlate SignNow when managing documents like form 8917 instructions?

Security is a top priority at airSlate SignNow. Our platform uses bank-level encryption and complies with industry standards to protect your data, including sensitive information in form 8917 instructions. You can work confidently, knowing your documents are safe and secure.

-

Can I track the status of form 8917 instructions sent for signature using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of any document, including form 8917 instructions. You can see when a document is viewed or signed, ensuring you stay up to date with the signing process and follow up when necessary.

Get more for Form 8917

- Bexar county constable pct form

- How to fill middlesex application form

- Form 3200 113 aquatic plant control mechanical manual permit application dnr wi

- Cans ny form

- Lease cum sale agreement plot doc form

- All night grad party waiver and release form

- Landlord tenant contract template form

- Landlord and tenant contract template form

Find out other Form 8917

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF