Georgia Hotel Tax Exempt Form

What is the Georgia Hotel Tax Exempt Form

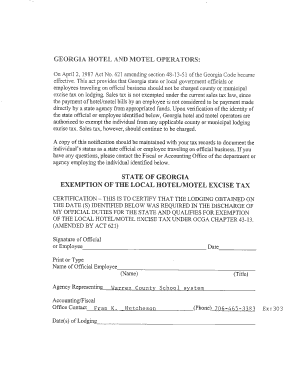

The Georgia Hotel Tax Exempt Form is a document that allows qualifying individuals or organizations to claim exemption from hotel and motel taxes in the state of Georgia. This form is primarily used by government entities, non-profit organizations, and certain educational institutions that are exempt from paying these taxes while traveling for official business. By submitting this form, eligible parties can avoid incurring additional costs during their stay at hotels or motels across Georgia.

How to use the Georgia Hotel Tax Exempt Form

To effectively use the Georgia Hotel Tax Exempt Form, individuals or organizations must first ensure they meet the eligibility criteria for tax exemption. Once confirmed, the form should be filled out accurately with the necessary information, including the name of the exempt organization, the purpose of the stay, and the details of the hotel. After completing the form, it should be presented to the hotel management at the time of check-in to ensure the tax exemption is applied correctly.

Steps to complete the Georgia Hotel Tax Exempt Form

Completing the Georgia Hotel Tax Exempt Form involves several key steps:

- Obtain the form from a reliable source, such as the Georgia Department of Revenue website or your organization’s finance department.

- Fill in the required fields, including the name of the organization, address, and tax identification number.

- Provide details about the stay, including the hotel name, address, and dates of occupancy.

- Sign and date the form to validate it.

- Present the completed form to the hotel during check-in to ensure the exemption is processed.

Legal use of the Georgia Hotel Tax Exempt Form

The legal use of the Georgia Hotel Tax Exempt Form is governed by state tax laws. To be considered valid, the form must be accurately completed and signed by an authorized representative of the exempt organization. Misuse of the form, such as submitting it without proper eligibility, can lead to penalties, including back taxes owed and potential fines. It is essential to understand the legal implications and ensure compliance with all applicable regulations.

Eligibility Criteria

Eligibility for using the Georgia Hotel Tax Exempt Form is limited to specific types of entities. Generally, the following groups may qualify:

- Government agencies and officials traveling for official business.

- Non-profit organizations recognized under IRS regulations.

- Educational institutions that are tax-exempt.

Individuals traveling for personal reasons or businesses that do not meet these criteria are not eligible for tax exemption and should not use this form.

Required Documents

When completing the Georgia Hotel Tax Exempt Form, certain documents may be required to support the exemption claim. These typically include:

- A valid tax identification number for the exempt organization.

- Proof of the organization’s tax-exempt status, such as a letter from the IRS.

- Any additional documentation that may be requested by the hotel for verification purposes.

Having these documents ready can facilitate a smoother check-in process and ensure compliance with hotel policies.

Quick guide on how to complete georgia hotel tax exempt form 100011015

Complete Georgia Hotel Tax Exempt Form seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without lags. Manage Georgia Hotel Tax Exempt Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Georgia Hotel Tax Exempt Form without hassle

- Locate Georgia Hotel Tax Exempt Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate the printing of new document versions. airSlate SignNow fulfills your requirements in document management in a few clicks from any device you prefer. Edit and eSign Georgia Hotel Tax Exempt Form ensuring effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia hotel tax exempt form 100011015

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Georgia hotel tax exempt form?

The Georgia hotel tax exempt form is a document that allows eligible individuals or organizations to avoid paying hotel occupancy taxes in the state of Georgia. This form is essential for those who qualify, such as government employees or certain non-profit organizations. By using the Georgia hotel tax exempt form, you can ensure compliance with state tax laws while reducing accommodation costs.

-

How do I obtain the Georgia hotel tax exempt form?

You can obtain the Georgia hotel tax exempt form from the Georgia Department of Revenue's website or directly from your hotel upon request. Most hotels have the form readily available and can guide you through the process of completing it. Ensure that you fill out the Georgia hotel tax exempt form correctly to avoid any complications during check-in.

-

What details are required on the Georgia hotel tax exempt form?

The Georgia hotel tax exempt form typically requires your name, organization details, and the nature of the exemption. You'll also need to provide the dates of your stay and the hotel’s information. Filling out these details accurately is critical for the acceptance of the Georgia hotel tax exempt form.

-

Can I use the Georgia hotel tax exempt form for all hotel stays in Georgia?

No, the Georgia hotel tax exempt form can only be used by eligible individuals or organizations such as government entities or tax-exempt non-profits. It's essential to verify your eligibility before submitting the Georgia hotel tax exempt form at any hotel. Each hotel may have its own policies regarding tax exemptions, so always clarify beforehand.

-

Is there a fee associated with the Georgia hotel tax exempt form?

Generally, there is no fee to obtain or submit the Georgia hotel tax exempt form, but it's wise to check with the specific hotel for any potential processing fees. Using the form should not incur additional costs if you meet the eligibility criteria. Always verify with the hotel to understand their policies regarding the Georgia hotel tax exempt form.

-

Can I submit the Georgia hotel tax exempt form electronically?

Many hotels are now accepting the Georgia hotel tax exempt form electronically, especially through e-signature platforms like airSlate SignNow. This allows for a quicker and more convenient submission process. Check with your chosen hotel to see if they offer electronic submission options for the Georgia hotel tax exempt form.

-

What are the benefits of using the Georgia hotel tax exempt form?

Using the Georgia hotel tax exempt form can save you a signNow amount on hotel stays, especially for extended visits. It ensures that you remain compliant with state tax regulations while reducing your travel expenses. Additionally, it streamlines the checkout process when staying at a hotel in Georgia.

Get more for Georgia Hotel Tax Exempt Form

- Pre tenancy application form 382428006

- Bewijs van garantstelling en of particuliere logiesverstrekking pdf form

- Approved supplier list template form

- Dc fr 500 pdf form

- Ct scan consent form

- Manifest destiny word search form

- Application for firearm control card for licensee form

- Always medical history 1 of 1 medical history pati form

Find out other Georgia Hotel Tax Exempt Form

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now