Irs Fuel 2022

What is the IRS Fuel Credit?

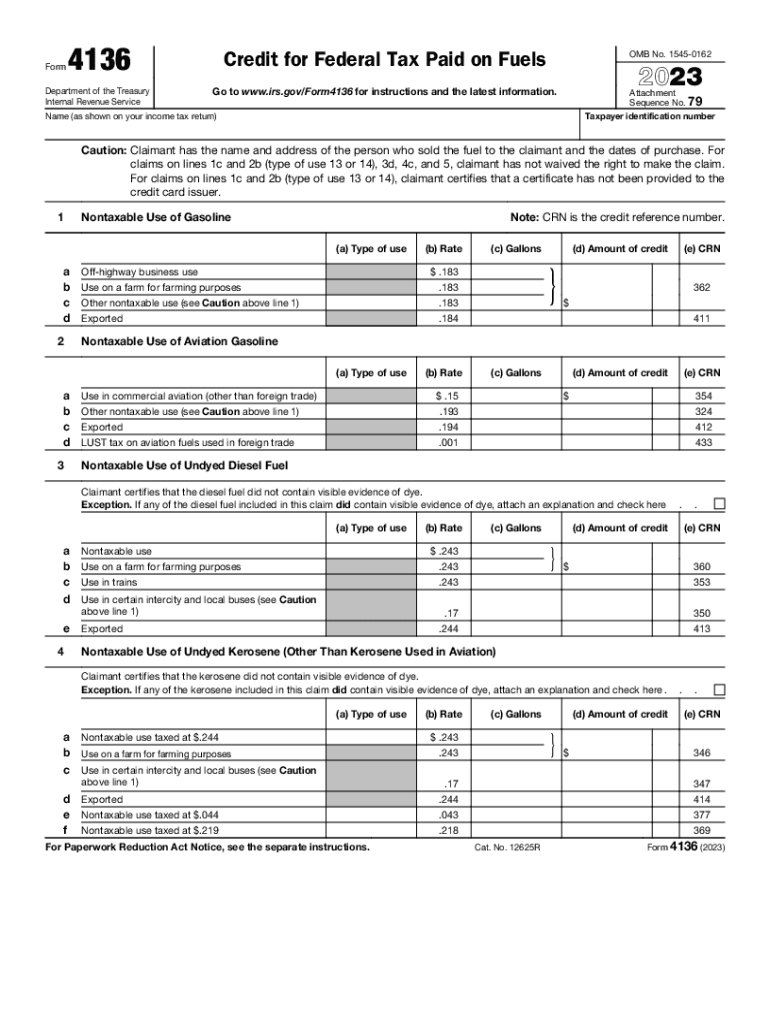

The IRS Fuel Credit, specifically referenced in Form 4136, allows taxpayers to claim a credit for federal tax paid on fuels used for specific purposes. This credit is particularly relevant for individuals and businesses that utilize fuel for non-highway use, such as agricultural purposes or for certain types of machinery. The credit is designed to reimburse taxpayers for the excise taxes they have paid on fuel that is not used on public highways, promoting the use of alternative fuels and supporting various industries.

Eligibility Criteria for the IRS Fuel Credit

To qualify for the IRS Fuel Credit, taxpayers must meet specific eligibility criteria. Generally, the credit applies to those who have paid federal excise tax on fuels used for qualified purposes. Eligible uses include:

- Off-road vehicles and equipment

- Farm machinery

- Certain commercial vehicles

- Non-highway use of fuel

Taxpayers must ensure they maintain accurate records of fuel purchases and usage to substantiate their claims when filing Form 4136.

Steps to Complete Form 4136

Completing Form 4136 involves several key steps to ensure accurate reporting and eligibility for the credit. Here’s a straightforward process:

- Gather all necessary documentation, including receipts for fuel purchases and records of fuel usage.

- Download the latest version of Form 4136 from the IRS website.

- Fill out the form with the required information, including your personal details and the amount of fuel used.

- Calculate the credit based on the applicable rates and the amount of fuel consumed for eligible uses.

- Review the form for accuracy and completeness.

- Submit the completed form along with your tax return.

Key Elements of Form 4136

Form 4136 includes several critical elements that taxpayers need to be aware of when claiming the IRS Fuel Credit. These elements consist of:

- Taxpayer identification information

- Details of the fuel used, including type and amount

- Calculation of the credit based on the fuel consumed

- Signature and date of submission

Understanding these components is essential for ensuring a smooth filing process and maximizing the potential credit received.

Filing Deadlines for Form 4136

It is important for taxpayers to be aware of the filing deadlines associated with Form 4136. Typically, this form is filed along with your annual tax return. For most taxpayers, the deadline is April 15 of the following year. However, if you are self-employed or have other specific circumstances, different deadlines may apply. Keeping track of these dates can help avoid penalties and ensure timely processing of your credit claim.

Form Submission Methods

Taxpayers have several options for submitting Form 4136. The form can be submitted in the following ways:

- Electronically, as part of your e-filed tax return

- By mail, sent to the appropriate IRS address based on your location

- In-person, at designated IRS offices during tax season

Choosing the right submission method can streamline the process and help ensure that your claim is processed efficiently.

Quick guide on how to complete irs fuel

Complete Irs Fuel effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed files, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Irs Fuel across any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to edit and eSign Irs Fuel with ease

- Locate Irs Fuel and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Irs Fuel and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs fuel

Create this form in 5 minutes!

How to create an eSignature for the irs fuel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 4136 pdf and how is it used in the airSlate SignNow platform?

The 4136 pdf is a specific document format that can be easily created, edited, and signed using airSlate SignNow. This format allows users to streamline their document workflows and ensure compliance with industry standards.

-

How can I create a 4136 pdf using airSlate SignNow?

Creating a 4136 pdf with airSlate SignNow is simple. Users can upload existing documents, convert them to the 4136 pdf format, and utilize the platform’s editing features to customize them before sending for eSignature.

-

What are the key features of airSlate SignNow related to 4136 pdf documents?

airSlate SignNow offers robust features for managing 4136 pdf documents, including customizable templates, collaborative editing, and secure eSigning. These features ensure that users can efficiently manage their paperwork while maintaining a professional appearance.

-

Is there a cost associated with using airSlate SignNow for 4136 pdf documents?

Yes, airSlate SignNow offers a variety of pricing plans that provide access to features for handling 4136 pdf documents. These plans are designed to accommodate businesses of all sizes and offer a cost-effective solution for document management.

-

Can I integrate airSlate SignNow with other applications for managing 4136 pdf files?

Absolutely! airSlate SignNow supports integration with various applications, allowing users to easily manage their 4136 pdf documents across different platforms. This seamless integration enhances efficiency and keeps all your documents in sync.

-

What are the benefits of using airSlate SignNow for eSigning 4136 pdfs?

Using airSlate SignNow to eSign 4136 pdf documents offers multiple benefits, including fast turnaround times, improved accuracy, and enhanced security. These features help streamline business operations and improve customer satisfaction.

-

How does airSlate SignNow ensure the security of 4136 pdf documents?

airSlate SignNow prioritizes document security by employing encryption and secure access protocols for all 4136 pdf files. Users can be confident that their sensitive information is protected throughout the signing process.

Get more for Irs Fuel

Find out other Irs Fuel

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy