Us Population 2012

IRS Guidelines

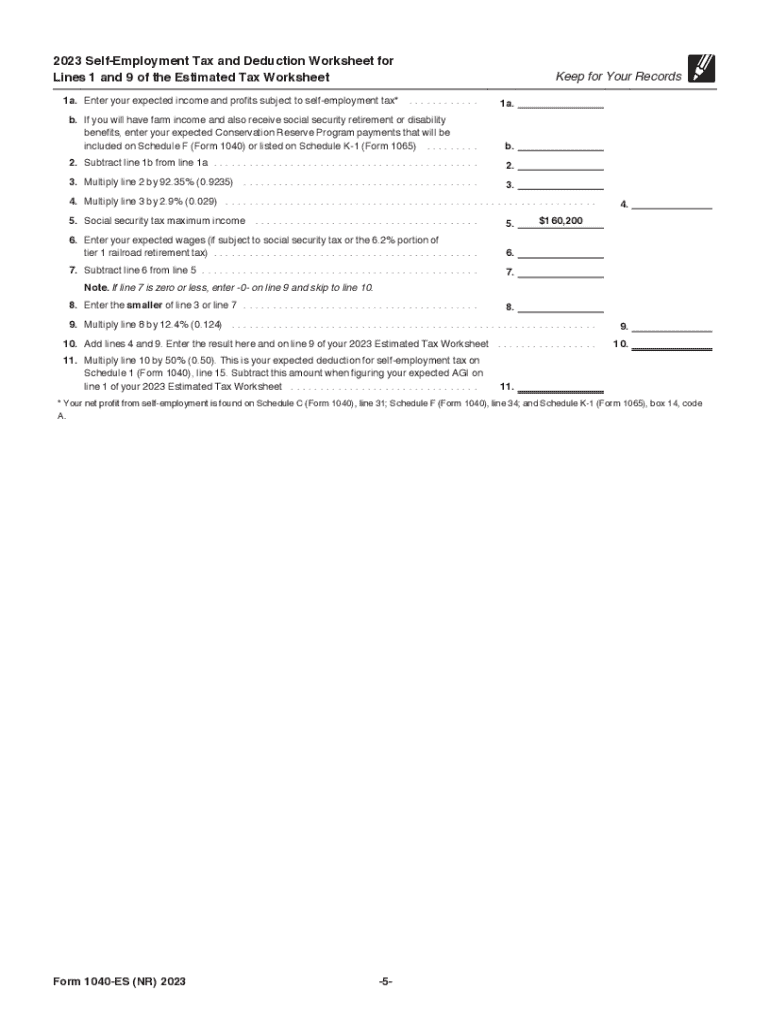

The IRS provides clear guidelines for calculating and paying estimated taxes in the United States. These guidelines help taxpayers understand their obligations and ensure compliance with federal tax laws. Taxpayers must estimate their tax liability for the year and make quarterly payments if they expect to owe a certain amount. The IRS Form 1040-ES is typically used for this purpose, allowing individuals to report their estimated income and calculate the appropriate payment amounts. It is essential to keep accurate records and stay informed about any changes in tax laws that may affect estimated tax calculations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for estimated taxes is crucial for avoiding penalties. For most taxpayers, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. These dates correspond to the four quarters of the tax year. If the due date falls on a weekend or holiday, the deadline is typically extended to the next business day. Keeping track of these dates ensures that you remain compliant and can help you avoid unnecessary interest and penalties for late payments.

Required Documents

To accurately complete your estimated tax payments, certain documents are essential. Taxpayers should gather their previous year's tax return, which provides a baseline for estimating current income and deductions. Additionally, any records of income received throughout the year, such as pay stubs or invoices for self-employed individuals, should be collected. If applicable, taxpayers should also have documentation for any credits or deductions they plan to claim, as these can significantly affect the estimated tax amount.

Taxpayer Scenarios

Different taxpayer scenarios can influence how estimated taxes are calculated and paid. For instance, self-employed individuals often have more complex tax situations and may need to use an estimated tax calculator to determine their payments accurately. Retired individuals may have different income sources, such as pensions or Social Security, which can also affect their estimated tax obligations. Understanding how various life circumstances impact tax liabilities can help taxpayers plan effectively and avoid underpayment penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting their estimated tax payments. Payments can be made online through the IRS website using the Electronic Federal Tax Payment System (EFTPS) or by credit card. Alternatively, individuals may choose to mail a check or money order along with their completed Form 1040-ES. For those who prefer in-person transactions, payments can be made at designated IRS offices. Each method has its advantages, and taxpayers should choose the one that best fits their needs.

Penalties for Non-Compliance

Failing to pay estimated taxes on time can result in penalties and interest charges. The IRS imposes penalties for underpayment if taxpayers do not pay at least 90 percent of their current year's tax liability or 100 percent of the previous year's tax liability. Additionally, late payments can accrue interest, increasing the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate estimated tax payments, helping taxpayers avoid unnecessary financial burdens.

Quick guide on how to complete us population

Complete Us Population effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Us Population on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused task today.

How to modify and eSign Us Population effortlessly

- Obtain Us Population and then click Get Form to commence.

- Leverage the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Us Population to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us population

Create this form in 5 minutes!

How to create an eSignature for the us population

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is US estimated tax and how does it affect my business?

US estimated tax is a system that requires taxpayers to pay tax on income as it is earned throughout the year. For businesses, understanding how US estimated tax works is vital to ensure compliance and avoid penalties. It’s essential to calculate and remit these payments quarterly to manage cash flow effectively.

-

How can airSlate SignNow assist with US estimated tax document management?

With airSlate SignNow, businesses can seamlessly send and eSign important US estimated tax documents quickly and securely. This improves efficiency, allowing you to focus more on your business and less on paperwork. Our platform simplifies the signing process, ensuring you meet all your tax obligations on time.

-

What pricing options does airSlate SignNow offer for businesses handling US estimated tax?

airSlate SignNow offers various pricing plans designed to cater to different business needs, including those focusing on US estimated tax management. Our plans are cost-effective, allowing you to choose one that fits your budget while providing all essential features. Check our website for detailed pricing and plan comparisons.

-

What features does airSlate SignNow provide to streamline the US estimated tax process?

AirSlate SignNow includes features such as templates for US estimated tax forms, automated reminders, and integrations with accounting software. These features help businesses streamline their tax submissions and ensure compliance. With our user-friendly interface, managing your US estimated tax documents is easier than ever.

-

Can airSlate SignNow integrate with my existing accounting software for US estimated tax?

Yes, airSlate SignNow offers integrations with various accounting programs to assist with US estimated tax management. This allows for automated data transfer, reducing manual input errors and saving time. Check our integrations page for a list of compatible software to see how we can enhance your tax filing process.

-

What are the benefits of using airSlate SignNow for US estimated tax compliance?

Using airSlate SignNow for US estimated tax compliance helps ensure timely submissions and reduces the risk of penalties. Our platform increases the speed of document processing and enhances collaboration among team members. This allows your business to maintain accurate records and stay up-to-date with tax obligations.

-

Is airSlate SignNow suitable for small businesses managing US estimated tax?

Absolutely! AirSlate SignNow is an excellent solution for small businesses dealing with US estimated tax. Our platform is designed to be user-friendly and flexible, offering tools that cater to businesses of all sizes. Small businesses can benefit from our affordable pricing and robust features without a steep learning curve.

Get more for Us Population

Find out other Us Population

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors