Irs Schedule D 2023

What is the IRS Schedule D?

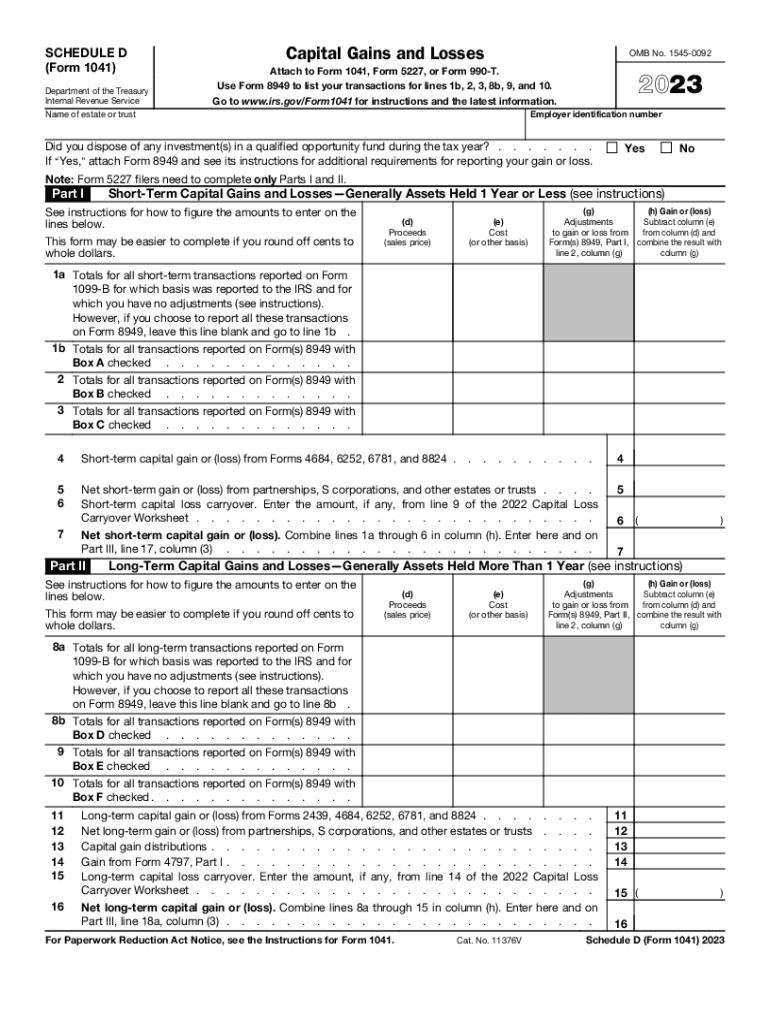

The IRS Schedule D is a tax form used to report capital gains and losses from the sale of assets. This form is essential for individuals and estates filing Form 1041, as it helps determine the tax implications of transactions involving stocks, bonds, and other investments. By detailing these transactions, taxpayers can accurately calculate their taxable income and ensure compliance with IRS regulations.

Steps to Complete the IRS Schedule D

Completing the IRS Schedule D involves several important steps:

- Gather all necessary documents, including records of asset purchases and sales.

- Fill out Part I of the form, which covers short-term capital gains and losses.

- Complete Part II for long-term capital gains and losses, ensuring to differentiate between the two types.

- Transfer the totals from Schedule D to Form 1041 to reflect the overall impact on your tax return.

It is crucial to double-check all calculations and ensure that all transactions are accurately reported to avoid potential penalties.

How to Obtain the IRS Schedule D

The IRS Schedule D can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, tax preparation software often includes the form, allowing for easier completion and submission. For those who prefer paper forms, they can be requested via mail from the IRS or found at local tax offices.

Key Elements of the IRS Schedule D

Understanding the key elements of the IRS Schedule D is vital for accurate reporting. The form includes:

- Short-term capital gains and losses: Reported in Part I, these are gains from assets held for one year or less.

- Long-term capital gains and losses: Reported in Part II, these are gains from assets held for more than one year.

- Carryover amounts: If applicable, taxpayers can report capital loss carryovers from previous years.

Each section requires careful attention to detail to ensure compliance with IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule D align with the overall tax return deadlines. For most taxpayers, the due date is April 15 of the following year. If additional time is needed, a six-month extension can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing Schedule D, including instructions on how to report various types of transactions. Taxpayers should refer to the IRS instructions for Schedule D for detailed information on eligibility, reporting requirements, and any changes from previous years. Staying informed about these guidelines can help prevent errors and ensure compliance.

Penalties for Non-Compliance

Failing to accurately report capital gains and losses on Schedule D can result in significant penalties. The IRS may impose fines for underreporting income, and interest may accrue on any unpaid taxes. In severe cases, criminal charges could be pursued for fraudulent reporting. Therefore, it is crucial to ensure that all information is correct and submitted on time to avoid these consequences.

Quick guide on how to complete irs schedule d

Effortlessly Prepare Irs Schedule D on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Irs Schedule D on any device using airSlate SignNow Android or iOS applications and enhance your document-based workflows today.

How to Modify and Electronically Sign Irs Schedule D With Ease

- Locate Irs Schedule D and click Obtain Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Signature tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Finish button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, burdensome form searches, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Alter and electronically sign Irs Schedule D while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs schedule d

Create this form in 5 minutes!

How to create an eSignature for the irs schedule d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 1041 schedule d and how is it used?

The 2022 1041 schedule d is a tax form used to report capital gains and losses for estates and trusts. It is an integral part of the IRS Form 1041, which must be filed annually. Understanding its requirements can help ensure accurate reporting and compliance with tax laws.

-

How can I effectively fill out the 2022 1041 schedule d using airSlate SignNow?

With airSlate SignNow, you can easily fill out the 2022 1041 schedule d electronically. Our platform offers user-friendly tools for document completion, allowing you to add necessary information quickly while ensuring accuracy. Plus, eSigning features streamline the process of obtaining necessary approvals.

-

What features does airSlate SignNow offer for 2022 1041 schedule d users?

airSlate SignNow provides an array of features for users handling the 2022 1041 schedule d, including document templates, eSigning capabilities, and workflow automation. These features enhance efficiency and reduce the potential for errors, making the filing process smoother and more efficient.

-

Is airSlate SignNow a cost-effective solution for managing 2022 1041 schedule d forms?

Yes, airSlate SignNow offers a cost-effective solution for managing the 2022 1041 schedule d forms. With competitive pricing plans, businesses can access powerful tools without a hefty investment. This affordability makes it an ideal choice for small businesses and individuals alike.

-

Can airSlate SignNow integrate with other software for 2022 1041 schedule d processing?

Absolutely, airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This ensures that your 2022 1041 schedule d data can flow smoothly between systems, enhancing collaboration and data accuracy. You can work more efficiently by leveraging your existing tools.

-

How does airSlate SignNow ensure the security of my 2022 1041 schedule d documents?

AirSlate SignNow prioritizes document security by employing encryption and secure access controls. Your 2022 1041 schedule d documents are protected from unauthorized access and tampering. We adhere to industry standards to safeguard your sensitive financial information at all times.

-

What are the benefits of using airSlate SignNow for the 2022 1041 schedule d?

Using airSlate SignNow for the 2022 1041 schedule d offers numerous benefits such as time savings, improved accuracy, and enhanced collaboration. The intuitive interface allows users to complete forms swiftly, while eSigning capabilities eliminate the need for physical signatures. These advantages streamline your tax filing process and improve overall effectiveness.

Get more for Irs Schedule D

Find out other Irs Schedule D

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed