Irs Form 1041 2011

What is the IRS Form 1041

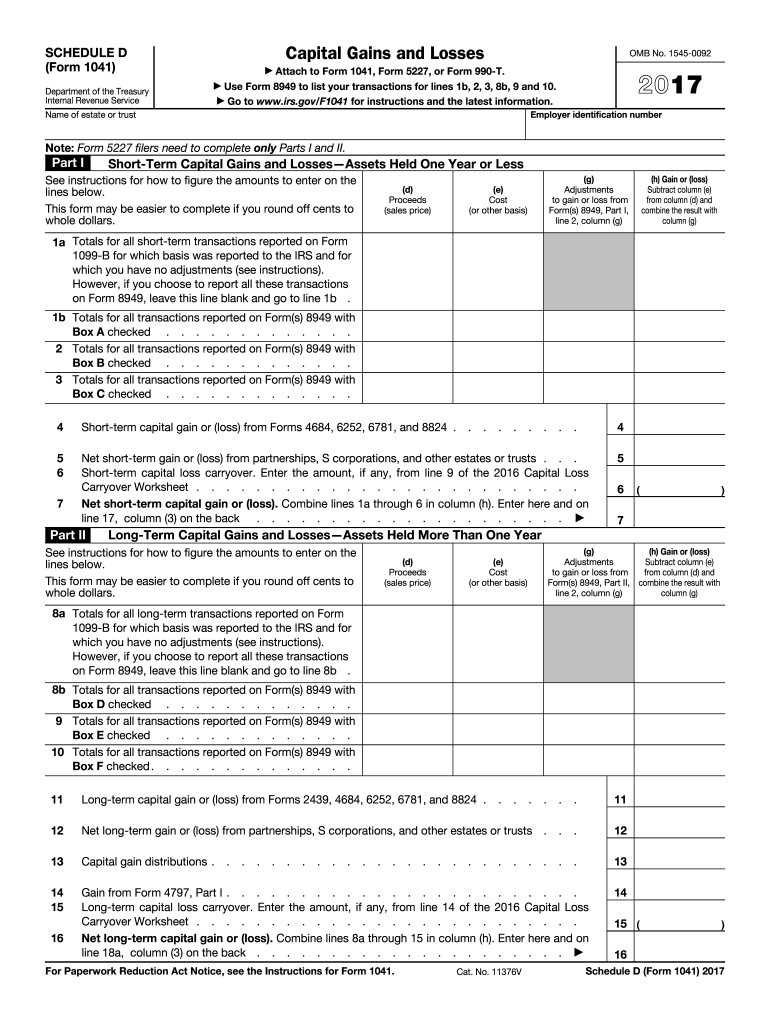

The IRS Form 1041 is a tax return form used by estates and trusts in the United States to report income, deductions, gains, and losses. This form is essential for fiduciaries who manage the financial affairs of an estate or trust. It ensures that any income generated by the estate or trust is reported to the IRS, allowing for the appropriate taxation of that income. The form also allows for the distribution of income to beneficiaries, which may affect their individual tax situations.

How to use the IRS Form 1041

To use the IRS Form 1041, fiduciaries must gather relevant financial information regarding the estate or trust, including income sources, expenses, and distributions made to beneficiaries. The form is divided into several sections, allowing for detailed reporting of income types, deductions, and credits. After completing the form, it must be filed with the IRS, typically by the 15th day of the fourth month following the end of the tax year. Understanding the specific requirements for reporting can help ensure compliance and accurate tax reporting.

Steps to complete the IRS Form 1041

Completing the IRS Form 1041 involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and prior tax returns.

- Fill out the form, starting with basic information about the estate or trust, such as its name, address, and taxpayer identification number.

- Report all income received by the estate or trust, including interest, dividends, and rental income.

- Detail any deductions the estate or trust is entitled to, such as administrative expenses and distributions to beneficiaries.

- Calculate the taxable income and determine the tax owed, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the IRS Form 1041

The IRS Form 1041 is legally required for estates and trusts that generate income. Failure to file this form can lead to penalties and interest on unpaid taxes. It is essential for fiduciaries to understand the legal implications of the form, including the responsibilities associated with managing the estate or trust. Proper use of the form ensures compliance with federal tax laws and helps maintain transparency in financial reporting.

Filing Deadlines / Important Dates

The IRS Form 1041 must be filed by the 15th day of the fourth month after the end of the tax year for the estate or trust. For example, if the tax year ends on December 31, the form is due by April 15 of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, fiduciaries may request an extension to file, but this does not extend the time to pay any taxes owed.

Required Documents

When completing the IRS Form 1041, several documents are necessary to ensure accurate reporting. These include:

- Income statements from various sources, such as bank interest, dividends, and rental income.

- Records of expenses incurred by the estate or trust, including administrative costs and legal fees.

- Documentation of distributions made to beneficiaries, which may affect their individual tax obligations.

- Prior year tax returns for reference, if applicable.

Quick guide on how to complete 2011 irs form 1041

Effortlessly Prepare Irs Form 1041 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Irs Form 1041 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Irs Form 1041 Without Stress

- Locate Irs Form 1041 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information, then click the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 1041 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 irs form 1041

Create this form in 5 minutes!

How to create an eSignature for the 2011 irs form 1041

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is IRS Form 1041 and why is it important?

IRS Form 1041 is the tax form used by estates and trusts to report income, deductions, and tax liability. Completing this form accurately is crucial for fulfilling tax obligations and ensuring compliance with federal tax laws. Using airSlate SignNow can simplify the process of eSigning and submitting IRS Form 1041.

-

How does airSlate SignNow help with IRS Form 1041?

airSlate SignNow provides an easy-to-use platform for electronically signing IRS Form 1041 and other important documents. With tools designed for seamless collaboration, users can efficiently manage the signing process, reducing time and errors associated with traditional paper forms.

-

Is airSlate SignNow cost-effective for managing IRS Form 1041?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs, making it a cost-effective solution for managing IRS Form 1041 and other documentation. By streamlining the signing process, businesses can save both time and money.

-

What features does airSlate SignNow offer for IRS Form 1041?

airSlate SignNow comes equipped with features like customizable templates, secure eSigning, and easy document sharing, which make handling IRS Form 1041 straightforward. These functionalities enhance productivity and ensure that all necessary forms are completed correctly and efficiently.

-

Can airSlate SignNow integrate with tax software for IRS Form 1041?

Yes, airSlate SignNow seamlessly integrates with various tax software solutions, which can help simplify the filing of IRS Form 1041. This integration allows users to import necessary data directly into the form, reducing manual entry and minimizing errors.

-

How does eSigning IRS Form 1041 with airSlate SignNow benefit me?

eSigning IRS Form 1041 with airSlate SignNow saves time and increases efficiency, allowing you to complete the process from anywhere with internet access. Plus, it enhances security by providing verification and audit trails for every signed document.

-

What kind of support does airSlate SignNow offer for IRS Form 1041 users?

airSlate SignNow provides comprehensive support for users handling IRS Form 1041, including detailed guides and customer service assistance. Whether you have questions about functionalities or need help with specific forms, their team is ready to assist you.

Get more for Irs Form 1041

- Legal last will and testament form for divorced person not remarried with adult children iowa

- Legal last will and testament form for divorced person not remarried with no children iowa

- Legal last will and testament form for divorced person not remarried with minor children iowa

- Legal last will and testament form for divorced person not remarried with adult and minor children iowa

- Last will married form

- Legal last will and testament form for a married person with no children iowa

- Iowa married form

- Iowa will form

Find out other Irs Form 1041

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement