Form 1041 Schedule DFill Out and Use This PDF 2024-2026

Understanding Form 1041 and Its Schedule D

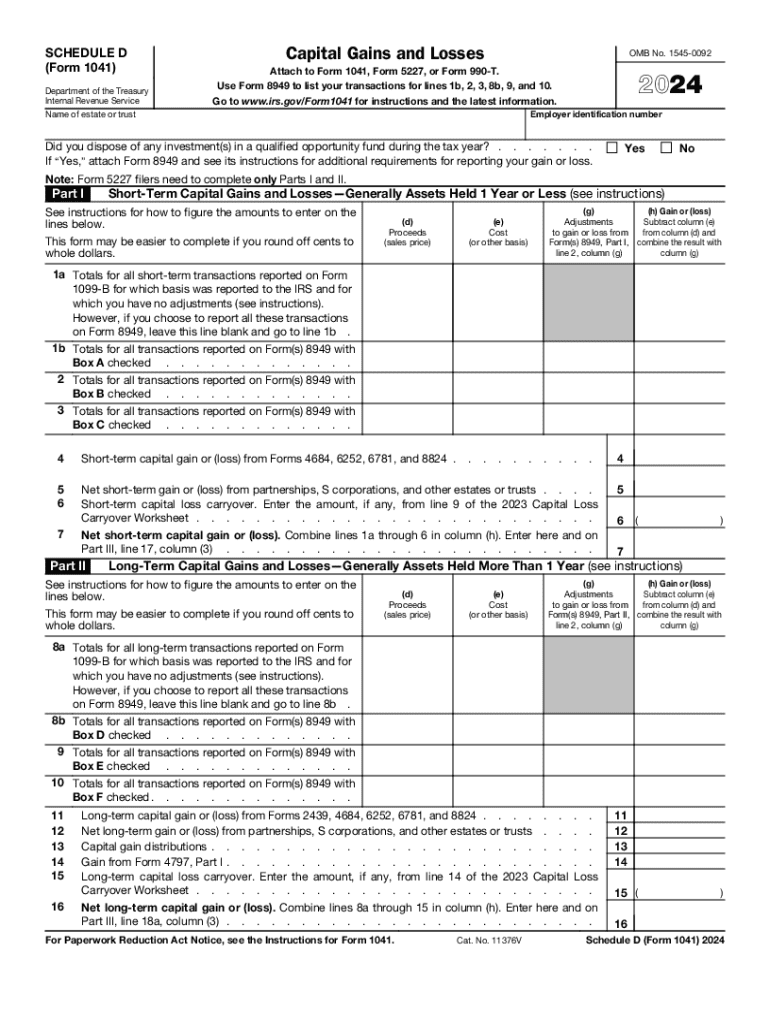

Form 1041 is the U.S. Income Tax Return for Estates and Trusts, used to report income, deductions, gains, and losses of estates and trusts. The Schedule D, which accompanies Form 1041, is specifically designed to report capital gains and losses. This form is essential for fiduciaries managing estates or trusts, ensuring compliance with IRS regulations while accurately accounting for the financial activities of the estate or trust.

Steps to Complete Form 1041 and Schedule D

Completing Form 1041 along with Schedule D involves several key steps:

- Gather all necessary financial documents, including income statements and records of capital transactions.

- Fill out Form 1041, providing details about the estate or trust, including its name, address, and taxpayer identification number.

- Complete Schedule D by detailing capital gains and losses, including transactions that occurred during the tax year.

- Calculate the total capital gains or losses and transfer this information to Form 1041.

- Review the completed forms for accuracy before submission.

IRS Guidelines for Form 1041 and Schedule D

The IRS provides specific guidelines for filing Form 1041 and its Schedule D. It is important to follow these guidelines to ensure compliance and avoid penalties:

- Form 1041 must be filed for any estate or trust that has gross income of $600 or more.

- Schedule D must accurately reflect all capital transactions, including sales of assets held by the estate or trust.

- Fiduciaries should maintain detailed records of all transactions to support the information reported on the forms.

- Consult IRS publications for updates on tax laws and filing requirements related to estates and trusts.

Filing Deadlines for Form 1041

The filing deadline for Form 1041 is generally the 15th day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts that operate on a calendar year, this means the return is due on April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to adhere to these deadlines to avoid late filing penalties.

Required Documents for Form 1041

To complete Form 1041 and its Schedule D, several documents are required:

- Income statements from all sources, including dividends, interest, and rental income.

- Records of capital gains and losses, including purchase and sale documentation for assets.

- Prior year tax returns, if applicable, to ensure consistency and accuracy in reporting.

- Any relevant deductions or credits that the estate or trust may qualify for under IRS guidelines.

Digital Options for Form 1041 Submission

Filing Form 1041 can be done electronically, which is a convenient option for many fiduciaries. The IRS allows electronic filing through authorized e-file providers. Using software like TurboTax can streamline the process, ensuring that all necessary forms, including Schedule D, are completed accurately. Alternatively, Form 1041 can be printed and mailed to the IRS, but electronic filing is often faster and more secure.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 schedule dfill out and use this pdf

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule dfill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 and why is it important?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is important because it allows fiduciaries to report income, deductions, gains, and losses of the estate or trust. Properly completing Form 1041 ensures compliance with tax regulations and helps in the accurate distribution of assets.

-

How can airSlate SignNow help with Form 1041?

airSlate SignNow streamlines the process of preparing and signing Form 1041 by providing an easy-to-use platform for document management. Users can create, send, and eSign the form securely, ensuring that all necessary signatures are obtained efficiently. This reduces the time spent on paperwork and enhances overall productivity.

-

What features does airSlate SignNow offer for managing Form 1041?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 1041. These features allow users to easily manage the form, ensuring that all necessary information is included and that the document is signed by all required parties. Additionally, users can access their documents from anywhere, enhancing flexibility.

-

Is there a cost associated with using airSlate SignNow for Form 1041?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to manage Form 1041. The plans are designed to be cost-effective, providing value through features that simplify document management and eSigning. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 1041?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Form 1041 alongside your existing tools. This integration helps streamline workflows and ensures that all relevant data is synchronized, enhancing efficiency in document handling.

-

What are the benefits of using airSlate SignNow for Form 1041?

Using airSlate SignNow for Form 1041 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which speeds up the process of filing the form. Additionally, it provides a secure environment for sensitive information, ensuring compliance with privacy regulations.

-

How does airSlate SignNow ensure the security of Form 1041 documents?

airSlate SignNow employs advanced security measures to protect Form 1041 documents, including encryption and secure access controls. This ensures that only authorized individuals can view or sign the documents. Regular security audits and compliance with industry standards further enhance the safety of your sensitive information.

Get more for Form 1041 Schedule DFill Out And Use This PDF

Find out other Form 1041 Schedule DFill Out And Use This PDF

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form