Irs Form Capital 2016

What is the Irs Form Capital

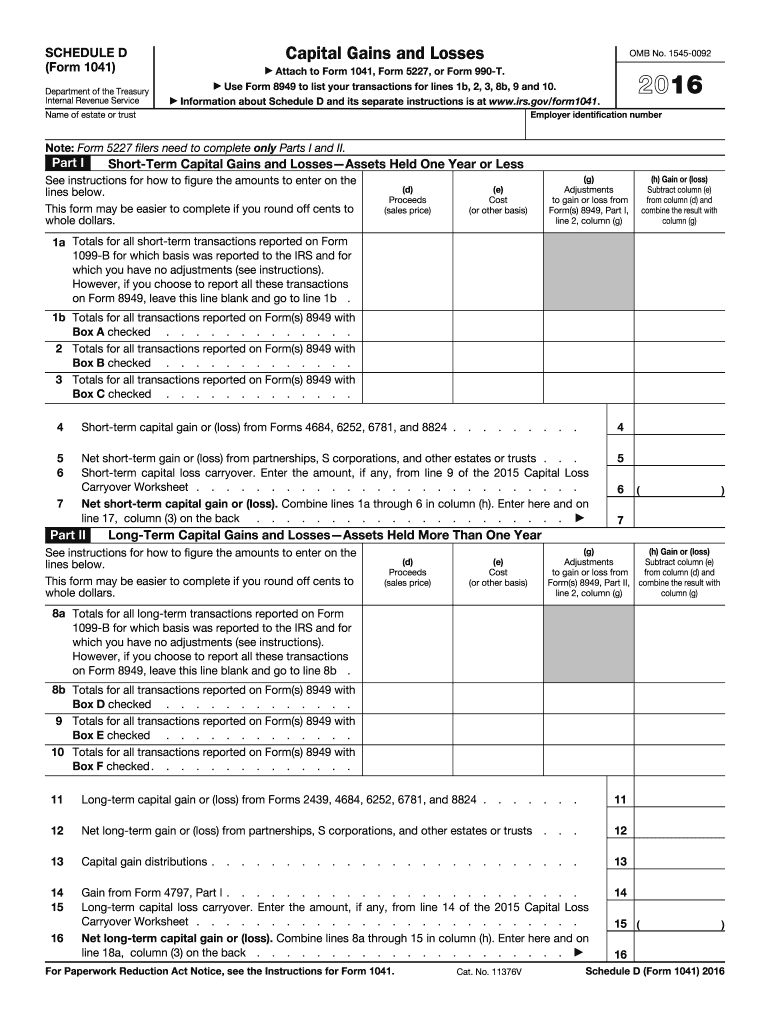

The Irs Form Capital is a specific tax form used by individuals and businesses to report capital gains and losses to the Internal Revenue Service (IRS). This form plays a crucial role in determining the tax liability associated with the sale of assets such as stocks, bonds, and real estate. Accurate completion of this form is essential for compliance with U.S. tax laws, as it helps the IRS assess the correct amount of tax owed based on the gains or losses incurred during the tax year.

How to use the Irs Form Capital

Using the Irs Form Capital involves several steps to ensure that all required information is accurately reported. First, gather all relevant financial documents, including records of asset purchases, sales, and any associated costs. Next, complete the form by entering details such as the date of acquisition, date of sale, and the amount realized from the sale. It is important to categorize gains and losses as either short-term or long-term, as this affects the tax rate applied. After filling out the form, review it for accuracy before submission to the IRS.

Steps to complete the Irs Form Capital

Completing the Irs Form Capital can be broken down into a series of straightforward steps:

- Gather Documentation: Collect all necessary records related to the assets sold, including purchase and sale receipts.

- Determine Holding Period: Identify whether the asset was held for less than or more than one year to classify the gain or loss as short-term or long-term.

- Calculate Gains and Losses: Subtract the cost basis (purchase price plus any additional costs) from the sale price to determine the gain or loss.

- Fill Out the Form: Enter the calculated figures into the appropriate sections of the Irs Form Capital, ensuring all information is accurate.

- Review and Submit: Double-check the completed form for errors before submitting it to the IRS by the designated deadline.

Legal use of the Irs Form Capital

The legal use of the Irs Form Capital is governed by IRS regulations, which stipulate that taxpayers must accurately report all capital gains and losses to ensure compliance with tax obligations. Failure to properly complete and submit this form can lead to penalties, including fines and interest on unpaid taxes. It is essential for taxpayers to understand the legal implications of their reporting, as accurate disclosures can prevent potential audits or legal disputes with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form Capital typically align with the annual tax return deadlines. For most individual taxpayers, the deadline falls on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to be aware of these dates to avoid late filing penalties and ensure timely compliance with tax regulations.

Required Documents

To complete the Irs Form Capital, several documents are required to substantiate the information reported. These include:

- Purchase receipts for the assets sold.

- Sale agreements or closing statements.

- Records of any improvements or additional costs incurred on the asset.

- Previous tax returns, if applicable, to reference prior capital gains or losses.

Penalties for Non-Compliance

Non-compliance with the Irs Form Capital can result in significant penalties imposed by the IRS. These penalties may include monetary fines, interest on unpaid taxes, and potential legal action for willful neglect. It is important for taxpayers to understand the seriousness of accurately reporting capital gains and losses to avoid these repercussions. Regularly consulting with a tax professional can help ensure compliance and mitigate risks associated with filing errors.

Quick guide on how to complete irs form capital 2016

Complete Irs Form Capital effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Irs Form Capital on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Irs Form Capital effortlessly

- Obtain Irs Form Capital and then click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and then click on the Done button to save your modifications.

- Select your preferred method to submit your form, be it via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form Capital and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form capital 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form capital 2016

How to create an electronic signature for your Irs Form Capital 2016 online

How to create an electronic signature for your Irs Form Capital 2016 in Chrome

How to make an electronic signature for signing the Irs Form Capital 2016 in Gmail

How to create an electronic signature for the Irs Form Capital 2016 right from your smart phone

How to generate an eSignature for the Irs Form Capital 2016 on iOS devices

How to generate an electronic signature for the Irs Form Capital 2016 on Android

People also ask

-

What is the purpose of the IRS Form Capital?

The IRS Form Capital is a crucial document that helps businesses report their capital gains and losses to the Internal Revenue Service. It ensures compliance with tax regulations, making it easier for companies to manage their financial reporting effectively. Using airSlate SignNow, you can quickly eSign and send the IRS Form Capital, streamlining your tax filing process.

-

How does airSlate SignNow support IRS Form Capital signing?

AirSlate SignNow simplifies the process of signing the IRS Form Capital by providing an intuitive eSignature platform. Users can easily upload their documents, add necessary signatures, and send them securely, all while ensuring compliance with IRS regulations. This efficient process saves time and reduces the paperwork hassle associated with traditional signing methods.

-

What are the pricing options for using airSlate SignNow with IRS Form Capital?

AirSlate SignNow offers flexible pricing plans tailored to suit different business needs, including those requiring IRS Form Capital signing. Plans vary based on features, allowing users to choose the level of service that fits their budget. This cost-effective solution helps businesses save on operational costs while benefiting from seamless document management.

-

Are there any features specifically for IRS Form Capital on airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to enhance the signing process for IRS Form Capital. These features include template creation for repetitive forms, advanced security measures, and real-time tracking of document status. This ensures that your IRS Form Capital is handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for IRS Form Capital management?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, allowing for efficient management of your IRS Form Capital and other documents. Whether it’s accounting software or customer relationship management tools, integrating these applications enhances your workflow and ensures all your documents are in one place.

-

How secure is the signing process for IRS Form Capital with airSlate SignNow?

The signing process for IRS Form Capital using airSlate SignNow is highly secure. The platform employs advanced encryption technologies and complies with industry standards to protect your sensitive financial information. You can confidently eSign and send your IRS Form Capital, knowing that your data is safeguarded.

-

What benefits does airSlate SignNow provide for filing IRS Form Capital?

Using airSlate SignNow for filing IRS Form Capital offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform allows for easy collaboration among team members, ensuring the right people are involved in the signing process. Overall, it streamlines your workflow, making tax season less stressful.

Get more for Irs Form Capital

Find out other Irs Form Capital

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist