Irs Schedule D Form 1041 Fillable 2018

What is the IRS Schedule D Form 1041 Fillable

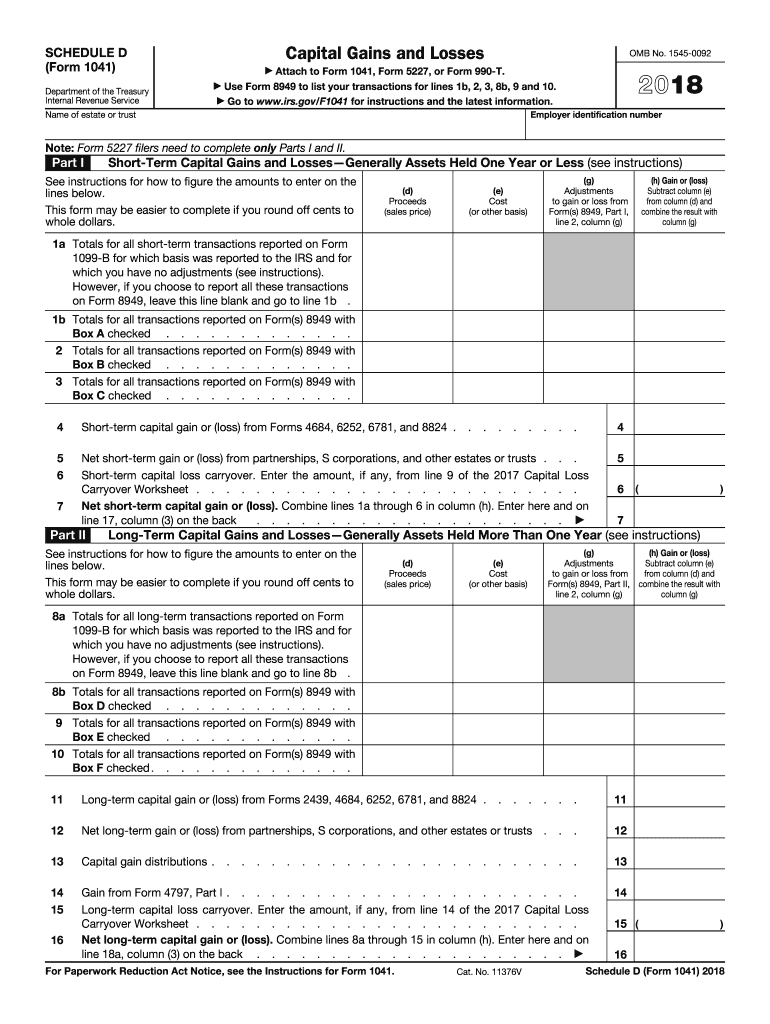

The IRS Schedule D Form 1041 is a crucial document used by estates and trusts to report capital gains and losses. This form is specifically designed for fiduciaries who are responsible for managing the assets of a decedent's estate or a trust. The fillable version of this form allows users to enter information digitally, making it easier to complete and submit. It is essential to ensure that the form is filled out accurately to comply with IRS regulations and to avoid potential penalties.

How to Use the IRS Schedule D Form 1041 Fillable

Using the IRS Schedule D Form 1041 fillable version involves several straightforward steps. First, download the form from the IRS website or a reliable source. Next, open the form in a PDF reader that supports fillable forms. Enter your information in the designated fields, ensuring all required details are completed. After filling out the form, review it for accuracy and completeness. Once satisfied, you can print the form for submission or save it electronically if filing online is permitted.

Steps to Complete the IRS Schedule D Form 1041 Fillable

Completing the IRS Schedule D Form 1041 fillable version requires careful attention to detail. Follow these steps:

- Gather all necessary documentation, including records of capital gains and losses.

- Open the fillable form and begin entering the estate or trust's identifying information.

- Input details regarding each capital asset, including purchase and sale dates, as well as the amounts involved.

- Calculate total gains and losses, ensuring to follow IRS guidelines for reporting.

- Review the completed form for accuracy, checking for any missing information.

- Save the form in a secure location, and prepare it for submission.

Legal Use of the IRS Schedule D Form 1041 Fillable

The IRS Schedule D Form 1041 fillable version is legally binding when completed and submitted according to IRS regulations. It is essential for fiduciaries to use the correct version of the form for the specific tax year and to ensure that all information is accurate. Failure to comply with legal requirements can result in penalties, including fines and interest on unpaid taxes. Always refer to the latest IRS guidelines to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule D Form 1041 are critical for compliance. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts operating on a calendar year, this typically means April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is advisable to keep track of these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS Schedule D Form 1041 can be submitted through various methods, depending on the preferences of the fiduciary and the requirements of the IRS. If filing electronically, ensure that you use an approved e-filing software that supports the form. For those opting to file by mail, print the completed form and send it to the appropriate IRS address based on the location of the estate or trust. In-person submissions are generally not accepted, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete irs form 1041 2018 2019

Discover the easiest method to complete and sign your Irs Schedule D Form 1041 Fillable

Are you still spending time preparing your official documents on paper instead of managing them online? airSlate SignNow provides a superior approach to complete and sign your Irs Schedule D Form 1041 Fillable and related forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle documents swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing tools are all readily available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Irs Schedule D Form 1041 Fillable:

- Insert the fillable template into the editor using the Get Form button.

- Review what information is required in your Irs Schedule D Form 1041 Fillable.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Cover sections that are no longer relevant.

- Select Sign to create a legally valid eSignature using any method you prefer.

- Include the Date next to your signature and conclude your task with the Done button.

Store your completed Irs Schedule D Form 1041 Fillable in the Documents folder of your profile, download it, or send it to your preferred cloud storage. Our service also provides flexible form sharing options. There’s no need to print your forms when you want to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery through your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1041 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 1041 2018 2019

How to create an electronic signature for the Irs Form 1041 2018 2019 in the online mode

How to make an eSignature for your Irs Form 1041 2018 2019 in Chrome

How to generate an eSignature for signing the Irs Form 1041 2018 2019 in Gmail

How to generate an eSignature for the Irs Form 1041 2018 2019 from your smartphone

How to generate an eSignature for the Irs Form 1041 2018 2019 on iOS

How to create an electronic signature for the Irs Form 1041 2018 2019 on Android

People also ask

-

What is the irs gov 1041 schedule d used for?

The irs gov 1041 schedule d is used by estates and trusts to report capital gains and losses from the sale of capital assets. This form helps beneficiaries and fiduciaries accurately report income and comply with tax regulations, ensuring transparency in financial matters.

-

How can airSlate SignNow assist with filling out the irs gov 1041 schedule d?

airSlate SignNow streamlines the process of preparing and signing the irs gov 1041 schedule d by providing easy-to-use templates and electronic signature capabilities. This reduces time spent on paperwork and ensures that all documents are securely signed and stored.

-

What are the pricing options for using airSlate SignNow for the irs gov 1041 schedule d?

airSlate SignNow offers various pricing plans that cater to different businesses' needs. Whether you are a small estate or a large trust, you can find an economical solution that fits your budget while ensuring compliance with the irs gov 1041 schedule d requirements.

-

Is airSlate SignNow compliant with IRS regulations for the irs gov 1041 schedule d?

Yes, airSlate SignNow is designed to meet all necessary compliance standards, including those set by the IRS for the irs gov 1041 schedule d. You can trust that our platform provides a secure and legally binding way to handle your tax documents.

-

What features does airSlate SignNow offer for managing the irs gov 1041 schedule d?

With airSlate SignNow, you get features like customizable templates, real-time collaboration, and secure document storage, all specifically designed to support users in managing the irs gov 1041 schedule d efficiently. These tools enhance productivity and simplify the documentation process.

-

Can I integrate airSlate SignNow with other tools for managing the irs gov 1041 schedule d?

Absolutely! airSlate SignNow offers integrations with a variety of business tools, allowing you to streamline your workflow when preparing the irs gov 1041 schedule d. Connect it with your existing platforms for a more seamless experience.

-

How does airSlate SignNow enhance the signing process for the irs gov 1041 schedule d?

airSlate SignNow enhances the signing process for the irs gov 1041 schedule d by offering features such as mobile signing and automated reminders. This ensures that all necessary parties can sign documents quickly, reducing delays and ensuring compliance.

Get more for Irs Schedule D Form 1041 Fillable

Find out other Irs Schedule D Form 1041 Fillable

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online