Additional Items Related to Schedule D Form 1041Internal Revenue 2022

Understanding IRS Form 1041 Schedule D

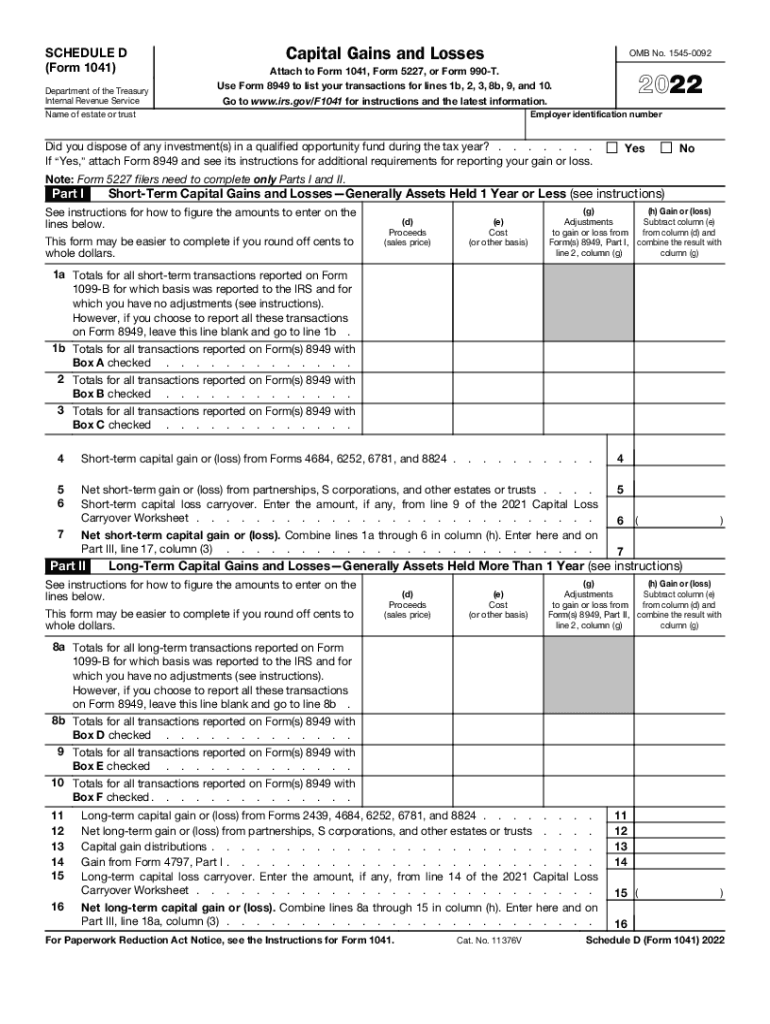

The IRS Form 1041 Schedule D is a crucial document for estates and trusts that need to report capital gains and losses. This form is used to summarize the gains and losses from the sale of capital assets. It is essential for ensuring compliance with federal tax regulations. The form requires detailed information about each transaction, including dates of acquisition and sale, the cost basis of the assets, and the proceeds from the sale. Understanding how to accurately complete this form is vital for proper tax reporting.

Steps to Complete IRS Form 1041 Schedule D

Completing the IRS Form 1041 Schedule D involves several steps:

- Gather necessary documentation, including records of all capital transactions.

- Fill out the identification section, including the name of the estate or trust and its Employer Identification Number (EIN).

- List each capital asset sold during the tax year, providing details such as acquisition and sale dates.

- Calculate the gain or loss for each transaction by subtracting the cost basis from the sale proceeds.

- Summarize total gains and losses on the form.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 1041 Schedule D

The IRS provides specific guidelines for filling out Form 1041 Schedule D. These guidelines include instructions on what constitutes a capital asset, how to report different types of gains, and the implications of short-term versus long-term capital gains. It is essential to adhere to these guidelines to avoid penalties and ensure the accuracy of the tax return. The IRS also offers resources and publications that can assist in understanding the requirements for this form.

Filing Deadlines for IRS Form 1041 Schedule D

The filing deadline for IRS Form 1041, including Schedule D, typically aligns with the tax return due date for estates and trusts. Generally, this is the fifteenth day of the fourth month following the end of the tax year. For estates with a calendar year-end, this means the form is due by April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended. It is important to be aware of these deadlines to avoid late filing penalties.

Legal Use of IRS Form 1041 Schedule D

IRS Form 1041 Schedule D is legally binding when completed accurately and submitted according to IRS regulations. The form must be signed by the fiduciary of the estate or trust, affirming that the information provided is true and correct. Failure to comply with the legal requirements associated with this form can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is vital for fiduciaries managing estates and trusts.

Required Documents for Completing Form 1041 Schedule D

To complete IRS Form 1041 Schedule D, several documents are required:

- Records of capital asset transactions, including purchase and sale agreements.

- Statements from brokers or financial institutions detailing sales of securities.

- Documentation of any improvements made to capital assets that may affect the cost basis.

- Prior year tax returns, if applicable, to ensure consistency in reporting.

Quick guide on how to complete additional items related to schedule d form 1041internal revenue

Completing Additional Items Related To Schedule D Form 1041Internal Revenue effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Additional Items Related To Schedule D Form 1041Internal Revenue across any platform with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

The easiest method to modify and eSign Additional Items Related To Schedule D Form 1041Internal Revenue effortlessly

- Locate Additional Items Related To Schedule D Form 1041Internal Revenue and click on Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about losing or misplacing files, time-consuming form searches, or errors that necessitate reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Additional Items Related To Schedule D Form 1041Internal Revenue while ensuring excellent communication throughout the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct additional items related to schedule d form 1041internal revenue

Create this form in 5 minutes!

People also ask

-

What is the 2022 IRS Form 1041 Schedule D?

The 2022 IRS Form 1041 Schedule D is used to report capital gains and losses for estates and trusts. It allows you to report the sale of assets, helping you determine your tax obligations. Understanding this form is essential for proper tax reporting.

-

How can airSlate SignNow help with filing the 2022 IRS Form 1041 Schedule D?

airSlate SignNow allows you to easily send, eSign, and manage documents required for filing the 2022 IRS Form 1041 Schedule D. Our platform simplifies the document workflow, making it easier to gather signatures and maintain an organized filing process. This ensures that you remain compliant and efficient in your tax submissions.

-

What are the pricing options for using airSlate SignNow in relation to the 2022 IRS Form 1041 Schedule D?

airSlate SignNow offers several pricing plans tailored to suit different business needs, starting from a cost-effective basic plan. Each plan includes features like document templates and eSigning capabilities that can signNowly simplify your process when dealing with the 2022 IRS Form 1041 Schedule D. Check our website for current pricing and promotions.

-

Are there any features in airSlate SignNow that specifically aid with the 2022 IRS Form 1041 Schedule D?

Yes, airSlate SignNow offers features like document templates and automatic reminders that are particularly helpful when preparing the 2022 IRS Form 1041 Schedule D. These features help ensure that all necessary information is collected promptly, reducing the risk of errors. This streamlines your preparation process for tax filings.

-

Can airSlate SignNow integrate with tax preparation software for the 2022 IRS Form 1041 Schedule D?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software. This allows you to import and export necessary documents required for the 2022 IRS Form 1041 Schedule D efficiently. Such integration ensures a smooth workflow and minimizes manual data entry.

-

Is there customer support available for using airSlate SignNow with the 2022 IRS Form 1041 Schedule D?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any queries related to the 2022 IRS Form 1041 Schedule D. Our support team is available via chat, email, and phone to help ensure a seamless user experience.

-

What benefits does eSigning offer for the 2022 IRS Form 1041 Schedule D?

Using eSigning with airSlate SignNow for the 2022 IRS Form 1041 Schedule D ensures faster turnaround times and improved document security. eSigning increases efficiency by allowing multiple parties to sign documents without the need for physical meetings. Additionally, it provides an audit trail that enhances the validity of the documents.

Get more for Additional Items Related To Schedule D Form 1041Internal Revenue

- Subcontractor mechanic form

- Quitclaim deed from individual to corporation illinois form

- Warranty deed from individual to corporation illinois form

- Subcontractors verified statement mechanic liens corporation or llc illinois form

- Subcontractors lien notice of claim mechanic liens individual illinois form

- Quitclaim deed from individual to llc illinois form

- Il llc 497306109 form

- Illinois lien 497306110 form

Find out other Additional Items Related To Schedule D Form 1041Internal Revenue

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online