1041 Schedule D Form 2012

What is the 1041 Schedule D Form

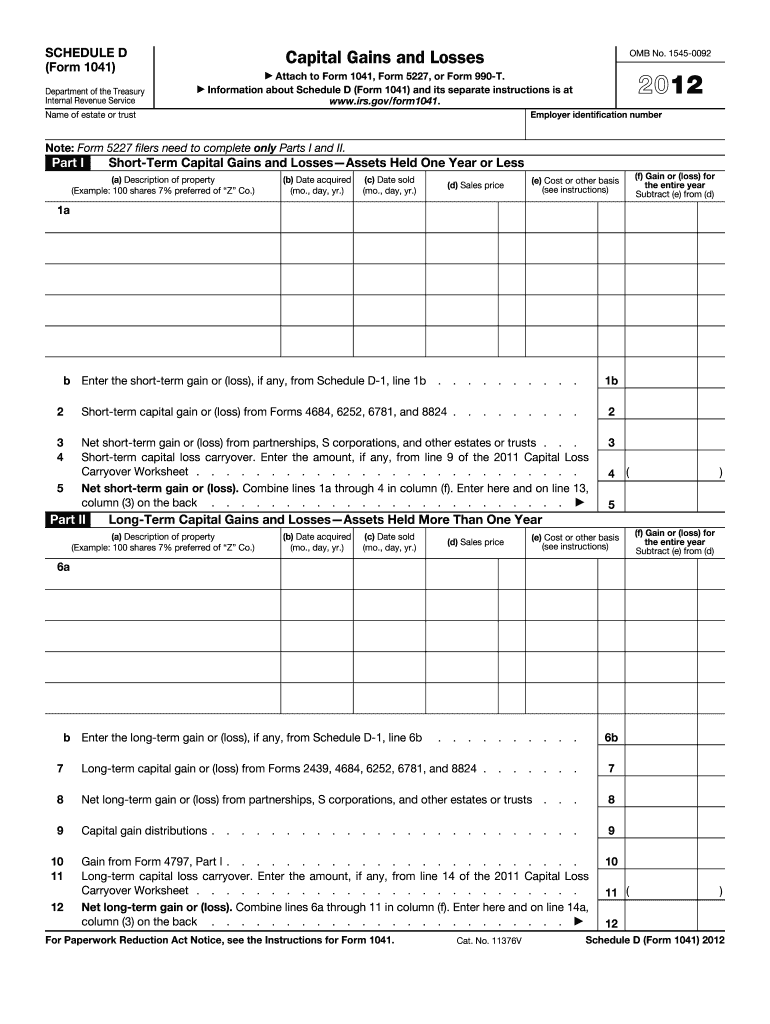

The 1041 Schedule D Form is a tax document used by estates and trusts to report capital gains and losses. This form is an essential part of the IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. It allows fiduciaries to detail the sale of capital assets, such as stocks, bonds, and real estate, ensuring accurate reporting of income generated from these transactions. Understanding this form is crucial for proper tax compliance and to avoid potential penalties.

How to use the 1041 Schedule D Form

Using the 1041 Schedule D Form involves several steps to ensure accurate reporting of capital gains and losses. First, gather all necessary financial information regarding the estate or trust's capital transactions. This includes purchase prices, sale prices, and any associated costs. Next, complete the form by detailing each transaction, including the date of acquisition, date of sale, and the gain or loss realized. Finally, attach the completed Schedule D to the Form 1041 when submitting to the IRS. It is important to keep copies for your records.

Steps to complete the 1041 Schedule D Form

Completing the 1041 Schedule D Form requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including purchase and sale records of capital assets.

- Fill in the basic information at the top of the form, including the name and identification number of the estate or trust.

- List each capital asset transaction in the appropriate sections, ensuring to include dates and amounts.

- Calculate the total capital gains and losses, and transfer these figures to the main Form 1041.

- Review the completed form for accuracy before submission.

Legal use of the 1041 Schedule D Form

The legal use of the 1041 Schedule D Form is governed by IRS regulations. It must be filled out accurately to reflect the capital gains and losses of the estate or trust. Failure to comply with IRS guidelines can result in penalties, including fines and interest on unpaid taxes. Additionally, the form must be submitted by the tax filing deadline to avoid further legal complications. Understanding the legal implications of this form is essential for fiduciaries managing estates and trusts.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 Schedule D Form align with the overall deadlines for Form 1041. Typically, the due date for Form 1041 is the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this generally means April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to mark these dates to ensure timely filing and compliance.

Penalties for Non-Compliance

Non-compliance with the requirements of the 1041 Schedule D Form can lead to significant penalties. The IRS may impose fines for late filing, which can accumulate daily until the form is submitted. Additionally, inaccuracies in reporting capital gains and losses can result in further penalties, including interest on unpaid taxes. It is crucial for fiduciaries to ensure that the form is completed accurately and submitted on time to avoid these financial repercussions.

Quick guide on how to complete 2012 1041 schedule d form

Complete 1041 Schedule D Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 1041 Schedule D Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign 1041 Schedule D Form with ease

- Obtain 1041 Schedule D Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign 1041 Schedule D Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1041 schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1041 schedule d form

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is a 1041 Schedule D Form?

The 1041 Schedule D Form is used by estates and trusts to report capital gains and losses from the sale or exchange of assets. Completing this form accurately is essential for proper tax reporting. With airSlate SignNow, you can easily prepare and eSign your completed 1041 Schedule D Form quickly.

-

How does airSlate SignNow help with the 1041 Schedule D Form?

airSlate SignNow provides a user-friendly platform for filling out and eSigning the 1041 Schedule D Form. Our solution simplifies the document preparation process, ensuring that you can send, sign, and manage your forms efficiently. Enjoy the peace of mind that comes with knowing your tax documents are securely handled.

-

What are the pricing options for using airSlate SignNow for the 1041 Schedule D Form?

airSlate SignNow offers competitive pricing tailored to various business needs, including plans that are affordable for individual users as well as larger enterprises. By utilizing our services for the 1041 Schedule D Form, you can save time and reduce the costs associated with traditional document management. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools for managing the 1041 Schedule D Form?

Yes, airSlate SignNow seamlessly integrates with various applications, enabling you to manage your 1041 Schedule D Form alongside your other financial documents. This integration facilitates easier workflow management and enhances your productivity by keeping all your data in sync. Explore our integration options to find the best fit for your needs.

-

What are the security features for eSigning the 1041 Schedule D Form?

When using airSlate SignNow to eSign the 1041 Schedule D Form, your documents are protected by top-tier security features, including encryption and secure cloud storage. We prioritize the safety of your sensitive information, ensuring that your tax documents are handled with the utmost care. Trust airSlate SignNow for a safe eSigning experience.

-

Is there customer support available for assistance with the 1041 Schedule D Form?

Absolutely! airSlate SignNow offers robust customer support to assist you with any questions or challenges you might face while preparing your 1041 Schedule D Form. Our dedicated team is ready to help you navigate the platform and ensure you complete your documents accurately. signNow out via chat, email, or phone for assistance.

-

What benefits can I expect when using airSlate SignNow for the 1041 Schedule D Form?

Using airSlate SignNow for the 1041 Schedule D Form provides numerous benefits including streamlined document workflows, reduced processing time, and enhanced collaboration. This allows you to focus more on your core business activities rather than document management. Experience the efficiency that comes with our easy-to-use eSigning solution.

Get more for 1041 Schedule D Form

- Option to purchase package district of columbia form

- Amendment of lease package district of columbia form

- Annual financial checkup package district of columbia form

- Dc bill sale form

- Living wills and health care package district of columbia form

- Dc last form

- Subcontractors package district of columbia form

- Dc identity theft form

Find out other 1041 Schedule D Form

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast