Series Ee Savings Bond Value Chart 2023-2026

What is the Series Ee Savings Bond Value Chart

The Series Ee Savings Bond Value Chart is a tool that helps individuals determine the current value of their Series Ee savings bonds. These bonds are issued by the U.S. Department of the Treasury and are designed to encourage saving by offering a fixed interest rate. The value chart provides a comprehensive overview of how much a bond is worth based on its issue date and the length of time it has been held. It is essential for bondholders to understand this chart to make informed decisions regarding their investments.

How to use the Series Ee Savings Bond Value Chart

Using the Series Ee Savings Bond Value Chart is straightforward. First, locate the issue date of your bond, which is typically printed on the bond itself. Next, find the corresponding row in the value chart that matches your bond's issue date. The chart will display the bond's value based on the number of years it has been held. By cross-referencing these two pieces of information, you can easily determine the current value of your savings bond.

How to obtain the Series Ee Savings Bond Value Chart

The Series Ee Savings Bond Value Chart can be obtained through various sources. The most reliable method is to visit the official U.S. Treasury website, where the chart is regularly updated to reflect current values. Additionally, financial institutions and libraries may have printed copies available. It is important to ensure that you are using the most recent version of the chart to get accurate information.

Examples of using the Series Ee Savings Bond Value Chart

To illustrate the practical use of the Series Ee Savings Bond Value Chart, consider a bond issued in January 2010. If the bondholder checks the chart and sees that a bond issued in that month is worth $1,500 after ten years, they can assess whether to cash it in or hold onto it for potential future value growth. Another example could involve a bond issued in 2015 that has reached maturity. The holder can quickly find its value on the chart to make decisions regarding reinvestment or cashing out.

IRS Guidelines

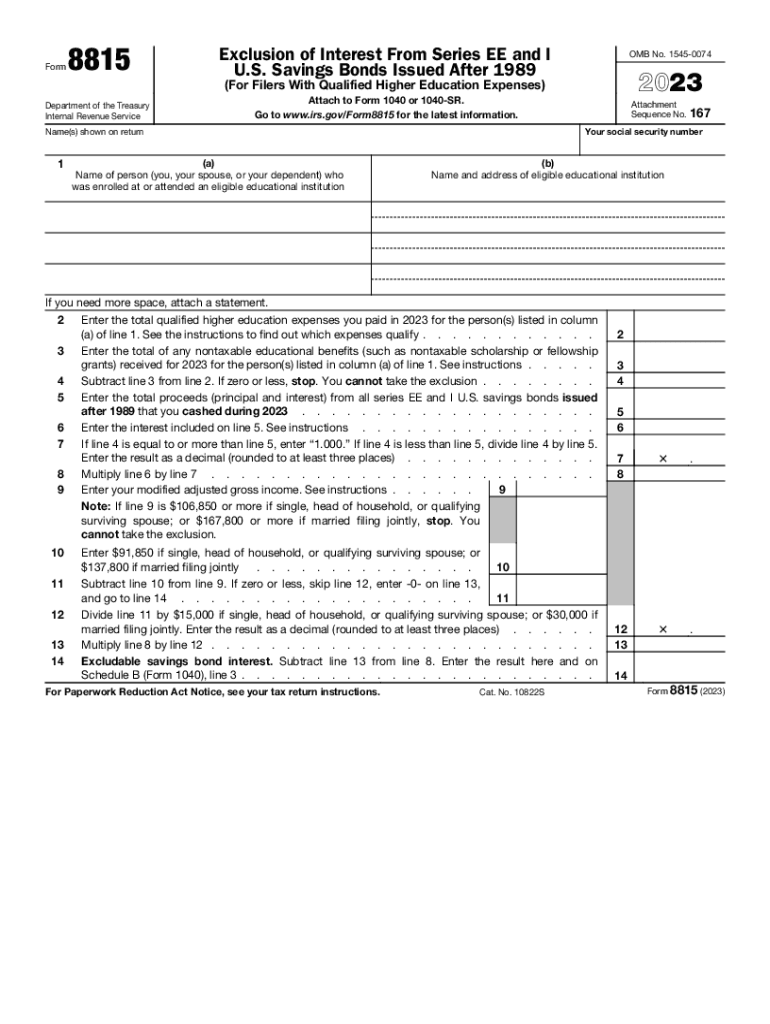

The IRS provides specific guidelines regarding the taxation of Series Ee savings bonds. Interest earned on these bonds is subject to federal income tax, but it may be excluded from income if used for qualified educational expenses. It is crucial for bondholders to keep accurate records and consult IRS publications to understand their tax obligations fully. The IRS Form 8815 may be used to report the exclusion of interest from taxable income when applicable.

Filing Deadlines / Important Dates

When dealing with Series Ee savings bonds, it is essential to be aware of important filing deadlines. Generally, the interest earned on these bonds must be reported in the year it is redeemed or matures. For tax purposes, the filing deadline for individual tax returns is typically April 15 of the following year. Understanding these dates helps bondholders avoid penalties and ensures compliance with IRS regulations.

Required Documents

To accurately assess the value of Series Ee savings bonds and report any interest earned, certain documents are necessary. These include the original bond certificates, any previous tax returns that may include interest from the bonds, and the Series Ee Savings Bond Value Chart for current valuation. Keeping these documents organized will facilitate easier filing and compliance with IRS requirements.

Quick guide on how to complete series ee savings bond value chart

Effortlessly Prepare Series Ee Savings Bond Value Chart on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without obstacles. Handle Series Ee Savings Bond Value Chart on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Series Ee Savings Bond Value Chart with Ease

- Obtain Series Ee Savings Bond Value Chart and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Series Ee Savings Bond Value Chart and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct series ee savings bond value chart

Create this form in 5 minutes!

How to create an eSignature for the series ee savings bond value chart

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a series EE savings bond value chart?

A series EE savings bond value chart provides detailed information on the current value of series EE bonds, allowing investors to track their growth over time. This chart includes interest rates and maturity values to help users understand their investment's worth at different intervals. It is essential for anyone managing savings bonds to refer to this chart regularly.

-

How can I use the series EE savings bond value chart effectively?

To use the series EE savings bond value chart effectively, first locate the denomination of your bonds and then find the corresponding value based on the issue date. This will help you determine how much your investment has appreciated and its current worth. Regularly checking this chart ensures you are informed about your financial assets.

-

What factors affect the value of series EE savings bonds?

The value of series EE savings bonds is primarily influenced by the interest rate set at the time of purchase and the duration for which the bonds are held. Additionally, the U.S. Treasury periodically updates the value via the series EE savings bond value chart, reflecting any changes in interest accrual. Understanding these factors can help you make informed decisions about your investments.

-

Are series EE savings bonds a good investment?

Yes, series EE savings bonds can be a great investment choice for conservative investors looking for a secure way to grow their savings. They offer guaranteed returns and are backed by the U.S. government, making them a low-risk option. Utilizing the series EE savings bond value chart can help you track your investment's performance and ensure it aligns with your financial goals.

-

How do I redeem my series EE savings bonds?

To redeem your series EE savings bonds, you can take them to a financial institution or bank that offers this service. Make sure to bring identification, as they may require it to process your redemption. Knowing the current worth through the series EE savings bond value chart can help you understand what amount you will receive.

-

Where can I find the latest series EE savings bond value chart?

The latest series EE savings bond value chart can be found on the official U.S. Department of the Treasury website or financial news sites that track bond performance. Additionally, you can find resources and tools that update this chart regularly, providing accurate and timely information. Keeping an eye on these resources can help you stay informed about your investments.

-

Do series EE savings bonds earn interest after maturity?

No, series EE savings bonds do not earn interest after signNowing their maturity period, which is typically 30 years. Once they mature, you will no longer accumulate interest, and it's advisable to redeem them to benefit from their full value. Utilizing the series EE savings bond value chart can help you determine the optimal time for redemption.

Get more for Series Ee Savings Bond Value Chart

- The best way to write and format a business letter wikihow

- Enclosed herewith please find a copy of the answer to motion for relief from the form

- Please find a copy of the final judgment of divorce which was entered by the court on form

- Dear n a m e form

- Enclosed herewith please find a copy of an order to disburse funds which has been entered form

- C i t y state zip code form

- Pdf how to say it third edition choice words rosalie maggio form

- Daycare tuition increase letter sample form

Find out other Series Ee Savings Bond Value Chart

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT