Form 8815 2017

What is the Form 8815

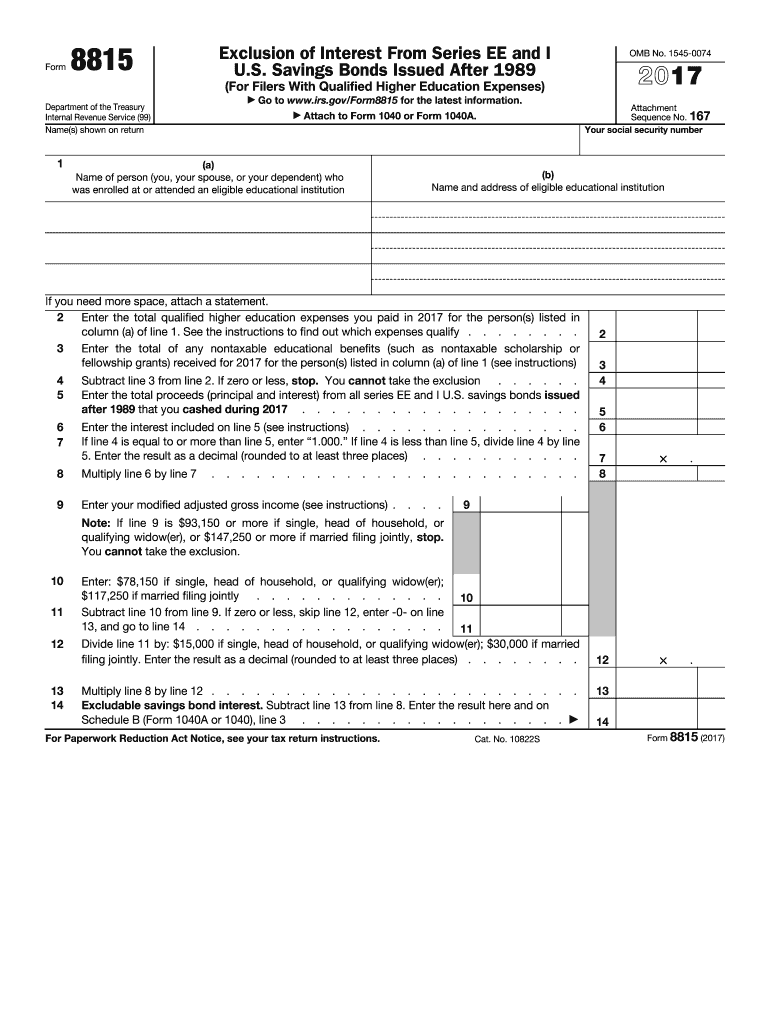

The Form 8815, officially known as the "Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989," is a tax form used by individuals to report the exclusion of interest earned on certain U.S. savings bonds. This form is particularly relevant for taxpayers who have used the proceeds from these bonds to pay for qualified higher education expenses. By completing Form 8815, eligible taxpayers can exclude interest income from their gross income on their federal tax returns, potentially lowering their taxable income and tax liability.

How to use the Form 8815

To effectively use Form 8815, taxpayers must first determine their eligibility based on income limits and the purpose of the bond proceeds. The form requires individuals to provide specific information, including the amount of interest earned on the bonds and the qualified education expenses. After filling out the form, it should be attached to the taxpayer's Form 1040 or 1040A when filing their federal tax return. It is essential to ensure that all figures are accurate and that the form is submitted by the tax filing deadline to avoid penalties.

Steps to complete the Form 8815

Completing Form 8815 involves several key steps:

- Gather Documentation: Collect all necessary documents, including the U.S. savings bonds and proof of qualified education expenses.

- Determine Eligibility: Check if your modified adjusted gross income is within the limits set by the IRS for the tax year.

- Fill Out the Form: Enter the required information, including the total interest earned and the amount of qualified expenses.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Attach and Submit: Attach the completed Form 8815 to your Form 1040 or 1040A and submit it by the filing deadline.

Legal use of the Form 8815

Form 8815 is legally recognized as a valid means for taxpayers to exclude interest income from their federal tax returns, provided that all eligibility criteria are met. The IRS has established guidelines that outline the proper use of this form, including the requirement to use the proceeds for qualified education expenses. Failure to adhere to these guidelines may result in penalties or the disallowance of the exclusion. It is crucial for taxpayers to maintain accurate records and documentation to support their claims when using this form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 8815 to ensure compliance. Typically, the deadline for filing individual tax returns, including Form 8815, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who require additional time to file can request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Eligibility Criteria

To qualify for using Form 8815, taxpayers must meet specific eligibility criteria. These include:

- Income Limits: The modified adjusted gross income must fall below certain thresholds set by the IRS.

- Qualified Expenses: The proceeds from the savings bonds must be used for qualified higher education expenses, such as tuition and fees.

- Bond Issuance: The savings bonds must have been issued after 1989 to be eligible for the exclusion.

Quick guide on how to complete form 8815 2017

Effortlessly Complete Form 8815 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8815 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 8815 with Ease

- Find Form 8815 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or an invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and electronically sign Form 8815 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8815 2017

Create this form in 5 minutes!

How to create an eSignature for the form 8815 2017

How to make an electronic signature for the Form 8815 2017 in the online mode

How to make an eSignature for the Form 8815 2017 in Chrome

How to generate an eSignature for putting it on the Form 8815 2017 in Gmail

How to create an electronic signature for the Form 8815 2017 from your smartphone

How to create an eSignature for the Form 8815 2017 on iOS

How to make an eSignature for the Form 8815 2017 on Android devices

People also ask

-

What is Form 8815 and how is it used?

Form 8815 is a tax form used to report the exclusion of certain types of income for qualified individuals. It is essential for taxpayers who need to claim the exclusion of interest income from U.S. savings bonds used for higher education expenses. Using airSlate SignNow, you can easily eSign and submit Form 8815 securely.

-

How can airSlate SignNow help with completing Form 8815?

airSlate SignNow simplifies the process of completing Form 8815 by allowing users to fill out the form digitally and electronically sign it. Our platform provides a user-friendly interface that guides you through the necessary steps, ensuring that you don’t miss any critical information required for Form 8815.

-

Is there a cost associated with using airSlate SignNow for Form 8815?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to work with Form 8815. Our subscription plans are cost-effective and designed to provide value for users who frequently eSign documents like tax forms.

-

What are the key features of airSlate SignNow for managing Form 8815?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning, which are beneficial for managing Form 8815. These tools help streamline the process, ensuring that you can complete and send your forms efficiently and securely.

-

Can I integrate airSlate SignNow with other software for Form 8815 management?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage Form 8815 seamlessly alongside your existing workflows. Whether you use CRM tools or accounting software, our integrations enhance productivity and collaboration.

-

What benefits does eSigning Form 8815 with airSlate SignNow provide?

Using airSlate SignNow to eSign Form 8815 provides numerous benefits, including faster processing times and reduced paperwork. Our secure platform ensures that your sensitive information is protected while allowing for convenient access from any device.

-

Is airSlate SignNow compliant with regulations for signing Form 8815?

Yes, airSlate SignNow is fully compliant with eSignature regulations, making it a reliable choice for signing Form 8815. Our platform adheres to the ESIGN Act and UETA, ensuring that your electronically signed forms are legally binding.

Get more for Form 8815

Find out other Form 8815

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed