Form 8815 2015

What is the Form 8815

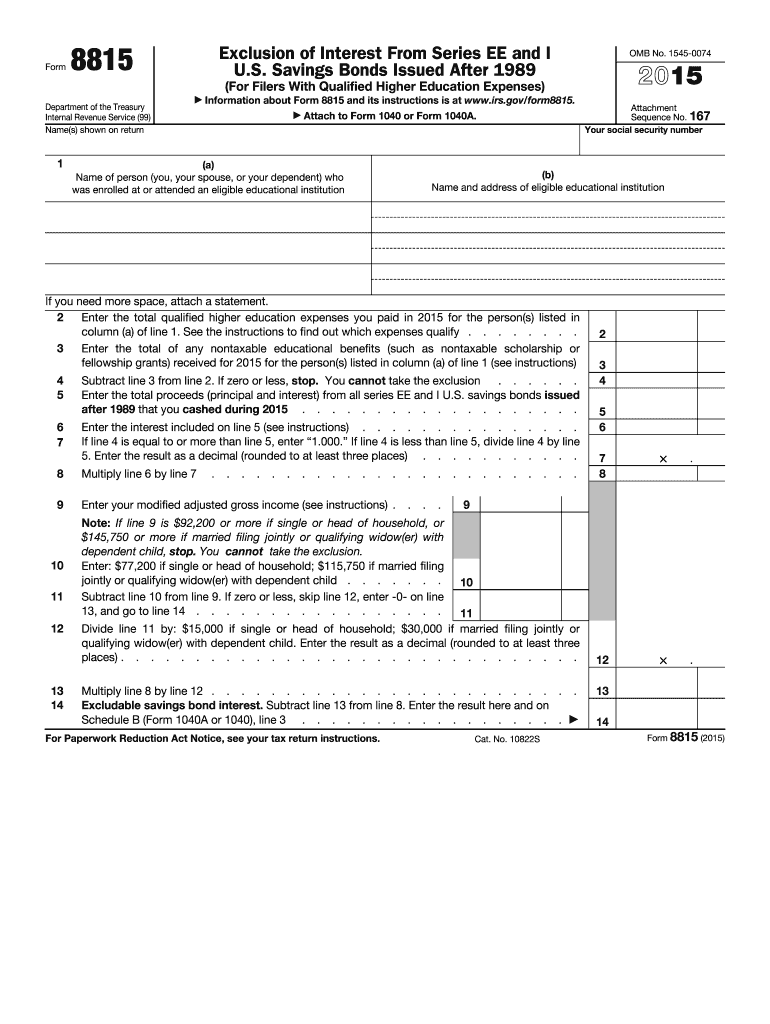

The Form 8815 is a tax form used by individuals to report and claim the exclusion of interest from qualified U.S. savings bonds. This form is particularly relevant for taxpayers who have received interest income from these bonds and meet specific income requirements. The purpose of the form is to determine the amount of interest that can be excluded from taxable income, thereby potentially reducing the overall tax liability for eligible taxpayers.

How to use the Form 8815

To effectively use the Form 8815, taxpayers must first ensure they qualify for the exclusion based on their modified adjusted gross income (MAGI). After confirming eligibility, the taxpayer should accurately fill out the form by providing necessary information such as the amount of interest received from U.S. savings bonds and any other required financial details. Once completed, the form must be submitted along with the taxpayer's federal income tax return.

Steps to complete the Form 8815

Completing the Form 8815 involves several key steps:

- Gather all relevant financial documents, including interest statements from U.S. savings bonds.

- Determine your modified adjusted gross income to confirm eligibility for the exclusion.

- Fill out the form by entering the required information accurately.

- Double-check all entries for accuracy and completeness.

- Attach the completed form to your federal income tax return before submission.

Legal use of the Form 8815

The legal use of Form 8815 is governed by IRS regulations that outline eligibility criteria for excluding interest from taxable income. Taxpayers must ensure they adhere to these regulations to avoid penalties. Proper completion and submission of the form are crucial for maintaining compliance with tax laws and ensuring that the exclusion is recognized by the IRS.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the Form 8815. Typically, the form should be filed by the due date of the federal income tax return, which is usually April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to file on time to avoid penalties and ensure the exclusion is applied correctly.

Required Documents

When completing the Form 8815, taxpayers should have the following documents ready:

- Interest statements from U.S. savings bonds.

- Previous year’s tax return for reference.

- Documentation of any other income sources that may affect eligibility.

Eligibility Criteria

To qualify for the exclusion of interest using Form 8815, taxpayers must meet specific eligibility criteria. These include having a modified adjusted gross income below certain thresholds, being the owner of the bonds, and using the proceeds for qualified education expenses. Understanding these criteria is vital for taxpayers to ensure they can legally claim the exclusion.

Quick guide on how to complete 2014 form 8815 2015

Complete Form 8815 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 8815 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 8815 without hassle

- Acquire Form 8815 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent parts of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form 8815 to ensure optimal communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8815 2015

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8815 2015

How to create an electronic signature for the 2014 Form 8815 2015 in the online mode

How to create an eSignature for the 2014 Form 8815 2015 in Chrome

How to create an electronic signature for signing the 2014 Form 8815 2015 in Gmail

How to create an electronic signature for the 2014 Form 8815 2015 right from your smartphone

How to generate an eSignature for the 2014 Form 8815 2015 on iOS

How to make an eSignature for the 2014 Form 8815 2015 on Android OS

People also ask

-

What is Form 8815 and why is it important?

Form 8815 is a tax form used by eligible taxpayers to report the exclusion of certain U.S. savings bonds from their income. It is important because it can help you save money by reducing your taxable income when cashing in these bonds. Understanding how to complete Form 8815 accurately can ensure you take full advantage of this tax benefit.

-

How can airSlate SignNow help with Form 8815?

airSlate SignNow simplifies the process of completing and eSigning Form 8815. With our user-friendly platform, you can easily fill out your tax forms, including Form 8815, and securely send them for electronic signatures. This streamlines your workflow, ensuring your documents are signed and submitted promptly.

-

Is airSlate SignNow a cost-effective solution for managing Form 8815?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 8815 and other documents. Our competitive pricing plans provide access to essential features that allow you to create, send, and eSign documents efficiently, making it a budget-friendly choice for both individuals and businesses.

-

What features does airSlate SignNow offer for completing Form 8815?

airSlate SignNow includes features such as customizable templates, easy form filling, and secure eSignature capabilities for Form 8815. Additionally, our platform supports document storage and organization, helping you keep track of your tax forms and related paperwork effortlessly.

-

Can I integrate airSlate SignNow with other applications while working on Form 8815?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow while working on Form 8815. Whether you use CRM systems or cloud storage services, our integrations make it simple to manage your documents and eSignatures in one place.

-

How secure is airSlate SignNow when handling Form 8815?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like Form 8815. We employ advanced encryption protocols and comply with industry standards to ensure that your documents remain confidential and secure throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for Form 8815?

Using airSlate SignNow for Form 8815 offers numerous benefits including efficiency, convenience, and improved accuracy. Our platform allows you to complete and eSign your tax forms quickly, reducing the risk of errors and ensuring timely submissions. Plus, your documents are easily accessible from anywhere.

Get more for Form 8815

- Anthem blue cross application form 2008

- 31323 selectemp ppo form

- Standard health application form

- Rabies vaccine official form

- California security guard renewal form

- Bangladesh passport form fill up sample

- Massachusetts integrated application for re credentialing reappointment form

- California participating physician reapplication form

Find out other Form 8815

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template