Form 8815 Exclusion of Interest from Series EE and I U S 2014

What is the Form 8815 Exclusion of Interest From Series EE and I U S

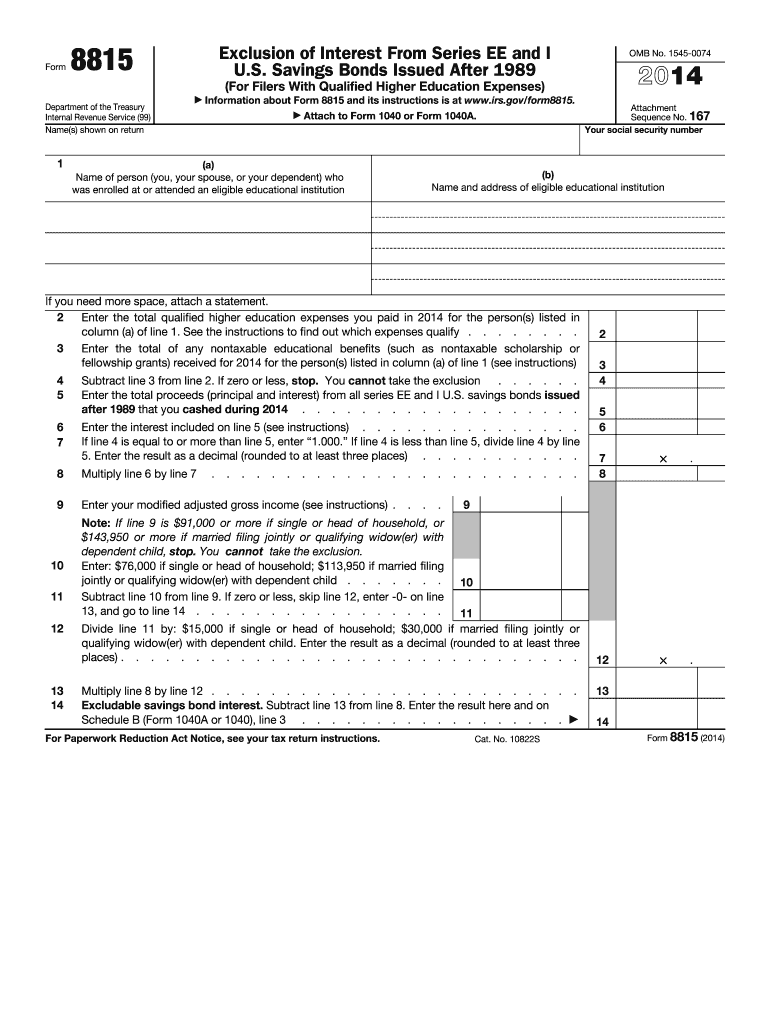

The Form 8815 is a tax form used by eligible taxpayers in the United States to exclude interest earned on certain U.S. savings bonds, specifically Series EE and I bonds, from their gross income. This exclusion is available for individuals who meet specific income thresholds and use the bond proceeds for qualified educational expenses. The purpose of this form is to facilitate the tax benefits associated with education savings, allowing taxpayers to reduce their taxable income and potentially lower their overall tax liability.

How to Use the Form 8815 Exclusion of Interest From Series EE and I U S

To use the Form 8815, taxpayers must first determine their eligibility based on income limits and the purpose of the bond proceeds. Once eligibility is confirmed, the form must be completed accurately, detailing the amount of interest to be excluded and the qualifying educational expenses. It is essential to keep records of the expenses and the bonds for future reference, as the IRS may request documentation. After filling out the form, it should be submitted along with the taxpayer's federal income tax return.

Steps to Complete the Form 8815 Exclusion of Interest From Series EE and I U S

Completing the Form 8815 involves several key steps:

- Gather necessary documents, including your tax return, interest statements from the bonds, and records of qualified educational expenses.

- Check the eligibility criteria to ensure you meet the income limits and that the bond proceeds are used for qualified education costs.

- Fill out the form by entering the required information, including your name, Social Security number, and the amount of interest to be excluded.

- Calculate the total qualified expenses and ensure they align with the interest amount being excluded.

- Review the form for accuracy before submitting it with your tax return.

Key Elements of the Form 8815 Exclusion of Interest From Series EE and I U S

Several key elements are essential for the proper completion of Form 8815:

- Eligibility Criteria: Confirm that your modified adjusted gross income is below the specified limits.

- Qualified Educational Expenses: Understand what qualifies as educational expenses, such as tuition and fees.

- Interest Amount: Accurately report the interest earned on the bonds that you wish to exclude.

- Documentation: Maintain records of your expenses and bonds for verification purposes.

IRS Guidelines for the Form 8815 Exclusion of Interest From Series EE and I U S

The IRS provides specific guidelines regarding the use of Form 8815. Taxpayers should refer to the IRS instructions for the form to understand the eligibility requirements, the definition of qualified educational expenses, and the necessary documentation. It is crucial to adhere to these guidelines to ensure compliance and to avoid potential penalties. The IRS also updates these guidelines periodically, so staying informed about any changes is beneficial.

Filing Deadlines for the Form 8815 Exclusion of Interest From Series EE and I U S

Taxpayers must file Form 8815 along with their federal income tax return by the standard tax filing deadline, which is typically April 15 of each year. If additional time is needed, taxpayers can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest. Being aware of these deadlines is essential for proper tax planning and compliance.

Quick guide on how to complete form 8815 exclusion of interest from series ee and i us

Effortlessly Prepare Form 8815 Exclusion Of Interest From Series EE And I U S on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8815 Exclusion Of Interest From Series EE And I U S on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 8815 Exclusion Of Interest From Series EE And I U S with Ease

- Locate Form 8815 Exclusion Of Interest From Series EE And I U S and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 8815 Exclusion Of Interest From Series EE And I U S and ensure outstanding communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8815 exclusion of interest from series ee and i us

Create this form in 5 minutes!

How to create an eSignature for the form 8815 exclusion of interest from series ee and i us

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Form 8815 Exclusion Of Interest From Series EE And I U S?

Form 8815 Exclusion Of Interest From Series EE And I U S is a tax form used by individuals to exclude certain interest earnings from their income. By effectively using this form, you can potentially reduce your taxable income and enhance your financial planning. Understanding its requirements is essential for anyone holding Series EE or I U S bonds.

-

How can airSlate SignNow help with Form 8815 Exclusion Of Interest From Series EE And I U S?

airSlate SignNow simplifies the process of preparing and sending Form 8815 Exclusion Of Interest From Series EE And I U S. With our intuitive platform, you can efficiently create, eSign, and share tax documents in a secure manner. This streamlines your tax preparation, saving you time and effort.

-

What features does airSlate SignNow provide for handling tax forms like Form 8815?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure storage, which are beneficial for managing tax documents like Form 8815 Exclusion Of Interest From Series EE And I U S. These features enhance accuracy and ensure compliance while making the document management process more efficient.

-

Is airSlate SignNow cost-effective for small businesses handling Form 8815?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to handle Form 8815 Exclusion Of Interest From Series EE And I U S. Our pricing plans are flexible and tailored to meet the budget of small businesses, ensuring you access essential features without overspending.

-

Can I integrate airSlate SignNow with other tools for managing Form 8815?

Absolutely! airSlate SignNow offers seamless integration with various productivity tools, making it easier to manage Form 8815 Exclusion Of Interest From Series EE And I U S alongside your other business applications. This ensures a smooth workflow and helps you keep all your documents organized.

-

How secure is airSlate SignNow for handling sensitive documents like Form 8815?

Security is a top priority at airSlate SignNow. We implement industry-standard security measures, including encryption and secure cloud storage, to protect sensitive documents like Form 8815 Exclusion Of Interest From Series EE And I U S. You can confidently eSign and share documents, knowing that your information is safe.

-

What benefits can I expect when using airSlate SignNow for Form 8815?

Using airSlate SignNow for Form 8815 Exclusion Of Interest From Series EE And I U S allows for a more efficient document management process, reduced turnaround times, and increased accuracy. Our platform offers built-in reminders and notifications that help you stay on top of your filing deadlines and ensure compliance.

Get more for Form 8815 Exclusion Of Interest From Series EE And I U S

- Acknowledgment of satisfaction for corporation iowa form

- Iowa file form

- Quitclaim deed from husband and wife to corporation iowa form

- Warranty deed from husband and wife to corporation iowa form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form iowa

- Demand to file suit by corporation or llc iowa form

- Subcontractors notice of nonpayment individual iowa form

- Ia wife form

Find out other Form 8815 Exclusion Of Interest From Series EE And I U S

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document