Individual Series EEE Savings Bonds Tax Considerations 2016

What is the Individual Series EEE Savings Bonds Tax Considerations

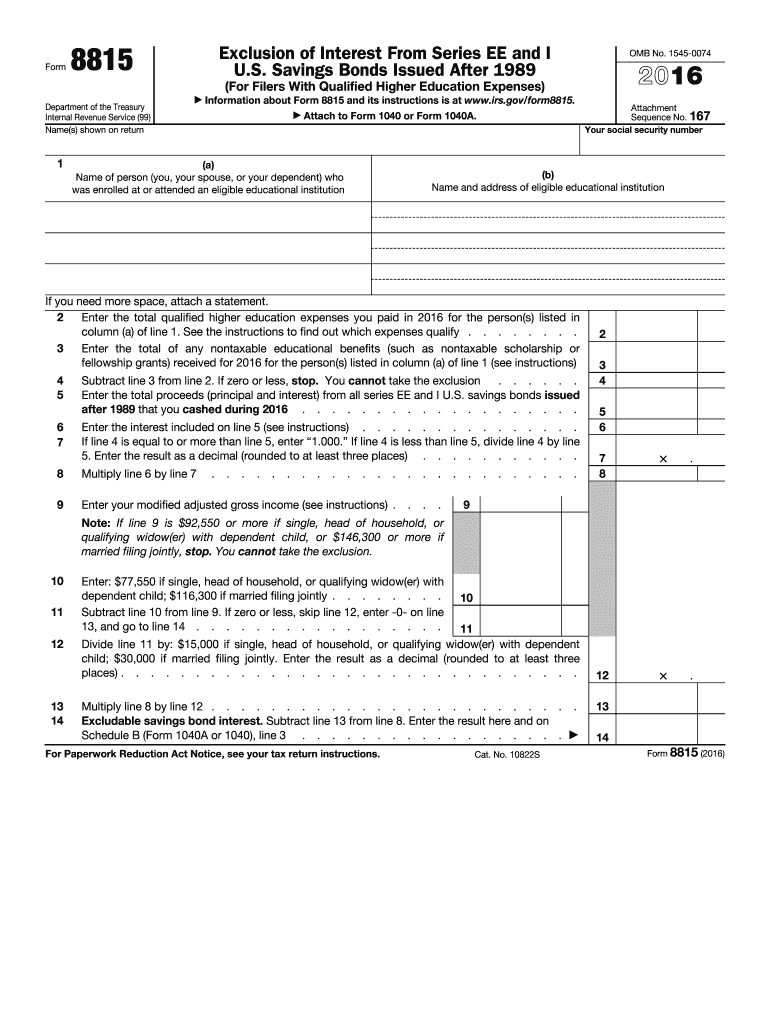

The Individual Series EEE Savings Bonds Tax Considerations form is a crucial document for U.S. taxpayers who hold Series EEE savings bonds. This form outlines the tax implications associated with the interest earned on these bonds. Generally, the interest on Series EEE bonds is exempt from state and local taxes, but federal tax considerations apply. Understanding these tax implications is essential for accurate reporting and compliance with IRS regulations.

How to use the Individual Series EEE Savings Bonds Tax Considerations

Using the Individual Series EEE Savings Bonds Tax Considerations form involves several steps. First, gather all necessary documentation related to your savings bonds, including purchase dates and amounts. Next, calculate the interest earned on your bonds. This information will help you determine your tax liability. Finally, complete the form accurately, ensuring that all figures are correct, and submit it according to IRS guidelines. Utilizing digital tools can streamline this process, making it easier to manage your records and submissions.

Steps to complete the Individual Series EEE Savings Bonds Tax Considerations

Completing the Individual Series EEE Savings Bonds Tax Considerations form requires a systematic approach. Follow these steps:

- Collect all relevant information about your Series EEE savings bonds, including purchase details and interest accrued.

- Calculate the total interest earned on each bond, as this will be necessary for tax reporting.

- Fill out the form with accurate information, ensuring that all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, following the IRS submission guidelines.

IRS Guidelines

The IRS provides specific guidelines for reporting interest from Series EEE savings bonds. According to IRS regulations, the interest earned on these bonds must be reported in the year it is redeemed. If the bonds are held until maturity, the interest is reported in the year of maturity. Taxpayers should refer to IRS Publication 550 for detailed instructions on how to report this income accurately. Adhering to these guidelines helps avoid potential penalties and ensures compliance with federal tax laws.

Penalties for Non-Compliance

Failing to comply with the tax regulations regarding Individual Series EEE Savings Bonds can result in significant penalties. If taxpayers do not report the interest earned on these bonds, they may face interest and penalties on unpaid taxes. Additionally, the IRS may impose fines for late submissions or inaccuracies in the reported information. It is important to keep accurate records and file the necessary forms on time to avoid these consequences.

Eligibility Criteria

Eligibility for the tax considerations associated with Individual Series EEE Savings Bonds primarily revolves around ownership and redemption status. Taxpayers must be the registered owner of the bonds to claim the tax benefits. Additionally, the bonds must be redeemed or matured to report the interest for tax purposes. Understanding these criteria ensures that individuals can take full advantage of the tax exemptions available for their savings bonds.

Quick guide on how to complete individual series eee savings bonds tax considerations

Prepare Individual Series EEE Savings Bonds Tax Considerations effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the resources necessary to generate, modify, and electronically sign your documents promptly without delays. Manage Individual Series EEE Savings Bonds Tax Considerations on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Individual Series EEE Savings Bonds Tax Considerations without hassle

- Find Individual Series EEE Savings Bonds Tax Considerations and click on Get Form to begin.

- Utilize the tools available to finish your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs swiftly from a device of your choice. Modify and electronically sign Individual Series EEE Savings Bonds Tax Considerations and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual series eee savings bonds tax considerations

Create this form in 5 minutes!

How to create an eSignature for the individual series eee savings bonds tax considerations

How to generate an electronic signature for the Individual Series Eee Savings Bonds Tax Considerations in the online mode

How to make an electronic signature for your Individual Series Eee Savings Bonds Tax Considerations in Chrome

How to generate an eSignature for signing the Individual Series Eee Savings Bonds Tax Considerations in Gmail

How to make an eSignature for the Individual Series Eee Savings Bonds Tax Considerations right from your mobile device

How to generate an electronic signature for the Individual Series Eee Savings Bonds Tax Considerations on iOS devices

How to create an electronic signature for the Individual Series Eee Savings Bonds Tax Considerations on Android OS

People also ask

-

What are the tax benefits of Individual Series EEE Savings Bonds?

Individual Series EEE Savings Bonds offer tax benefits such as tax-deferred interest until redemption. Furthermore, if the bonds are used for qualifying educational expenses, the interest may be entirely tax-exempt, making them a valuable saving tool when considering Individual Series EEE Savings Bonds tax considerations.

-

How do I report interest earned from Individual Series EEE Savings Bonds on my taxes?

When it comes to tax season, reporting the interest from Individual Series EEE Savings Bonds is straightforward. You must include the interest earned on your tax return using Schedule B. Understanding Individual Series EEE Savings Bonds tax considerations can help you accurately report your earnings and take advantage of any benefits.

-

Can I transfer my Individual Series EEE Savings Bonds as a gift?

Yes, Individual Series EEE Savings Bonds can be gifted to individuals, but the recipient must be aware of the tax implications involved. It's essential to understand the Individual Series EEE Savings Bonds tax considerations when gifting, as the interest will still be taxable to the recipient upon redemption.

-

What happens to Individual Series EEE Savings Bonds in case of the bondholder's death?

In the event of the bondholder's death, Individual Series EEE Savings Bonds can be transferred to a designated beneficiary according to IRS regulations. Understanding the Individual Series EEE Savings Bonds tax considerations during estate planning can ensure that tax obligations are clear and handled properly.

-

Are there any fees associated with purchasing Individual Series EEE Savings Bonds?

No, there are typically no fees or commissions associated with purchasing Individual Series EEE Savings Bonds directly from the government. This makes them a cost-effective option for savers, especially when considering Individual Series EEE Savings Bonds tax considerations, which may further protect your investment.

-

How long do I need to hold Individual Series EEE Savings Bonds before cashing them?

You must hold Individual Series EEE Savings Bonds for at least one year before cashing them in, with penalties for redeeming them before five years. Knowing the timeline and its potential tax implications can be crucial for your financial planning, especially in relation to Individual Series EEE Savings Bonds tax considerations.

-

What is the maximum amount I can invest in Individual Series EEE Savings Bonds?

The maximum purchase limit for Individual Series EEE Savings Bonds is currently $10,000 per Social Security number annually. This limit encourages individual investors to save while keeping in mind Individual Series EEE Savings Bonds tax considerations to optimize returns efficiently.

Get more for Individual Series EEE Savings Bonds Tax Considerations

- Tillys w2 form

- 4675 shoreditch annual app 6pge soho house form

- State of illinois department of financial and professional form

- Time warner formsmatchinggif matching gifts

- 2011 571 l form

- Form 84 application for relief from joint income tax massgov mass

- Island hospital surgical services 3602991314 or 36 form

- Pharmacy assistant application packet doh wa form

Find out other Individual Series EEE Savings Bonds Tax Considerations

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure