Form 8815 Instructions 2011

What is the Form 8815 Instructions

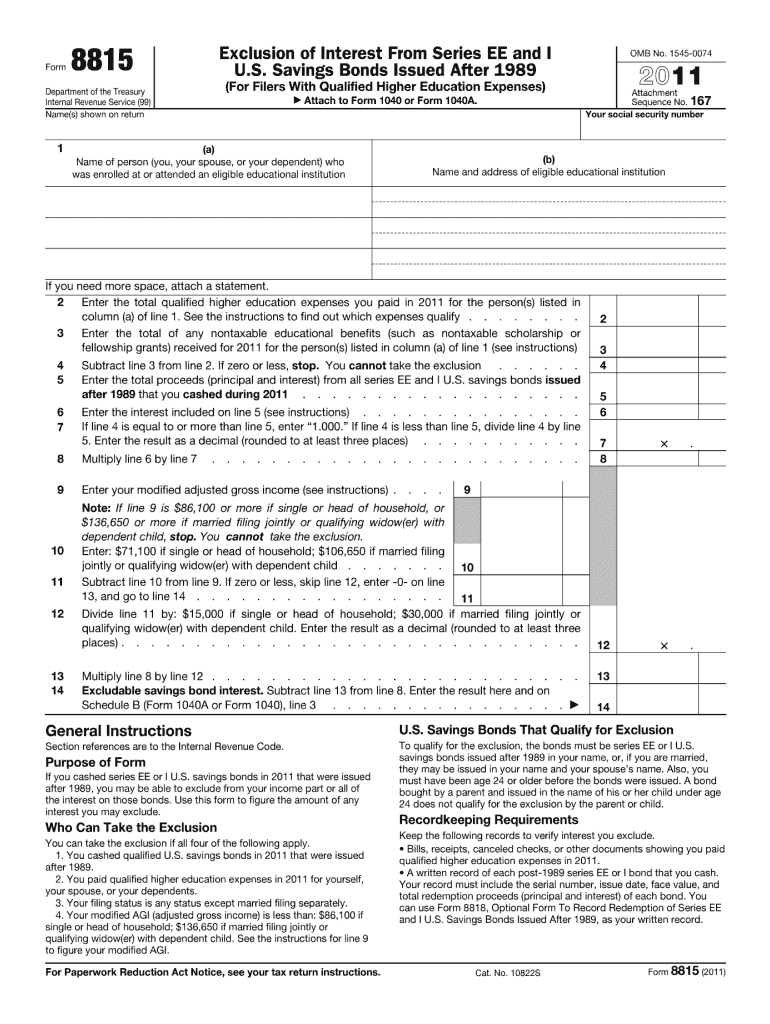

The Form 8815 Instructions provide guidance for taxpayers who need to report the exclusion of certain U.S. savings bonds from their income. This form is specifically designed for individuals who have received interest from qualified U.S. savings bonds and wish to exclude this income from their taxable income under specific conditions. Understanding the purpose of Form 8815 is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Form 8815 Instructions

Completing the Form 8815 requires careful attention to detail to ensure accuracy. Here are the steps involved:

- Gather necessary documents, including your savings bond interest statements and any relevant tax information.

- Begin by filling out your personal information at the top of the form, including your name, Social Security number, and filing status.

- Follow the instructions to report the amount of interest earned from qualified U.S. savings bonds.

- Calculate the exclusion amount based on the guidelines provided in the form instructions.

- Review your entries for accuracy and completeness before submitting the form.

Legal use of the Form 8815 Instructions

The legal use of Form 8815 is governed by IRS regulations that outline eligibility criteria for excluding interest from taxable income. To ensure compliance, taxpayers must adhere to the specific guidelines regarding the types of savings bonds eligible for exclusion and the income limits that apply. Utilizing the form correctly can help avoid potential penalties and ensure that taxpayers maximize their eligible tax benefits.

Filing Deadlines / Important Dates

Timely filing of Form 8815 is essential to avoid penalties. The form must be submitted along with your annual tax return by the standard tax filing deadline, typically April 15 of the following year. If you are unable to file by this date, consider applying for an extension, which can provide additional time to submit your tax documents, including Form 8815.

Required Documents

To complete Form 8815 accurately, several documents are required:

- Form 1099-INT or other interest statements that detail the amount of interest earned from U.S. savings bonds.

- Documentation of the purchase of the savings bonds, if applicable.

- Any previous tax returns that may provide context for your current filing.

Examples of using the Form 8815 Instructions

Understanding practical applications of Form 8815 can enhance comprehension. For instance, if a taxpayer has received interest from qualified U.S. savings bonds used for education expenses, they may be eligible to exclude this interest from their taxable income. Another example is a retiree who has cashed in savings bonds and wishes to report the interest without incurring additional tax liabilities. These scenarios illustrate the importance of correctly applying the form's instructions for maximizing tax benefits.

Quick guide on how to complete form 8815 instructions 2011

Complete Form 8815 Instructions seamlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Form 8815 Instructions on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Form 8815 Instructions effortlessly

- Locate Form 8815 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for the form, whether by email, SMS, or invite link, or download it to your computer.

No need to worry about lost or misplaced documents, tedious form searches, or mistakes necessitating new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you select. Adjust and electronically sign Form 8815 Instructions while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8815 instructions 2011

Create this form in 5 minutes!

How to create an eSignature for the form 8815 instructions 2011

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What are Form 8815 Instructions?

Form 8815 Instructions provide guidance on how to complete the IRS Form 8815, which is used to report the taxable amount of certain certain income items. This form is essential for taxpayers looking to effectively manage their tax obligations. Utilizing airSlate SignNow, you can easily eSign and submit documents related to Form 8815 Instructions.

-

How can airSlate SignNow help with Form 8815 Instructions?

airSlate SignNow streamlines the process of completing and submitting Form 8815 Instructions by enabling businesses to eSign and store their documents securely. With its user-friendly platform, you can collaborate with your team to ensure that you follow the instructions accurately. Our solution allows for seamless integration with other tools to enhance your productivity.

-

Are there any costs associated with using airSlate SignNow for Form 8815 Instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including features specifically designed for handling Form 8815 Instructions. Our plans are cost-effective, ensuring that you receive excellent value while managing your document signing processes efficiently. Check our website for detailed pricing options that best fit your requirements.

-

What features does airSlate SignNow offer for Form 8815 Instructions?

airSlate SignNow offers features like eSignature, document tracking, and templates to assist users with Form 8815 Instructions. These features make it easier to manage and edit your documents while ensuring compliance with IRS requirements. Additionally, you can access your documents from anywhere, streamlining the submission process.

-

How does airSlate SignNow ensure the security of documents related to Form 8815 Instructions?

We prioritize the security of your documents with advanced encryption protocols and secure cloud storage. When you use airSlate SignNow for Form 8815 Instructions, you can trust that your sensitive information is protected throughout the signing and submission process. Our platform complies with industry security standards to safeguard your data.

-

Can I integrate airSlate SignNow with other applications for Form 8815 Instructions?

Yes, airSlate SignNow easily integrates with various popular applications, enhancing your workflow for Form 8815 Instructions. Whether you're using accounting software or project management tools, our integrations can help automate the process and improve efficiency. Explore our integration options to see how we can fit into your existing tech stack.

-

Is there customer support available for questions about Form 8815 Instructions?

Absolutely! airSlate SignNow offers comprehensive customer support to help you navigate any questions regarding Form 8815 Instructions. Our knowledgeable team is available to assist you via chat, email, or phone, ensuring that you have the guidance you need when using our platform. We’re here to help you every step of the way.

Get more for Form 8815 Instructions

- Assignment of lease package iowa form

- Lease purchase agreements package iowa form

- Satisfaction cancellation or release of mortgage package iowa form

- Premarital agreements package iowa form

- Painting contractor package iowa form

- Framing contractor package iowa form

- Foundation contractor package iowa form

- Plumbing contractor package iowa form

Find out other Form 8815 Instructions

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free