Form 8815 Exclusion of Interest from Series EE and I U S Savings Bonds Issued After 1989 2020

What is the Form 8815 Exclusion of Interest from Series EE and I U.S. Savings Bonds Issued After 1989

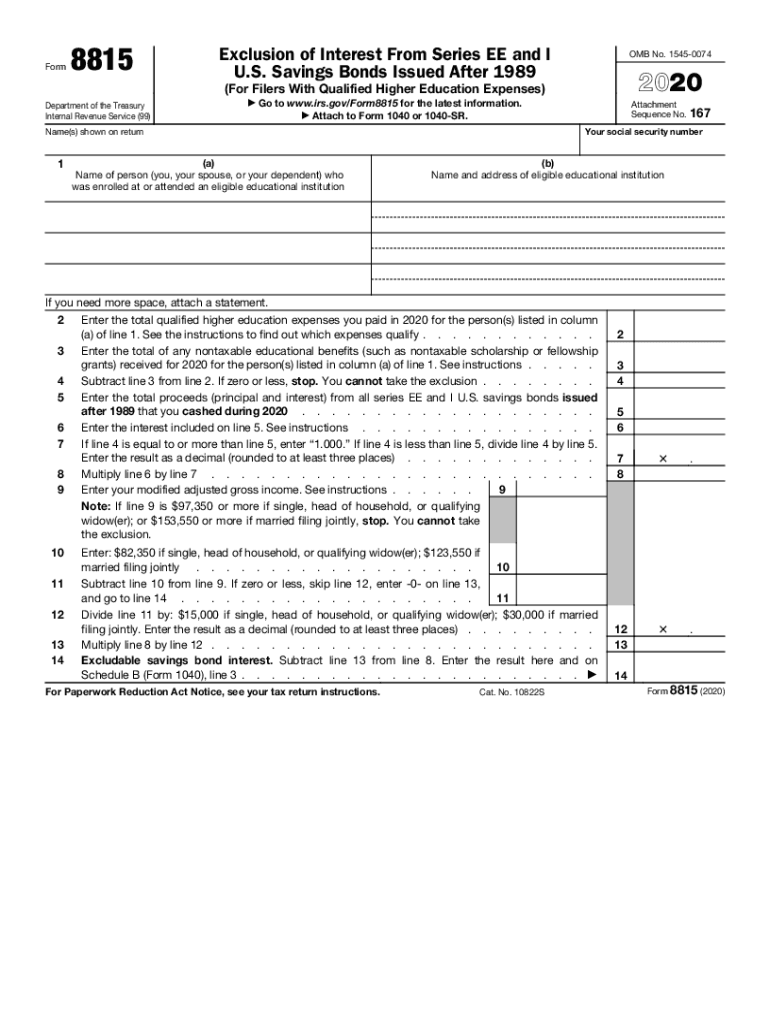

The Form 8815 is used to claim the exclusion of interest earned on Series EE and I U.S. savings bonds issued after 1989. This exclusion is available to eligible taxpayers who use the proceeds from these bonds to pay for qualified educational expenses. The primary purpose of this form is to allow individuals to exclude interest income from their taxable income, thereby reducing their overall tax liability. Understanding the eligibility criteria and the specific educational expenses that qualify is essential for maximizing tax benefits.

Steps to Complete the Form 8815 Exclusion of Interest from Series EE and I U.S. Savings Bonds Issued After 1989

Completing the Form 8815 involves several key steps:

- Gather necessary documentation, including your savings bond information and proof of qualified educational expenses.

- Fill out the personal information section, including your name, address, and Social Security number.

- Provide details about the savings bonds, including the issue date and the amount of interest earned.

- Detail your qualified educational expenses, ensuring they align with IRS guidelines.

- Calculate the amount of interest you wish to exclude from your taxable income.

- Review the completed form for accuracy and sign it before submission.

Eligibility Criteria for the Form 8815 Exclusion of Interest from Series EE and I U.S. Savings Bonds Issued After 1989

To qualify for the exclusion of interest using Form 8815, taxpayers must meet specific eligibility criteria:

- The bonds must be issued after 1989.

- The taxpayer must be the owner of the bonds.

- The proceeds from the bonds must be used for qualified educational expenses, such as tuition and fees for higher education.

- Income limitations apply; the exclusion phases out for higher-income taxpayers.

IRS Guidelines for Using Form 8815

The IRS provides clear guidelines regarding the use of Form 8815. Taxpayers should refer to IRS Publication 550 for detailed instructions on qualifying expenses and income limits. It is crucial to retain documentation that supports the educational expenses claimed, as the IRS may request this information during an audit. Additionally, taxpayers should ensure that they are filing the form in conjunction with their annual tax return to ensure compliance.

Filing Deadlines for Form 8815

Form 8815 must be filed with your annual tax return by the standard filing deadline, which is typically April 15 of the following year. If you require additional time to file, you may request an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these deadlines is essential for maintaining compliance and maximizing potential tax benefits.

Digital vs. Paper Version of Form 8815

The Form 8815 is available in both digital and paper formats. Using the digital version allows for easier completion and submission, as many tax software programs can automatically calculate the exclusion based on the information provided. However, some taxpayers may prefer to complete a paper version for their records. Regardless of the format chosen, ensuring accuracy and compliance with IRS requirements is vital.

Quick guide on how to complete 2020 form 8815 exclusion of interest from series ee and i us savings bonds issued after 1989

Handle Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989 across all platforms with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to edit and electronically sign Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989 with ease

- Find Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989 and click on Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989 to ensure clear communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8815 exclusion of interest from series ee and i us savings bonds issued after 1989

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8815 exclusion of interest from series ee and i us savings bonds issued after 1989

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is form 8815 2017 and why is it important?

Form 8815 2017 is used to report the exclusion of interest from qualified U.S. savings bonds. This form is important for taxpayers who want to exclude interest earned from these bonds from their taxable income, potentially leading to signNow savings. Ensuring accurate completion of form 8815 2017 can help in optimizing tax liabilities.

-

How can airSlate SignNow help with form 8815 2017?

With airSlate SignNow, you can easily upload and eSign form 8815 2017, streamlining the process of submitting your tax documents. Our platform ensures that all your signatures are legally binding and securely stored, allowing for a hassle-free filing experience. This can save you time and reduce the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business needs. Whether you're an individual user or part of an organization, you can choose a plan that suits your volume of documents, including those like form 8815 2017. Our pricing is competitive and provides great value given the features included.

-

Can I integrate airSlate SignNow with other applications for form 8815 2017?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and many CRMs. This makes it easy to manage your documents, including form 8815 2017, across different platforms. These integrations enhance your efficiency and simplify your workflow.

-

What features does airSlate SignNow offer for completing form 8815 2017?

airSlate SignNow provides essential features such as customizable templates, secure electronic signatures, and the ability to track document status in real time. These features are particularly beneficial for managing form 8815 2017, ensuring that all necessary fields are accurately completed and submitted. Our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow secure for handling sensitive documents like form 8815 2017?

Absolutely! airSlate SignNow prioritizes your security with bank-level encryption and compliant practices. When handling sensitive documents such as form 8815 2017, you can trust that your information is secure and protected against unauthorized access. This allows you to focus on your tasks without worrying about data bsignNowes.

-

What are the benefits of using airSlate SignNow for form 8815 2017?

Using airSlate SignNow for form 8815 2017 streamlines the signing and submission process, making it quicker and more efficient. Additionally, our cloud-based platform allows you to access and manage your documents anytime, anywhere, which is crucial during tax season. The convenience and enhanced organization lead to a smoother experience overall.

Get more for Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989

- 2827 power of attorney form

- Instruction 1099 b form

- Forms 1099 r 1099 misc 1099 k 1099 nec and w 2g

- Ppdffillercomenmicro catalogirs health insurance form templatespdffiller

- Form ct 706 nt connecticut estate tax return forfree form ct 706 nt estate tax return for nontaxablect 706 nt instructions

- Note specific information about what to attach to your

- Wwwuslegalformscomform librarytaxirs 8752 2021 2022 fill and sign printable template online

- Form w 2 electronic filing requirements for tax year 2022

Find out other Form 8815 Exclusion Of Interest From Series EE And I U S Savings Bonds Issued After 1989

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template