Form 6251 Alternative Minimum TaxIndividuals 2024-2026

What is the Form 6251 Alternative Minimum Tax?

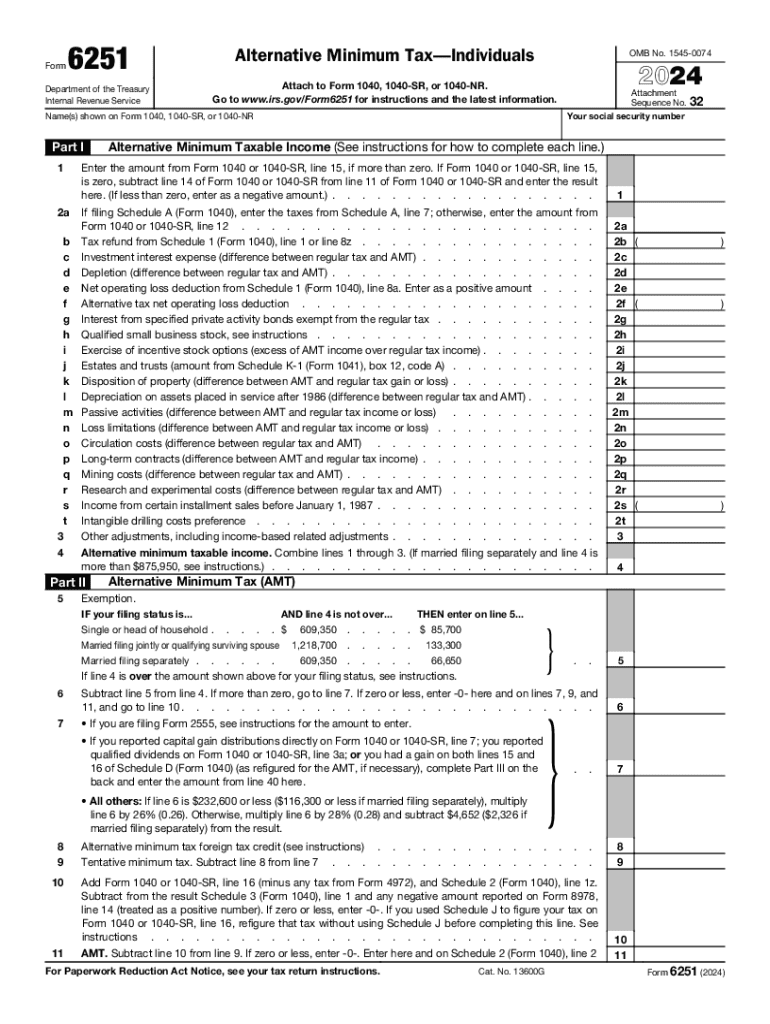

The Form 6251 is a crucial document used to calculate the Alternative Minimum Tax (AMT) for individuals in the United States. This tax ensures that taxpayers who benefit from certain deductions and credits still pay a minimum amount of tax. The IRS introduced the AMT to prevent high-income earners from significantly reducing their tax liabilities through various tax benefits. Understanding this form is essential for individuals who might be subject to the AMT, as it helps determine if they owe additional taxes beyond the regular income tax calculations.

How to Use the Form 6251 Alternative Minimum Tax

Using Form 6251 involves several key steps to accurately assess your tax liability. First, gather all necessary financial documents, including your income statements and details of deductions. Begin by completing the first section of the form, which requires you to report your regular taxable income. Next, you will adjust this income by adding back certain deductions that are not allowed under the AMT rules, such as state and local tax deductions. Finally, calculate your AMT liability by following the instructions on the form, which guide you through the necessary calculations to determine if you owe additional tax.

Steps to Complete the Form 6251 Alternative Minimum Tax

Completing the Form 6251 involves a systematic approach:

- Start by entering your regular taxable income on the form.

- Add back any disallowed deductions, such as state and local taxes.

- Calculate your AMT income by making necessary adjustments.

- Refer to the AMT tax rates to determine your tax liability based on your AMT income.

- Complete the form by calculating any credits that may apply to your situation.

Ensure that you double-check your calculations and retain copies of all documents for your records.

Key Elements of the Form 6251 Alternative Minimum Tax

Several key elements are essential for understanding and completing Form 6251:

- Taxable Income: Your starting point for calculations.

- Adjustments: Specific deductions that must be added back to your income.

- AMT Exemption: A set amount that reduces your AMT income, depending on your filing status.

- AMT Rates: The tax rates applicable to your AMT income, which may differ from regular tax rates.

- Credits: Certain credits may reduce your AMT liability, so it's important to identify any that apply.

IRS Guidelines for Form 6251

The IRS provides comprehensive guidelines for completing Form 6251. These guidelines outline the specific calculations needed to determine your AMT liability. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on allowable deductions, exemptions, and credits. It is crucial to stay updated on any changes to tax laws that may affect the AMT calculations, as these can vary from year to year. The IRS also offers resources to assist taxpayers in understanding the implications of the AMT and how to navigate the form effectively.

Filing Deadlines for Form 6251

Filing deadlines for Form 6251 align with the standard tax return deadlines in the United States. Generally, individual taxpayers must file their federal income tax returns by April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to keep track of these deadlines to ensure compliance and avoid unnecessary complications.

Create this form in 5 minutes or less

Find and fill out the correct form 6251 alternative minimum taxindividuals

Create this form in 5 minutes!

How to create an eSignature for the form 6251 alternative minimum taxindividuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax worksheet and how can airSlate SignNow help?

A tax worksheet is a document that helps individuals and businesses organize their financial information for tax preparation. airSlate SignNow simplifies this process by allowing users to create, send, and eSign tax worksheets securely and efficiently, ensuring that all necessary information is accurately captured.

-

How much does airSlate SignNow cost for managing tax worksheets?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while efficiently managing your tax worksheets and other documents.

-

Can I integrate airSlate SignNow with other accounting software for tax worksheets?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easy to manage your tax worksheets alongside your financial data. This integration streamlines your workflow, allowing for efficient document handling and eSigning.

-

What features does airSlate SignNow offer for tax worksheet management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for tax worksheets. These tools enhance collaboration and ensure that your documents are processed quickly and securely.

-

Is airSlate SignNow secure for handling sensitive tax worksheet information?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive tax worksheet information. You can trust that your documents are safe while being processed and signed.

-

How can airSlate SignNow improve my tax worksheet workflow?

By using airSlate SignNow, you can automate the process of sending and signing tax worksheets, reducing the time spent on manual tasks. This efficiency allows you to focus more on your core business activities while ensuring compliance and accuracy in your tax documentation.

-

Can I access my tax worksheets from mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your tax worksheets from any device. This flexibility ensures that you can work on your documents anytime, anywhere, enhancing productivity.

Get more for Form 6251 Alternative Minimum TaxIndividuals

Find out other Form 6251 Alternative Minimum TaxIndividuals

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors