Form 6251 2017

What is the Form 6251

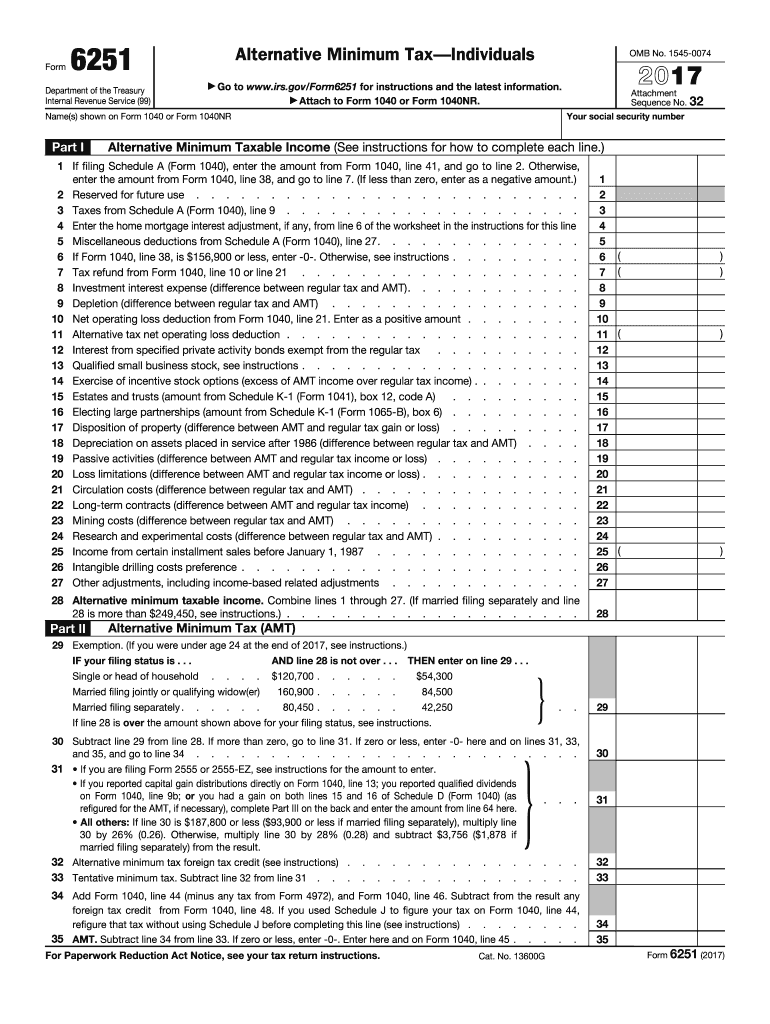

The Form 6251, officially known as the Alternative Minimum Tax (AMT) Calculation, is a tax form used by individuals in the United States to determine their alternative minimum tax liability. This form is crucial for taxpayers who may be subject to the AMT, which is designed to ensure that high-income earners pay a minimum amount of tax, regardless of deductions or credits. The form helps calculate the difference between the regular tax and the AMT, ensuring compliance with tax obligations.

How to use the Form 6251

Using Form 6251 involves several steps to accurately report your income and deductions. First, gather all necessary financial documents, including your W-2s, 1099s, and any records of deductions. Next, fill out the form by entering your income and adjustments as outlined in the instructions. Pay close attention to the specific lines that pertain to your situation, as the AMT calculations can vary based on income sources and deductions. After completing the form, review it for accuracy before submitting it with your tax return.

Steps to complete the Form 6251

Completing Form 6251 requires careful attention to detail. Follow these steps:

- Begin with your total income, as reported on your regular tax return.

- Adjust your income by adding back certain deductions that are not allowed under the AMT.

- Calculate your AMT taxable income by subtracting the AMT exemption amount from your adjusted income.

- Use the AMT rates to compute your tentative minimum tax.

- Compare the tentative minimum tax with your regular tax liability to determine if you owe any AMT.

Legal use of the Form 6251

The legal use of Form 6251 is essential for compliance with IRS regulations. Taxpayers must file this form if their income exceeds certain thresholds or if they have specific deductions that trigger the AMT. It is important to use the most current version of the form and ensure that all information is accurate and complete. Failure to file the form when required can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for Form 6251 align with the standard tax return deadlines. Typically, individual tax returns, including Form 6251, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers who need additional time can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 6251 can be submitted through various methods. Taxpayers may file electronically using tax preparation software that supports the form. This method often allows for quicker processing and confirmation of receipt. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person submission is generally not an option for individual taxpayers, as the IRS does not accept forms at local offices.

Quick guide on how to complete form 6251 2017

Explore the most efficient method to complete and sign your Form 6251

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to complete and sign your Form 6251 and other forms for public services. Our advanced eSignature solution equips you with everything necessary to manage documents swiftly and in compliance with formal guidelines - robust PDF editing, handling, securing, signing, and sharing features all available within a user-friendly interface.

There are only a few steps necessary to finish filling out and signing your Form 6251:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to input in your Form 6251.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally binding eSignature using your preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finished Form 6251 in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our solution also offers versatile file sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 6251 2017

FAQs

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the form 6251 2017

How to create an electronic signature for your Form 6251 2017 in the online mode

How to create an electronic signature for your Form 6251 2017 in Chrome

How to create an electronic signature for putting it on the Form 6251 2017 in Gmail

How to make an eSignature for the Form 6251 2017 from your smartphone

How to make an electronic signature for the Form 6251 2017 on iOS devices

How to generate an electronic signature for the Form 6251 2017 on Android

People also ask

-

What is Form 6251 and why do I need it?

Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals. If you're filing your taxes and your income exceeds certain thresholds, you may need to complete Form 6251 to ensure compliance with tax regulations. Using airSlate SignNow can simplify the signing and submission process for this important tax document.

-

How can airSlate SignNow help me with Form 6251?

With airSlate SignNow, you can easily eSign your Form 6251 and send it to others for their signatures. Our platform streamlines the document workflow, making it easy to manage and store your tax forms securely. Plus, you can access your signed Form 6251 anytime from any device.

-

Is there a free trial available for using airSlate SignNow for Form 6251?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for signing and managing documents like Form 6251. During the trial, you can experience how easy it is to eSign and collaborate on your tax documents without any upfront costs.

-

What are the pricing plans for airSlate SignNow to manage Form 6251?

airSlate SignNow offers flexible pricing plans designed to suit various business needs. You can choose from monthly or annual subscriptions, allowing you to manage documents like Form 6251 efficiently without breaking the bank. Each plan includes features that make eSigning and document management straightforward.

-

Can I integrate airSlate SignNow with my accounting software to handle Form 6251?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions. This integration allows you to streamline your tax filing process, ensuring that your Form 6251 is easily accessible and can be signed directly within your accounting platform.

-

What features does airSlate SignNow offer for completing Form 6251?

airSlate SignNow provides several features to facilitate the completion of Form 6251, including customizable templates, secure cloud storage, and real-time tracking of document status. These tools help ensure that your tax documents are completed accurately and efficiently.

-

How secure is my information when using airSlate SignNow for Form 6251?

Your security is a top priority at airSlate SignNow. When you use our platform to manage Form 6251, your data is protected with advanced encryption and secure access controls. You can trust that your sensitive tax information remains confidential and safe.

Get more for Form 6251

- Butler county clerk of courts form

- Nderung der bankverbindung santander consumer bank santander form

- Eeds form

- Hvcc vehicle registr form

- Download the bare essentials form b sarah norton brian green

- North carolina separation notice form

- Noncustodial parent form mass gov

- Annual statement of economic interest for public officials form

Find out other Form 6251

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation