Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms 2022

Understanding Form 6251: Alternative Minimum Tax

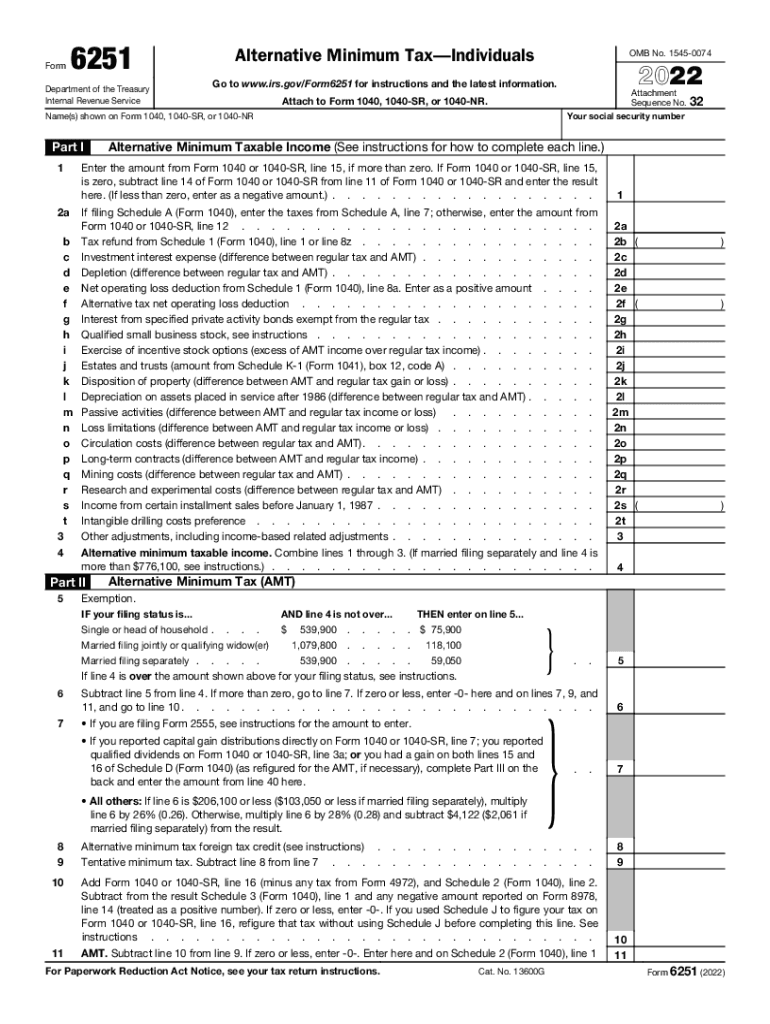

Form 6251 is a crucial IRS document used to calculate the Alternative Minimum Tax (AMT) for individuals. The AMT is designed to ensure that taxpayers who benefit from certain deductions and credits still pay a minimum amount of tax. This form is particularly relevant for those with higher incomes or specific tax situations that may allow them to reduce their taxable income significantly. By completing Form 6251, taxpayers can determine whether they owe the AMT and how much they need to pay.

Steps to Complete Form 6251

Filling out Form 6251 involves several steps to ensure accuracy and compliance with IRS guidelines. Here are the essential steps:

- Gather Necessary Documents: Collect your tax return, W-2s, 1099s, and any other relevant financial documents.

- Complete the Income Section: Report your total income, including wages, interest, and dividends.

- Adjust for AMT Preferences: Make adjustments for items that may be treated differently under AMT rules, such as certain deductions.

- Calculate AMT Income: Use the adjustments to calculate your Alternative Minimum Taxable Income (AMTI).

- Determine AMT Liability: Follow the instructions to calculate your AMT based on the AMTI.

- Complete the Form: Fill out the form accurately, ensuring all calculations are correct.

Obtaining Form 6251

Taxpayers can obtain Form 6251 from several sources. The most straightforward way is to download it directly from the IRS website. Additionally, many tax preparation software programs include the form as part of their package, allowing for easy electronic completion. For those who prefer a physical copy, local IRS offices and public libraries often have printed forms available.

Legal Use of Form 6251

Form 6251 holds legal significance as it is used to determine tax liability under the Alternative Minimum Tax system. When completed accurately, it serves as a binding document for tax reporting purposes. The IRS recognizes e-signed versions of the form as valid, provided they comply with electronic signature regulations. This ensures that taxpayers can file their forms securely and legally, whether electronically or by mail.

Key Elements of Form 6251

Several key elements are essential when completing Form 6251:

- Alternative Minimum Taxable Income (AMTI): This is the income calculated after adjustments and preferences.

- Exemption Amount: Taxpayers may qualify for an exemption that reduces their AMTI.

- Tax Rates: The AMT is calculated using specific tax rates that may differ from regular income tax rates.

- Credits: Certain credits can reduce AMT liability, so it's important to identify which apply.

Examples of Using Form 6251

Form 6251 is commonly used in various taxpayer scenarios. For instance, a taxpayer with substantial itemized deductions may need to complete the form to determine if they owe AMT. Additionally, individuals with high income from investments or self-employment may find themselves using this form to ensure compliance with AMT regulations. Understanding how to apply Form 6251 in these contexts can help taxpayers navigate their tax obligations more effectively.

Quick guide on how to complete 2021 form 6251 irs tax formsabout form 6251 alternative minimum tax individuals2021 form 6251 irs tax forms

Effortlessly Prepare Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms on Any Device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the required form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms with Ease

- Locate Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or hide sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 6251 irs tax formsabout form 6251 alternative minimum tax individuals2021 form 6251 irs tax forms

Create this form in 5 minutes!

People also ask

-

What is Form 6251 and why is it important?

Form 6251 is used by taxpayers to calculate their Alternative Minimum Tax (AMT). It is important because it ensures that taxpayers pay at least a minimum amount of tax, even if they have deductions that signNowly reduce their regular tax liability. Understanding Form 6251 is crucial for accurate tax reporting.

-

How can airSlate SignNow help with Form 6251 filing?

airSlate SignNow provides tools for easily sending and eSigning Form 6251 and other tax-related documents. With its user-friendly interface, you can streamline the eSignature process and ensure that all necessary parties sign the form timely. This efficiency can help reduce errors and expedite your overall tax filing process.

-

Is there a cost associated with using airSlate SignNow for Form 6251?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including features for handling Form 6251. The subscription plans are designed to be cost-effective, ensuring that you get value for your investment while simplifying document management and eSigning processes.

-

What features does airSlate SignNow offer for handling Form 6251?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage for handling Form 6251. These features allow for a streamlined eSigning process, ensuring your documents are completed accurately and on time. The software also provides audit trails for each signed document.

-

Can airSlate SignNow integrate with tax software that manages Form 6251?

Yes, airSlate SignNow offers integrations with a variety of tax software solutions that help manage Form 6251 and other tax documents. This integration streamlines your workflow and reduces the time spent on document management, allowing you to focus on preparing your taxes efficiently.

-

How does eSigning Form 6251 with airSlate SignNow enhance security?

eSigning Form 6251 with airSlate SignNow provides enhanced security features, including encryption and secure access. These measures ensure that your sensitive tax information is protected during the signing process. Additionally, airSlate SignNow complies with industry standards to maintain the highest levels of data security.

-

What benefits does airSlate SignNow provide for small businesses handling Form 6251?

For small businesses, airSlate SignNow offers a cost-effective solution for managing and eSigning Form 6251. Its user-friendly platform simplifies the document process, reducing administrative burdens and enabling faster turnaround times. Small businesses can save time and resources, ultimately focusing more on growth.

Get more for Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms

- Partial release of property from mortgage for corporation new york form

- Partial release of property from mortgage by individual holder new york form

- New york court 497321898 form

- New york supreme court form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy new york form

- Warranty deed for parents to child with reservation of life estate new york form

- Ny property new york form

- Warranty deed to separate property of one spouse to both spouses as joint tenants new york form

Find out other Form 6251 IRS Tax FormsAbout Form 6251, Alternative Minimum Tax Individuals2021 Form 6251 IRS Tax Forms

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast