Irs Form 6251 2015

What is the IRS Form 6251

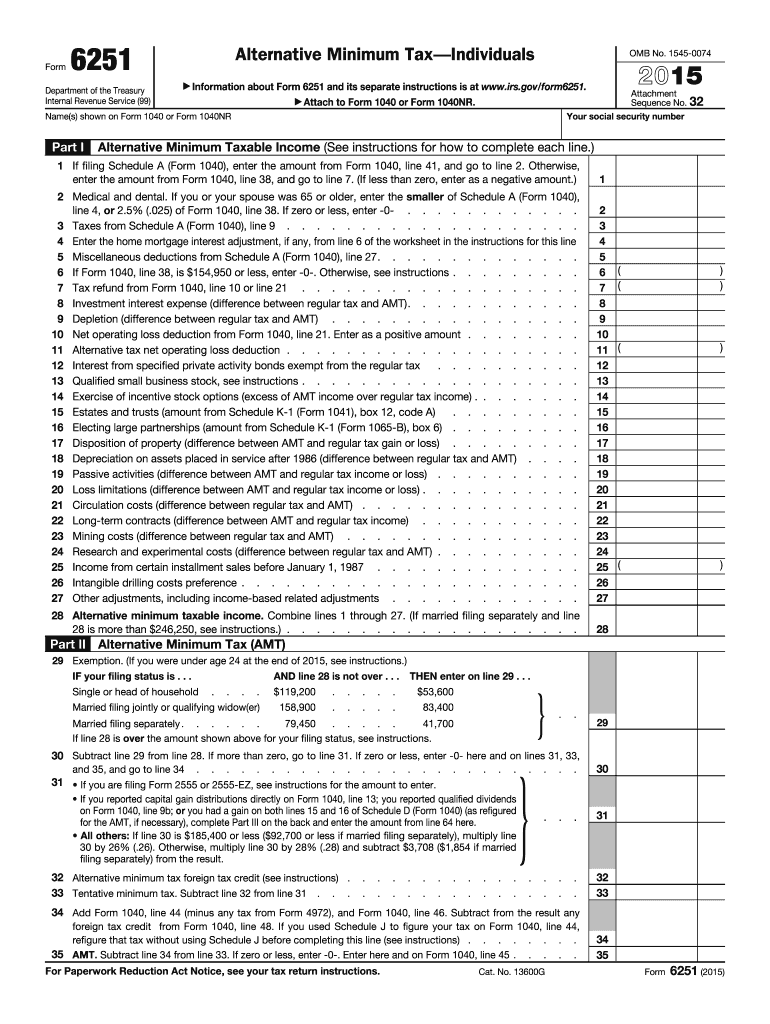

The IRS Form 6251 is a tax form used by individuals to determine if they owe alternative minimum tax (AMT). This form is essential for taxpayers who have certain types of income or deductions that could trigger AMT liability. The primary purpose of Form 6251 is to ensure that taxpayers pay a minimum amount of tax, regardless of their deductions and credits. It is particularly relevant for those with high incomes or specific tax benefits that may reduce their regular tax liability significantly.

How to use the IRS Form 6251

Using the IRS Form 6251 involves several steps to accurately assess your AMT liability. First, gather all necessary financial documents, including your income statements and details of any deductions or credits claimed. Next, complete the form by following the instructions provided on the form itself, which guide you through calculating your alternative minimum taxable income (AMTI). After determining your AMT, you will compare it with your regular tax liability to see if you need to pay additional tax.

Steps to complete the IRS Form 6251

Completing the IRS Form 6251 requires careful attention to detail. Here are the steps to follow:

- Start by entering your personal information at the top of the form.

- Calculate your alternative minimum taxable income (AMTI) by adjusting your regular taxable income with specific preferences and adjustments.

- Determine your AMT exemption amount based on your filing status and income level.

- Subtract the exemption from your AMTI to find your taxable income for AMT purposes.

- Apply the AMT rates to your taxable income to calculate your tentative minimum tax.

- Compare this amount to your regular tax liability to find out if you owe AMT.

Legal use of the IRS Form 6251

The legal use of the IRS Form 6251 is crucial for compliance with federal tax regulations. When filing your taxes, it is important to ensure that the form is filled out accurately and submitted on time. Failure to do so can result in penalties and interest charges. The form must be filed with your annual tax return, and it is advisable to keep a copy for your records in case of an audit. Understanding the legal implications of AMT and the proper use of Form 6251 can help avoid unnecessary complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 6251 align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If you require additional time to file, you can request an extension, which generally extends the deadline by six months. However, any taxes owed must still be paid by the original due date to avoid penalties. It is important to stay informed about any changes to tax deadlines, especially during tax season.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 6251 can be submitted through various methods. Taxpayers have the option to file their forms electronically using tax software, which is often the most efficient method. Alternatively, you can print the completed form and mail it to the IRS, ensuring that you send it to the correct address based on your state of residence. In-person submission is generally not available, as the IRS encourages electronic filing for faster processing. Regardless of the method chosen, ensure that you keep a copy of your submission for your records.

Quick guide on how to complete 2015 irs form 6251

Complete Irs Form 6251 effortlessly on any device

Online document management has grown in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 6251 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Irs Form 6251 without hassle

- Obtain Irs Form 6251 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 6251 and ensure superb communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs form 6251

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs form 6251

How to generate an electronic signature for the 2015 Irs Form 6251 online

How to make an electronic signature for your 2015 Irs Form 6251 in Google Chrome

How to generate an eSignature for signing the 2015 Irs Form 6251 in Gmail

How to create an eSignature for the 2015 Irs Form 6251 from your smartphone

How to generate an electronic signature for the 2015 Irs Form 6251 on iOS

How to generate an electronic signature for the 2015 Irs Form 6251 on Android OS

People also ask

-

What is IRS Form 6251 and why is it important?

IRS Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals. It ensures that taxpayers pay at least a minimum amount of tax, regardless of deductions and credits. Understanding how to fill out IRS Form 6251 is crucial for accurately reporting tax obligations.

-

How can airSlate SignNow help with IRS Form 6251?

With airSlate SignNow, you can easily send and eSign IRS Form 6251 documents securely online. Our platform streamlines the process, ensuring that your tax documents are signed and submitted promptly, reducing the risk of errors and delays.

-

What features does airSlate SignNow offer for managing IRS Form 6251?

airSlate SignNow provides features such as document templates, real-time collaboration, and secure cloud storage, specifically designed to simplify the management of IRS Form 6251. These tools enhance efficiency and help keep your tax documents organized.

-

Is airSlate SignNow cost-effective for filing IRS Form 6251?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Form 6251 and other tax documents. Our competitive pricing plans ensure that businesses of all sizes can affordably eSign and send important tax forms without compromising on quality.

-

Can I integrate airSlate SignNow with other tax software for IRS Form 6251?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, allowing users to streamline the process of filling out and submitting IRS Form 6251. This integration enhances productivity by reducing the need to switch between multiple platforms.

-

What security measures does airSlate SignNow implement for IRS Form 6251?

airSlate SignNow prioritizes the security of your documents, including IRS Form 6251. We use industry-standard encryption and secure cloud storage to protect sensitive information, ensuring that your tax documents are safe during eSigning and storage.

-

How quickly can I get my IRS Form 6251 signed using airSlate SignNow?

Using airSlate SignNow, you can have your IRS Form 6251 signed in a matter of minutes. Our user-friendly interface allows recipients to eSign documents quickly, helping you meet tax filing deadlines without hassle.

Get more for Irs Form 6251

Find out other Irs Form 6251

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors