Form 6251 Alternative Minimum TaxIndividuals 2020

What is the Form 6251 Alternative Minimum Tax

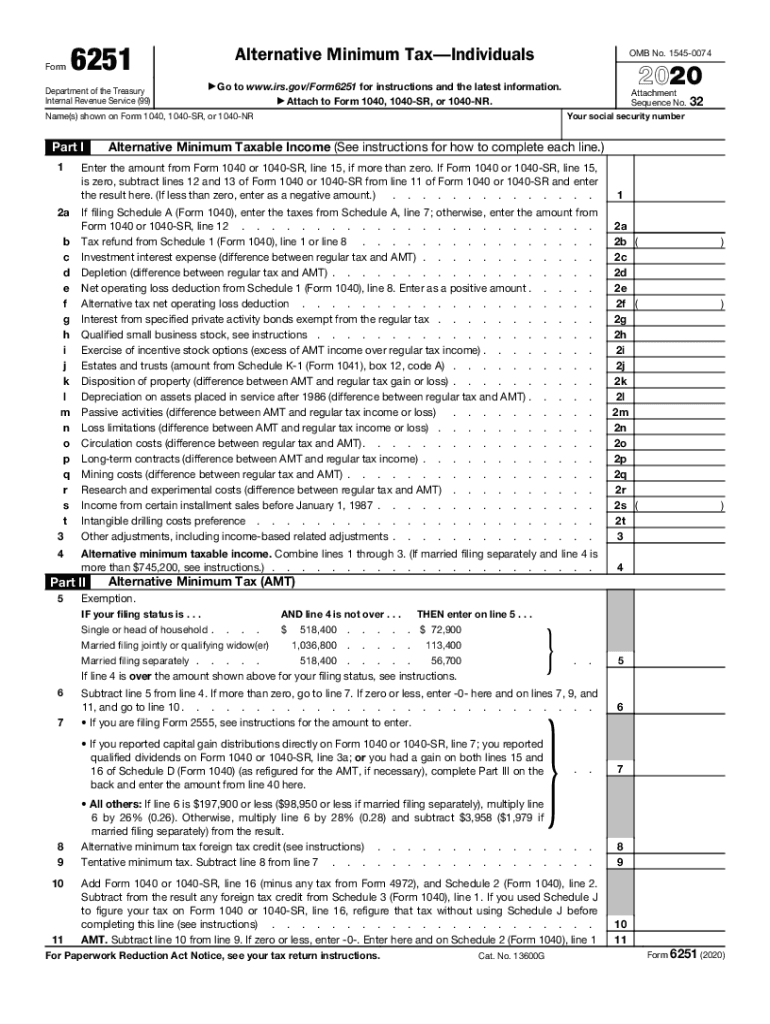

The Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals. This tax ensures that taxpayers who benefit from certain deductions and credits still pay a minimum amount of tax. The AMT applies to high-income earners who may otherwise pay little or no tax due to these benefits. Understanding the purpose of Form 6251 is essential for compliance with IRS regulations and for accurately reporting tax obligations.

How to obtain the Form 6251 Alternative Minimum Tax

To obtain Form 6251, individuals can visit the IRS website where the form is available for download in PDF format. Additionally, taxpayers can request a physical copy by calling the IRS or visiting a local IRS office. It's important to ensure that you have the correct version of the form for the tax year you are filing.

Steps to complete the Form 6251 Alternative Minimum Tax

Completing Form 6251 involves several steps:

- Begin by entering your personal information, including your name and Social Security number.

- Calculate your regular taxable income and any adjustments that may apply.

- Determine your Alternative Minimum Taxable Income (AMTI) by adding back certain deductions.

- Apply the AMT exemption amount to your AMTI to find your taxable income for AMT purposes.

- Calculate the AMT owed using the appropriate tax rates and complete the form with the final amount.

Legal use of the Form 6251 Alternative Minimum Tax

Form 6251 is legally binding when completed accurately and submitted to the IRS. To ensure its legality, the form must be signed and dated by the taxpayer. Additionally, all calculations must adhere to IRS guidelines to avoid penalties for inaccuracies. Using a reliable eSignature solution can help maintain the integrity of the document and ensure compliance with eSignature laws.

Key elements of the Form 6251 Alternative Minimum Tax

Key elements of Form 6251 include:

- Personal identification information

- Regular taxable income and adjustments

- Alternative Minimum Taxable Income (AMTI) calculations

- AMT exemption amount

- Final AMT calculation and tax owed

IRS Guidelines

The IRS provides specific guidelines for completing Form 6251, including detailed instructions on how to calculate AMTI and the applicable exemption amounts. Taxpayers should refer to the IRS instructions for the form to ensure that they are following the latest regulations and requirements. Keeping up to date with IRS publications is crucial for accurate tax reporting.

Quick guide on how to complete 2020 form 6251 alternative minimum taxindividuals

Complete Form 6251 Alternative Minimum TaxIndividuals effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without any holdups. Manage Form 6251 Alternative Minimum TaxIndividuals from any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 6251 Alternative Minimum TaxIndividuals seamlessly

- Locate Form 6251 Alternative Minimum TaxIndividuals and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or hide sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional signature made with ink.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 6251 Alternative Minimum TaxIndividuals and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 6251 alternative minimum taxindividuals

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 6251 alternative minimum taxindividuals

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 6251 get feature in airSlate SignNow?

The 6251 get feature in airSlate SignNow allows users to efficiently send documents for electronic signature. This functionality simplifies the signing process, ensuring that documents are securely signed and stored. With 6251 get, businesses can streamline their workflow and enhance productivity by minimizing paperwork.

-

How much does the 6251 get feature cost?

The 6251 get feature is included in the various pricing tiers of airSlate SignNow. Our plans are designed to be budget-friendly, offering flexible options tailored to different business needs. For detailed pricing information, visit our pricing page to find the best plan that includes the 6251 get functionality.

-

What are the key benefits of using the 6251 get feature?

Using the 6251 get feature provides signNow benefits, including faster turnaround times for document signing and enhanced security for sensitive information. Businesses can save time and resources, reduce errors, and improve overall efficiency. The 6251 get functionality also improves customer satisfaction by providing quick access to signed documents.

-

Does the 6251 get feature integrate with other applications?

Yes, the 6251 get feature in airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Microsoft Office. This integration streamlines document management and enhances your workflow by connecting with the tools you already use. With 6251 get, you can easily manage and send documents from your favorite apps.

-

What types of documents can I send with the 6251 get feature?

With the 6251 get feature, you can send a wide variety of documents for e-signature, including contracts, agreements, forms, and invoices. This versatility makes it suitable for various industries and business needs. The 6251 get functionality ensures that all document types are handled securely and efficiently.

-

Is there a mobile app for accessing the 6251 get feature?

Yes, airSlate SignNow offers a mobile app that allows users to access the 6251 get feature on the go. This ensures that you can send and manage documents from anywhere, making it convenient for busy professionals. The mobile app maintains all the functionalities of the desktop version, including the efficient 6251 get feature.

-

How does the 6251 get feature enhance document security?

The 6251 get feature includes multiple security measures to protect your documents, such as encryption, secure access, and audit trails. These features ensure that all signed documents remain confidential and tamper-proof. By utilizing the 6251 get functionality, businesses can confidently handle sensitive information without compromising security.

Get more for Form 6251 Alternative Minimum TaxIndividuals

- Mobile disco booking form wedding entertainment in gretna green gretna weddings

- Tv licence cancellation form pdf download

- Ease card north tyneside form

- Dairy nz milk smart workbook form

- Acc250 reimbursement of client travel expenses ancillary services client payments form

- Wine bottle forms

- 330 per dozen form

- Countertop order form

Find out other Form 6251 Alternative Minimum TaxIndividuals

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast