Form 6251 2016

What is the Form 6251

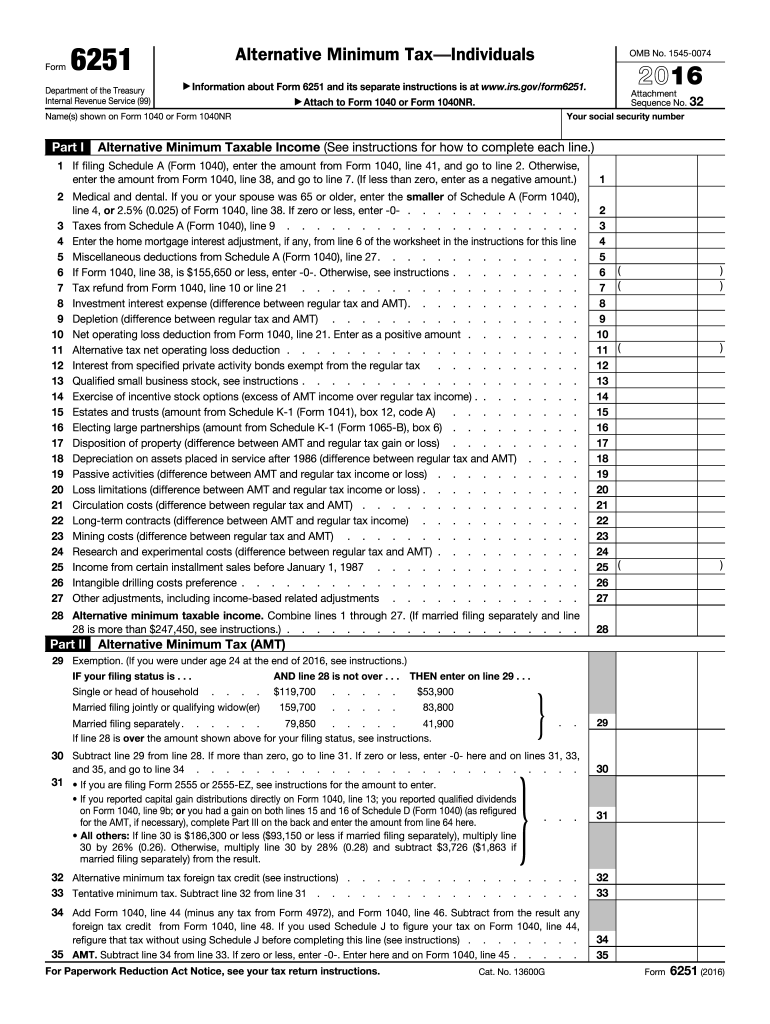

The Form 6251, also known as the Alternative Minimum Tax (AMT) Calculation, is a tax form used by individuals to determine their liability for the Alternative Minimum Tax. This form is essential for taxpayers whose income exceeds certain thresholds or who have specific tax preferences that could trigger the AMT. The purpose of the AMT is to ensure that individuals with higher incomes pay a minimum amount of tax, regardless of deductions and credits that may significantly reduce their tax liability under the regular tax system.

How to use the Form 6251

To effectively use Form 6251, taxpayers must first gather relevant financial information, including income, deductions, and credits. The form requires users to calculate their Alternative Minimum Taxable Income (AMTI) by making adjustments to their regular taxable income. Taxpayers will then apply the AMT rates to this income to determine their AMT liability. It is crucial to follow the instructions carefully, as errors in calculations can lead to incorrect tax filings.

Steps to complete the Form 6251

Completing Form 6251 involves several key steps:

- Begin by entering your name, Social Security number, and filing status at the top of the form.

- Calculate your Alternative Minimum Taxable Income (AMTI) by adjusting your regular taxable income with specific items.

- Complete the required sections to determine your AMT liability, including any applicable credits.

- Review your calculations to ensure accuracy before submitting.

Legal use of the Form 6251

Form 6251 is legally binding when completed accurately and submitted to the IRS. To ensure compliance, taxpayers should adhere to IRS guidelines regarding the form's use and submission deadlines. The form must be filed with the taxpayer's annual income tax return. Any discrepancies or errors can lead to penalties or additional taxes owed, making it essential to maintain accurate records and documentation.

Filing Deadlines / Important Dates

Form 6251 must be submitted along with your annual income tax return, typically due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to filing deadlines, especially in light of potential extensions granted by the IRS for specific tax years.

Required Documents

To complete Form 6251, taxpayers should gather several documents, including:

- Previous year’s tax return for reference.

- W-2 forms from employers and 1099 forms for other income.

- Documentation for deductions and credits, such as mortgage interest statements and investment income records.

- Any other relevant financial documents that may affect your tax situation.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 6251. Taxpayers should refer to the latest IRS instructions for the form, which outline the necessary calculations, eligibility criteria, and any updates to tax laws that may impact the AMT. Staying informed about IRS guidelines ensures that taxpayers remain compliant and avoid potential issues with their tax filings.

Quick guide on how to complete form 6251 2016

Finalize Form 6251 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 6251 on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to edit and electronically sign Form 6251 without hassle

- Obtain Form 6251 and click on Retrieve Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Signature tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and click on the Finish button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 6251 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6251 2016

Create this form in 5 minutes!

How to create an eSignature for the form 6251 2016

How to create an eSignature for the Form 6251 2016 in the online mode

How to generate an eSignature for the Form 6251 2016 in Chrome

How to generate an eSignature for signing the Form 6251 2016 in Gmail

How to generate an electronic signature for the Form 6251 2016 right from your smart phone

How to generate an electronic signature for the Form 6251 2016 on iOS devices

How to create an electronic signature for the Form 6251 2016 on Android OS

People also ask

-

What is Form 6251 and why is it important?

Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals, ensuring that taxpayers pay at least a minimum amount of tax. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

-

How can airSlate SignNow help with Form 6251?

airSlate SignNow simplifies the process of preparing and signing Form 6251 by allowing users to electronically sign documents securely and efficiently. This streamlines the workflow, ensuring that all necessary signatures are collected promptly.

-

Is there a cost associated with using airSlate SignNow for Form 6251?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that fits your budget while benefiting from features that facilitate the signing and management of documents like Form 6251.

-

What features does airSlate SignNow offer for handling Form 6251?

With airSlate SignNow, you can easily create, send, and track Form 6251 while ensuring compliance with eSignature laws. Key features include customizable templates, real-time tracking, and secure document storage.

-

Can I integrate airSlate SignNow with other applications for Form 6251 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRMs and accounting software, to enhance your workflow when handling Form 6251. This integration allows for efficient data sharing and management.

-

What are the benefits of using airSlate SignNow for Form 6251?

Using airSlate SignNow for Form 6251 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. It simplifies the signing process, allowing you to focus on your business rather than administrative tasks.

-

How does airSlate SignNow ensure the security of Form 6251 documents?

airSlate SignNow prioritizes security by using encryption and secure cloud storage to protect your Form 6251 documents. This ensures that sensitive information is safeguarded against unauthorized access.

Get more for Form 6251

- Quit claim form

- Minnesota well disclosure statement form

- Florida quitclaim deed from individual to two individuals in joint tenancy form

- Need a form for a rental agreement in missouri

- Form for power of attorney ga

- Rental lease agreement word template form

- Georgia limited liability company llc operating agreement form

- Arkansas marital legal separation and property settlement agreement where no children or no joint property or debts and divorce form

Find out other Form 6251

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney