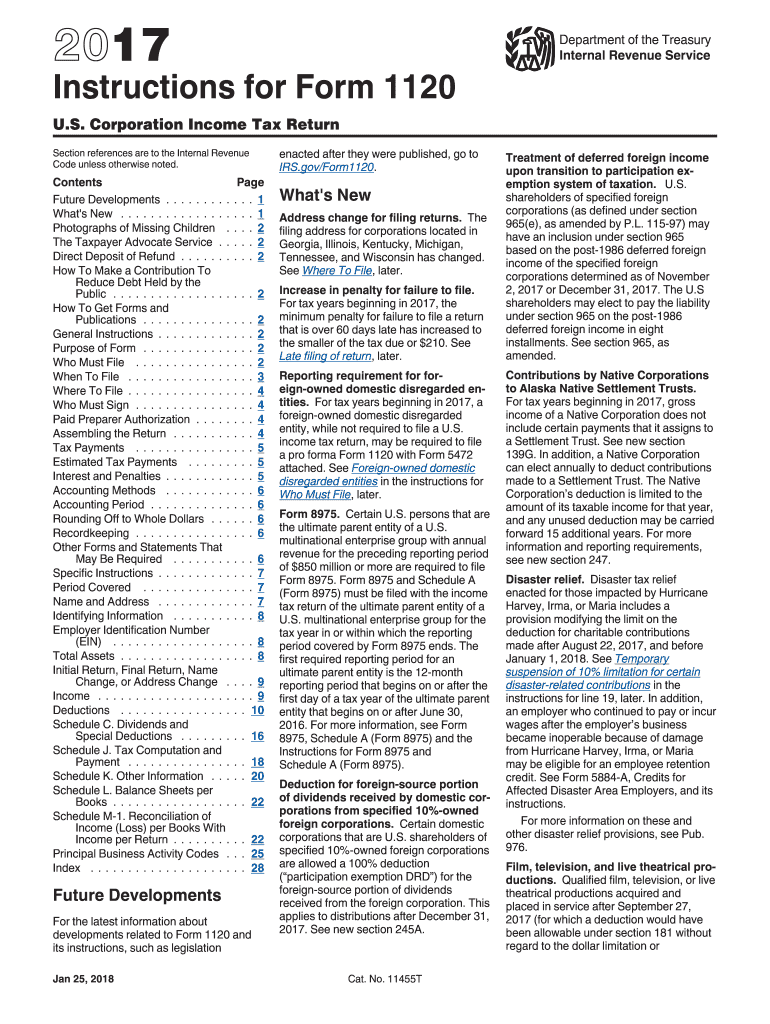

Irs Form 1120 Instructions 2017

What is the IRS Form 1120 Instructions

The IRS Form 1120 Instructions provide detailed guidance for corporations on how to complete and file their annual income tax return. This form is specifically designed for C corporations, which are separate legal entities that pay taxes on their income. The instructions outline the necessary information required, including income, deductions, and credits that corporations must report. Understanding these instructions is essential for compliance with federal tax regulations and to ensure accurate reporting.

Steps to Complete the IRS Form 1120 Instructions

Completing the IRS Form 1120 involves several key steps:

- Gather necessary documents: Collect financial statements, receipts, and any other relevant documentation that supports income and expenses.

- Fill out the form: Input all required information accurately, including corporate name, address, and Employer Identification Number (EIN).

- Report income: Detail all sources of income, including sales and other revenue streams.

- Claim deductions: List all allowable deductions, such as operating expenses, salaries, and benefits.

- Calculate tax liability: Use the provided tax rates to determine the amount owed based on taxable income.

- Review and sign: Ensure all information is correct before signing and dating the form.

How to Obtain the IRS Form 1120 Instructions

The IRS Form 1120 Instructions can be obtained directly from the IRS website or by contacting the IRS for a physical copy. It is important to ensure that you are using the most current version of the instructions, as they may change from year to year. Additionally, many tax preparation software programs include the form and instructions, providing an easy way to access the necessary materials while preparing your tax return.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the IRS Form 1120. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also file for an extension, but any taxes owed must still be paid by the original due date to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the IRS Form 1120. The form can be filed electronically using approved e-filing software, which is often the quickest and most efficient method. Alternatively, corporations can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submission is generally not available, as the IRS encourages electronic filing for faster processing. Regardless of the method chosen, it is crucial to keep a copy of the submitted form for your records.

Key Elements of the IRS Form 1120 Instructions

The IRS Form 1120 Instructions include several key elements that are essential for accurate completion:

- Identification Information: This section requires the corporation's name, address, and EIN.

- Income Section: Corporations must report all sources of income, including gross receipts and sales.

- Deductions Section: Detailed instructions on what expenses can be deducted to reduce taxable income.

- Tax Computation: Guidelines on how to calculate the tax owed based on taxable income.

- Signature Section: Requires a signature from an authorized representative of the corporation.

Quick guide on how to complete irs form 1120 instructions 2017 2019

Uncover the most efficient method to complete and endorse your Irs Form 1120 Instructions

Are you still spending time organizing your official documents on paper instead of online? airSlate SignNow presents a superior approach to complete and endorse your Irs Form 1120 Instructions and similar forms for public services. Our intelligent e-signature solution equips you with everything necessary to handle documentation swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing tools all available within an intuitive interface.

There are just a few actions needed to finish filling out and signing your Irs Form 1120 Instructions:

- Upload the editable template to the editor using the Get Form button.

- Review the information required in your Irs Form 1120 Instructions.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is truly signNow or Blackout fields that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Place the Date next to your signature and conclude your task with the Done button.

Store your completed Irs Form 1120 Instructions in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our solution also facilitates flexible document sharing. There’s no requirement to print your forms when you need to submit them to the appropriate public office - do it using email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1120 instructions 2017 2019

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 instructions 2017 2019

How to make an eSignature for your Irs Form 1120 Instructions 2017 2019 online

How to create an eSignature for your Irs Form 1120 Instructions 2017 2019 in Google Chrome

How to make an electronic signature for signing the Irs Form 1120 Instructions 2017 2019 in Gmail

How to create an electronic signature for the Irs Form 1120 Instructions 2017 2019 from your mobile device

How to generate an electronic signature for the Irs Form 1120 Instructions 2017 2019 on iOS devices

How to create an eSignature for the Irs Form 1120 Instructions 2017 2019 on Android

People also ask

-

What are the IRS Form 1120 instructions for filing corporate taxes?

The IRS Form 1120 instructions provide detailed guidelines on how to complete and file your corporate tax return. These instructions cover essential topics such as eligibility, required documentation, and deadlines. Familiarizing yourself with the IRS Form 1120 instructions can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with IRS Form 1120 instructions?

airSlate SignNow offers a streamlined solution for signing and sending IRS Form 1120 documents electronically. With features designed for efficiency, you can easily manage the e-signature process while adhering to IRS Form 1120 instructions. This ensures that your corporate tax documents are filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1120 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, ensuring a cost-effective solution for managing IRS Form 1120 documents. The pricing is designed to provide value while simplifying the e-signature process as per IRS Form 1120 instructions. You can choose a plan that best fits your business requirements.

-

What features does airSlate SignNow provide for handling IRS Form 1120?

airSlate SignNow includes features like customizable templates, document tracking, and secure storage, all of which are beneficial for handling IRS Form 1120. These features allow you to follow IRS Form 1120 instructions closely and manage your documents efficiently. The platform ensures that all your forms are compliant and easily accessible.

-

Can I integrate airSlate SignNow with other software for IRS Form 1120?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for IRS Form 1120 management. Whether you use accounting software or document management systems, these integrations help you follow IRS Form 1120 instructions and streamline the filing process. This flexibility makes it easier to keep all your documents organized.

-

What benefits does airSlate SignNow offer for e-signing IRS Form 1120?

Using airSlate SignNow for e-signing IRS Form 1120 provides several benefits, including time savings and increased security. Following the IRS Form 1120 instructions can be simplified with electronic signatures, allowing for quick approvals and fewer errors. Additionally, the platform is designed to maintain compliance with all legal requirements for electronic signatures.

-

How secure is airSlate SignNow for filing IRS Form 1120?

AirSlate SignNow prioritizes security, utilizing advanced encryption to protect your documents, including IRS Form 1120 filings. By following the IRS Form 1120 instructions, you can ensure that your sensitive information stays confidential. This level of security helps businesses maintain compliance and trust when handling important tax documents.

Get more for Irs Form 1120 Instructions

- Lmia form

- Greendot dispute form

- Employee census form health coverage guide

- Download the application form dominoamp39s pizza

- Nursing 100 fill in worksheet form

- Toll permit application florida department of transportation dot state fl form

- Notice of order of filiation 3rdcc form

- Family friend lease agreement form

Find out other Irs Form 1120 Instructions

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed