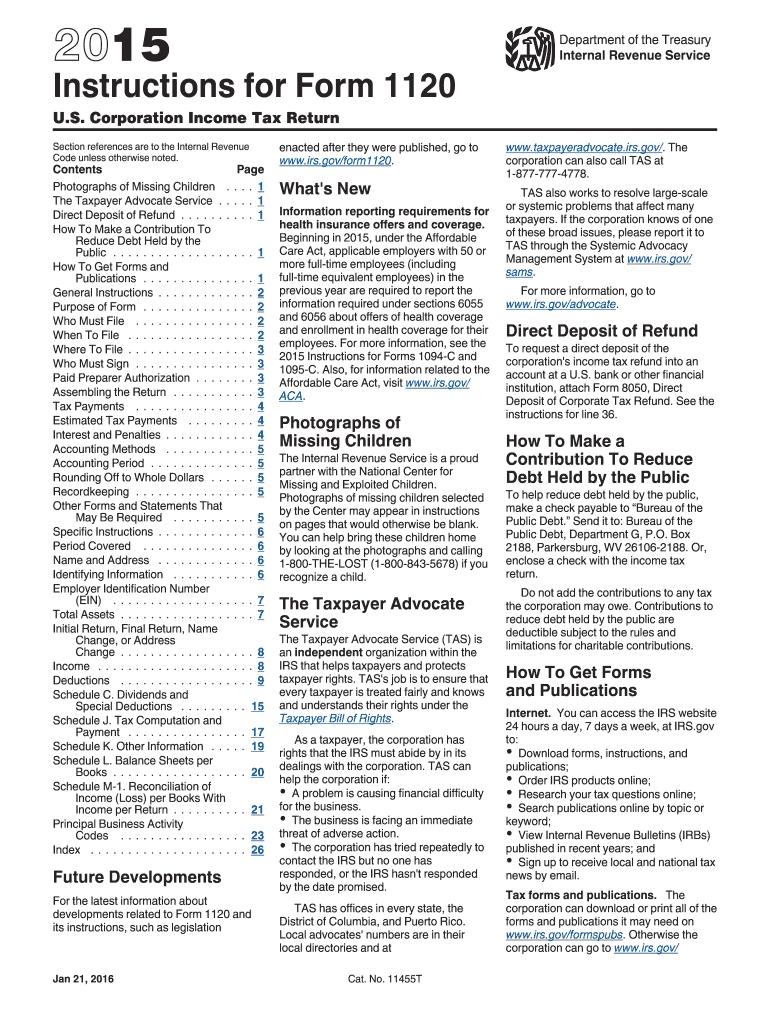

Form 1120 Instructions 2015

What is the Form 1120 Instructions

The Form 1120 Instructions provide detailed guidance for corporations filing their income tax returns in the United States. This form is specifically designed for C corporations, which are taxed separately from their owners. The instructions outline how to report income, deductions, and credits, ensuring compliance with IRS regulations. Understanding these instructions is crucial for accurate filing and to avoid penalties.

Steps to complete the Form 1120 Instructions

Completing the Form 1120 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, follow the instructions meticulously, filling in each section with the required information. Pay special attention to the calculations for taxable income and applicable deductions. Finally, review the completed form for errors before submission to the IRS.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for Form 1120. Generally, the form is due on the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Timely filing is essential to avoid late fees and penalties.

Legal use of the Form 1120 Instructions

The legal use of the Form 1120 Instructions is critical for ensuring that the tax return is valid and compliant with federal law. The instructions clarify the legal requirements for reporting income and expenses, as well as the implications of inaccuracies. Utilizing these guidelines helps corporations maintain compliance with IRS regulations, reducing the risk of audits and penalties.

Key elements of the Form 1120 Instructions

Key elements of the Form 1120 Instructions include sections on income reporting, deductions, and tax credits. Each section provides specific guidelines on what information must be included and how to calculate totals. Additionally, the instructions detail the importance of supporting documentation, such as receipts and financial statements, which are necessary for substantiating claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Form 1120. The form can be filed electronically through the IRS e-file system, which is often the quickest method. Alternatively, corporations may choose to submit the form by mail, sending it to the appropriate IRS address based on their location. In-person submissions are typically not available, making electronic and mail options the primary methods for filing.

Quick guide on how to complete 2015 form 1120 instructions

Effortlessly Prepare Form 1120 Instructions on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option compared to conventional printed and signed paperwork, as you can access the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form 1120 Instructions on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Adjust and Electronically Sign Form 1120 Instructions with Ease

- Obtain Form 1120 Instructions and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional signature with ink.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 1120 Instructions to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1120 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1120 instructions

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What are the Form 1120 Instructions?

The Form 1120 Instructions provide detailed guidance on how to accurately complete the Form 1120, which is used by corporations to report their income, gains, losses, and taxes. Understanding these instructions is essential for ensuring compliance with IRS regulations and minimizing errors in your tax filing.

-

How can airSlate SignNow assist with Form 1120 Instructions?

airSlate SignNow offers an intuitive platform that simplifies the process of signing and managing Form 1120 and its Instructions. You can easily upload your documents, share them with others for eSignature, and keep everything organized in one secure location.

-

Is there a cost to access Form 1120 Instructions through airSlate SignNow?

While access to Form 1120 Instructions is generally free through the IRS website, using airSlate SignNow comes with a subscription cost. This cost includes added features such as secure eSigning, document storage, and collaboration tools that enhance the overall experience.

-

What features does airSlate SignNow provide for managing Form 1120?

airSlate SignNow provides robust features for managing Form 1120, including customizable templates, secure eSignature options, and automatic reminders for document deadlines. These features streamline the filing process and ensure that you stay organized.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, allowing you to attach and manage your Form 1120 Instructions effortlessly. This integration helps maintain accurate records and simplifies your workflow between applications.

-

What benefits do I gain from using airSlate SignNow for Form 1120 filing?

Using airSlate SignNow for your Form 1120 filing offers several benefits, including enhanced document security, faster turnaround times for signatures, and improved collaboration with your accountant or tax professional. These advantages can ultimately lead to a more efficient tax preparation experience.

-

What support does airSlate SignNow provide for understanding Form 1120 Instructions?

airSlate SignNow offers extensive customer support resources, including tutorials and guides, to help you understand the Form 1120 Instructions better. Our team is also available for real-time chat or email support to assist with any queries you may have during the signing process.

Get more for Form 1120 Instructions

- Fitness waiver template form

- Ally homehealthcarecom form

- Insurance broker fee agreement abk brokerage form

- Molina healthcare authorization form

- Mammography forms

- Certification of attending physician for death claim philam life form

- Medication administration record mar patient name dob physician physician ph key dc discontinued c changed h medication on hold form

- Agla5051 form

Find out other Form 1120 Instructions

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now