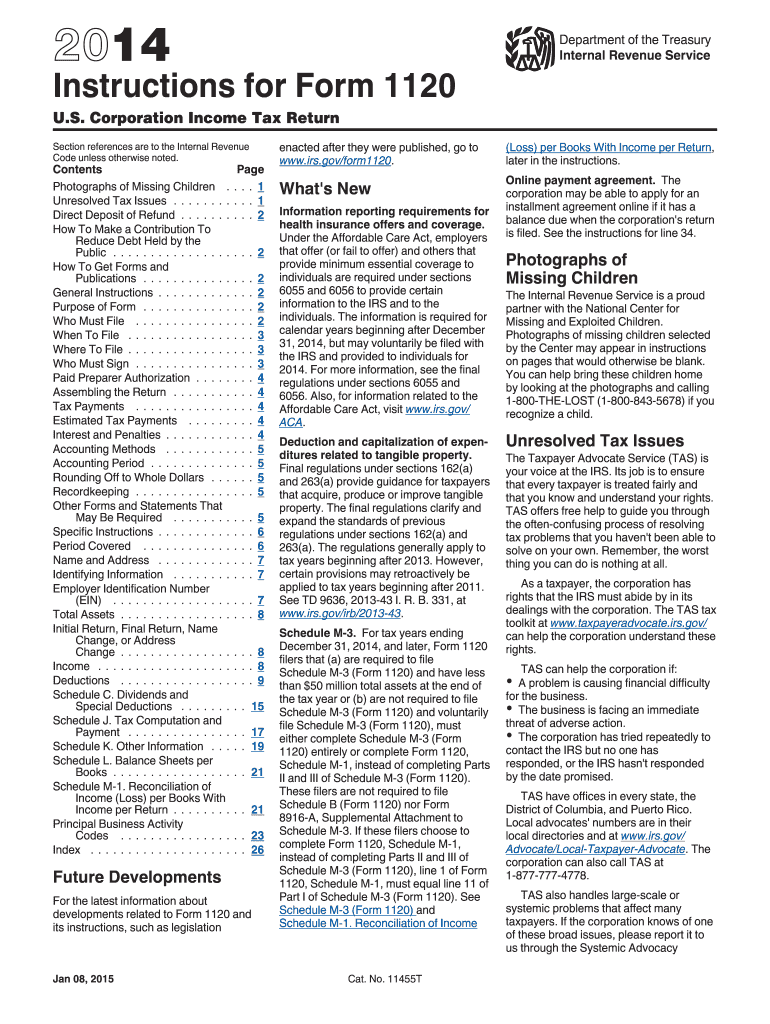

1120 Form 2014

What is the 1120 Form

The 1120 Form is a U.S. federal tax return used by corporations to report income, gains, losses, deductions, and credits. It is essential for C corporations, which are separate legal entities from their owners. This form provides the Internal Revenue Service (IRS) with a comprehensive overview of a corporation's financial activities for the tax year. Completing the 1120 Form accurately is crucial for compliance with tax regulations and to avoid potential penalties.

How to obtain the 1120 Form

The 1120 Form can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, businesses can request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to ensure that you are using the most current version of the form, as tax laws and requirements may change annually.

Steps to complete the 1120 Form

Completing the 1120 Form involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill out the form with accurate financial data, ensuring all sections are completed, including income, deductions, and credits.

- Review the form for accuracy and completeness to prevent errors that could lead to audits or penalties.

- Sign and date the form, ensuring it is signed by an authorized officer of the corporation.

Legal use of the 1120 Form

The 1120 Form must be filed in accordance with IRS regulations to be considered legally valid. It is vital that all information provided is truthful and accurate. Failure to comply with tax laws can result in penalties, including fines and interest on unpaid taxes. Corporations should maintain thorough records to support the information reported on the form, as this can be crucial in the event of an audit.

Filing Deadlines / Important Dates

The deadline for filing the 1120 Form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. Extensions may be available, but corporations must file Form 7004 to request additional time. It is important to adhere to these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The 1120 Form can be submitted to the IRS through various methods. Corporations may file electronically using approved tax software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether a payment is included. In-person submissions are generally not available for the 1120 Form, making electronic filing or mail the most common options.

Quick guide on how to complete 2014 1120 form

Accomplish 1120 Form smoothly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle 1120 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign 1120 Form with ease

- Obtain 1120 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about losing or misplacing files, tedious form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign 1120 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1120 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1120 form

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1120 Form and why is it important?

The 1120 Form is a U.S. tax return form used by corporations to report their income, gains, losses, deductions, and credits. Filing the 1120 Form accurately is crucial for compliance with IRS regulations and to avoid penalties. It ensures that your business's tax obligations are met effectively.

-

How can airSlate SignNow help with the 1120 Form filing process?

airSlate SignNow streamlines the process of signing and sending your 1120 Form and other important documents. With our easy-to-use platform, you can quickly eSign documents, gather necessary signatures, and keep track of your submission. This efficiency saves time and reduces the risk of errors in your filing.

-

What features does airSlate SignNow offer for managing the 1120 Form?

airSlate SignNow provides features such as document templates, secure eSignatures, and automated workflows tailored to the 1120 Form. These functionalities help simplify the preparation and filing process, ensuring that your documents are always compliant and professionally managed.

-

Is airSlate SignNow affordable for businesses filing the 1120 Form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. Our pricing structure ensures that you can access essential features for managing the 1120 Form without breaking the bank, allowing you to focus on your core business activities.

-

Can I integrate airSlate SignNow with other software for the 1120 Form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, enabling seamless data transfer for your 1120 Form. This integration enhances your workflow, allowing you to manage your documents and tax filings more efficiently.

-

What are the benefits of using airSlate SignNow for the 1120 Form?

Using airSlate SignNow for the 1120 Form provides numerous benefits, including enhanced security, easy collaboration, and faster turnaround times. Our platform ensures that your documents are signed and processed swiftly, allowing you to focus on growing your business while staying compliant.

-

Is it easy to get started with airSlate SignNow for the 1120 Form?

Yes, getting started with airSlate SignNow is straightforward. Simply sign up for an account, and you can begin creating, signing, and managing your 1120 Form documents in minutes. Our user-friendly interface makes it accessible for everyone, regardless of technical expertise.

Get more for 1120 Form

Find out other 1120 Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament