Tax PDF PDF 1120 U S Corporation Income Tax Return Form 2021

What is the IRS Form 1120?

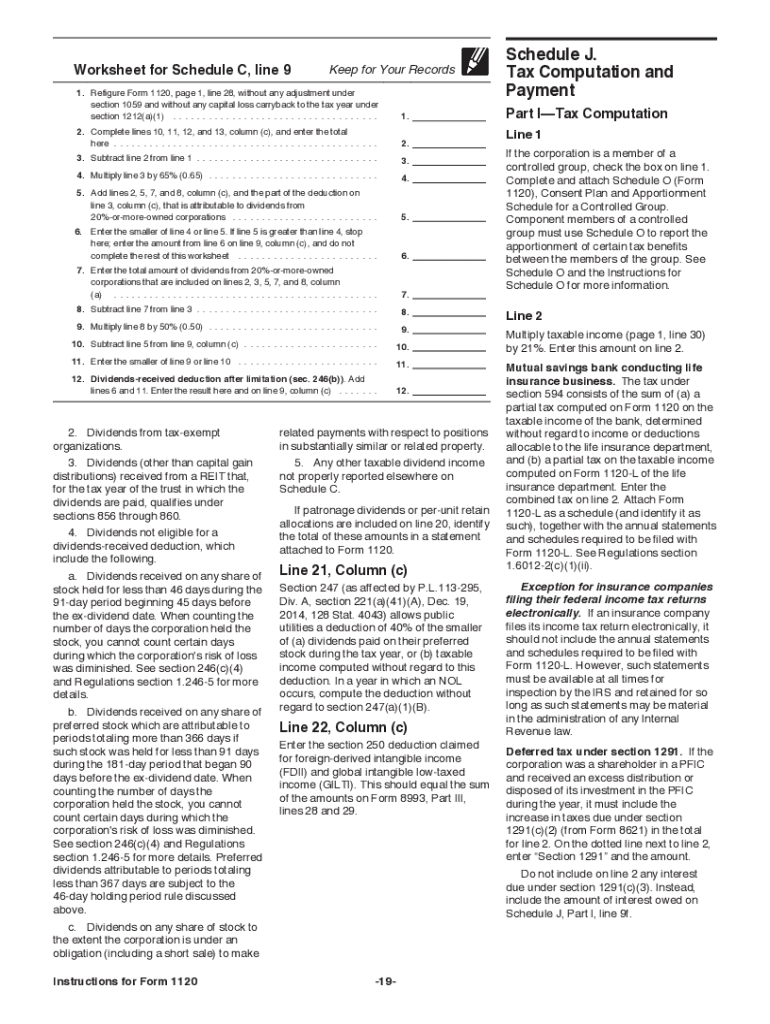

The IRS Form 1120 is the U.S. Corporation Income Tax Return form that corporations must file annually to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal corporate tax rate and determine their tax liability. The form requires detailed financial information, including revenue, expenses, and other relevant financial data. Understanding the purpose of this form is crucial for compliance with federal tax regulations.

Steps to Complete the IRS Form 1120

Completing the IRS Form 1120 involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill Out the Form: Input the required information into the appropriate sections of Form 1120, ensuring accuracy in reporting income and expenses.

- Calculate Tax Liability: Use the corporate income tax rates to determine the amount of tax owed based on the taxable income reported.

- Review and Sign: Carefully review the completed form for any errors or omissions before signing and dating it.

- File the Form: Submit the completed Form 1120 to the IRS by the due date, either electronically or by mail.

Filing Deadlines for IRS Form 1120

The filing deadline for IRS Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can also request a six-month extension to file, but any taxes owed must be paid by the original deadline to avoid penalties and interest.

Required Documents for IRS Form 1120

To complete the IRS Form 1120, corporations need to gather several key documents:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Records of deductions, including salaries, rent, and utilities.

- Previous year’s tax return for reference.

- Any supporting documentation for credits and deductions claimed.

IRS Guidelines for Form 1120

The IRS provides specific guidelines for completing Form 1120, which include instructions on how to report various types of income and deductions. Corporations must adhere to these guidelines to ensure compliance with tax laws. The IRS also offers resources, including publications and online tools, to assist in the accurate completion of the form. Familiarizing oneself with these guidelines can help prevent errors and reduce the risk of audits.

Penalties for Non-Compliance

Failure to file IRS Form 1120 on time or accurately can result in significant penalties. The IRS imposes a penalty for late filing, which can be a percentage of the unpaid tax amount for each month the return is late. Additionally, inaccuracies in reporting can lead to further penalties and interest on any taxes owed. Corporations should prioritize timely and accurate filing to avoid these financial repercussions.

Quick guide on how to complete tax pdfpdf 1120 us corporation income tax return form

Complete Tax Pdf pdf 1120 U S Corporation Income Tax Return Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow supplies you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Tax Pdf pdf 1120 U S Corporation Income Tax Return Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Tax Pdf pdf 1120 U S Corporation Income Tax Return Form with ease

- Access Tax Pdf pdf 1120 U S Corporation Income Tax Return Form and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your PC.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Pdf pdf 1120 U S Corporation Income Tax Return Form and ensure clear communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax pdfpdf 1120 us corporation income tax return form

Create this form in 5 minutes!

How to create an eSignature for the tax pdfpdf 1120 us corporation income tax return form

How to make an e-signature for a PDF document online

How to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What are corporate income tax rates and how do they affect eSigning services?

Corporate income tax rates refer to the percentage of a corporation's profits that is taxed by the government. Understanding these rates is crucial for businesses as they influence overall operational costs, including expenditures on eSigning services like airSlate SignNow. By utilizing affordable eSignature solutions, companies can manage their expenses more effectively, potentially impacting their taxable income.

-

How can airSlate SignNow help manage corporate income tax documentation?

airSlate SignNow streamlines the signing and managing of tax-related documents, ensuring compliance with corporate income tax rates. The platform allows users to send, receive, and store essential tax documents securely, which simplifies record-keeping and reporting during tax season. This efficiency can ultimately lead to savings and better financial oversight.

-

What pricing plans does airSlate SignNow offer for businesses concerned about corporate income tax rates?

airSlate SignNow offers a variety of pricing plans suited for different business sizes and needs, which can help mitigate costs related to corporate income tax rates. These plans include essential features for eSigning and document management, ensuring businesses pay only for what they need to maintain compliance and manage tax-related documents efficiently. Your choice can signNowly affect your overall tax strategy.

-

Are there any features in airSlate SignNow that help with tax-related compliance?

Yes, airSlate SignNow includes features specifically designed to enhance compliance with tax regulations, including those related to corporate income tax rates. The platform allows for the creation of legally binding signatures, audit trails, and secure storage of documents, which are all crucial for maintaining compliance during tax assessments. This minimizes the risk of audits and penalties.

-

Can airSlate SignNow integrate with accounting software to optimize corporate income tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software. This lets businesses streamline document management and ensures easy access to essential records necessary for calculating and reporting corporate income tax rates, enhancing overall efficiency in tax preparation processes.

-

What are the benefits of using airSlate SignNow for documenting corporate income tax transactions?

Using airSlate SignNow for documenting corporate income tax transactions provides several benefits. The platform enhances accuracy, promotes collaboration among teams, and ensures that all signatures are legally binding and easily accessible. This can reduce the time spent managing tax documentation, allowing your team to focus on strategic financial planning regarding corporate income tax rates.

-

How does airSlate SignNow ensure the security of tax-related documents?

airSlate SignNow prioritizes the security of your tax-related documents by implementing robust encryption and compliance standards. This ensures that any document containing sensitive information, such as those related to corporate income tax rates, is protected against unauthorized access. With these security measures, businesses can confidently manage and store their eSigned tax documents.

Get more for Tax Pdf pdf 1120 U S Corporation Income Tax Return Form

- Mississippi affidavit form

- Ms petition form

- Order authorizing the closing of the estate and the discharge of the executor mississippi form

- Petition letters administration form

- Letter administration form

- Order granting letters of administration mississippi form

- Mississippi oath form

- Quitclaim deed from husband and wife to husband and wife mississippi form

Find out other Tax Pdf pdf 1120 U S Corporation Income Tax Return Form

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT