1120 2019-2025 Form

What is the Form 1120?

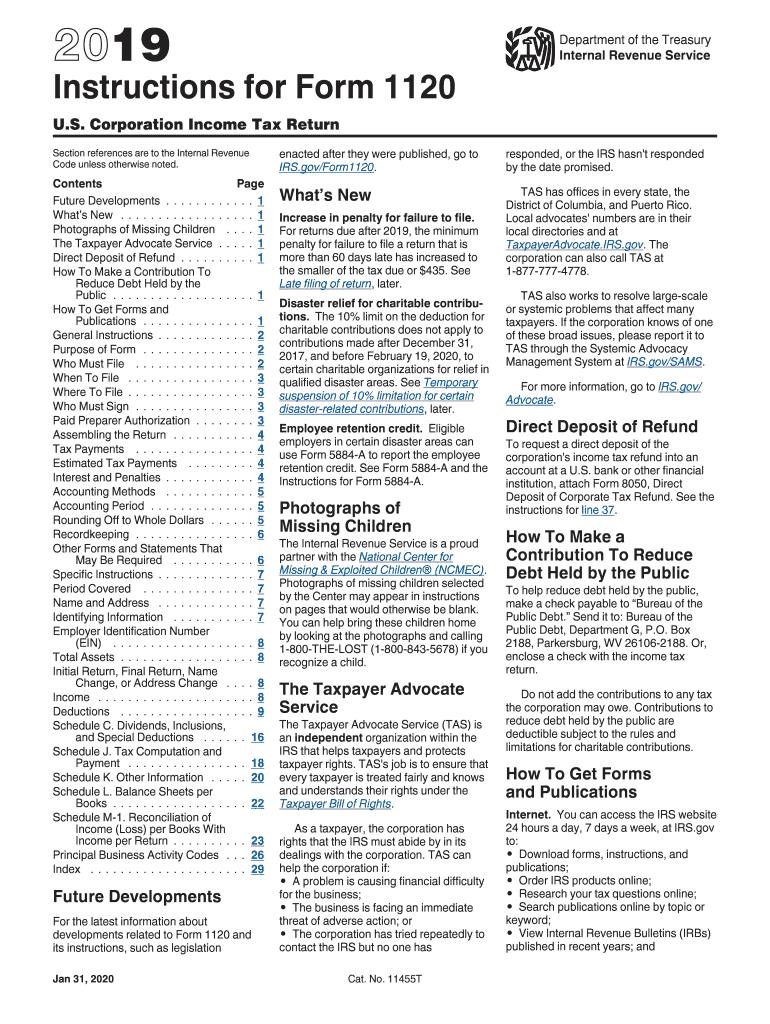

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are taxed separately from their owners. The 2013 version of the form includes specific lines and schedules that must be completed to accurately reflect the corporation's financial activities for that tax year.

Steps to Complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather Financial Information: Collect all necessary financial records, including income statements, balance sheets, and any supporting documentation for deductions and credits.

- Fill Out the Basic Information: Enter the corporation's name, address, Employer Identification Number (EIN), and the date of incorporation.

- Report Income: Complete the income section by listing all sources of income, including sales, dividends, and capital gains.

- Calculate Deductions: Detail all allowable deductions, such as operating expenses, salaries, and taxes paid.

- Determine Tax Liability: Use the information provided to calculate the corporation's tax liability based on the applicable tax rates for the year.

- Review and Sign: Ensure all information is accurate, then sign and date the form before submission.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also file for an automatic six-month extension using Form 7004.

Legal Use of the Form 1120

The Form 1120 must be filed in compliance with IRS regulations. It serves as a legal declaration of a corporation's income and tax obligations. Accurate reporting is crucial, as any discrepancies may lead to audits or penalties. Corporations must retain copies of the filed form and any supporting documentation for at least three years from the date of filing.

Who Issues the Form?

The Form 1120 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides the form along with detailed instructions on how to complete it. Corporations can access the form directly from the IRS website or through tax preparation software that includes IRS forms.

Required Documents

To complete the Form 1120, corporations need to gather several documents, including:

- Income statements and balance sheets for the tax year.

- Records of all income sources, including sales and dividends.

- Documentation for all deductions claimed, such as receipts and invoices.

- Previous year’s tax returns, if applicable, for reference.

Quick guide on how to complete 2014 1120 instructions

Effortlessly prepare 2014 1120 instructions on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an outstanding eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage form 1120 2013 on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented activity today.

How to alter and eSign 2017 us corporate tax rate with ease

- Locate 2014 1120 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important parts of the documents or redact sensitive data using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign form 1120 instruction for 2015 to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 corporate tax rates

Related searches to 2017 corporate tax rate

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs 1120

How to create an electronic signature for your 2019 Instructions For Form 1120 Instructions For Form 1120 Us Corporation Income Tax Return in the online mode

How to generate an electronic signature for your 2019 Instructions For Form 1120 Instructions For Form 1120 Us Corporation Income Tax Return in Google Chrome

How to generate an eSignature for putting it on the 2019 Instructions For Form 1120 Instructions For Form 1120 Us Corporation Income Tax Return in Gmail

How to create an eSignature for the 2019 Instructions For Form 1120 Instructions For Form 1120 Us Corporation Income Tax Return right from your smart phone

How to generate an eSignature for the 2019 Instructions For Form 1120 Instructions For Form 1120 Us Corporation Income Tax Return on iOS devices

How to create an electronic signature for the 2019 Instructions For Form 1120 Instructions For Form 1120 Us Corporation Income Tax Return on Android devices

People also ask 1120s instructions 2018

-

What is form 1120 2013 and who needs it?

Form 1120 2013 is the U.S. Corporation Income Tax Return that C corporations must file to report their income. Businesses that are classified as corporations according to tax law need to fill out this form to comply with federal tax regulations.

-

How can airSlate SignNow help with form 1120 2013?

airSlate SignNow streamlines the process of signing and sending documents, including the form 1120 2013. With its easy-to-use interface, businesses can quickly upload, eSign, and store their forms securely, ensuring compliance and efficient filing.

-

Is there a cost associated with using airSlate SignNow for form 1120 2013?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that help manage and eSign documents like form 1120 2013 efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 1120 2013?

airSlate SignNow provides an array of features such as customizable templates, workflow automation, and secure cloud storage to manage form 1120 2013. These features enhance efficiency, allowing businesses to handle their tax documents seamlessly.

-

Can I integrate airSlate SignNow with other applications for form 1120 2013?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and others, which helps in managing form 1120 2013. This connectivity makes it easy to access your documents across platforms and streamline your workflow.

-

Is it safe to use airSlate SignNow for submitting form 1120 2013?

Yes, it is safe to use airSlate SignNow for submitting form 1120 2013. The platform employs advanced security measures, including encryption and secure storage, to protect your sensitive information during the eSigning process.

-

How can I track the status of my form 1120 2013 with airSlate SignNow?

AirSlate SignNow allows users to track the status of their documents, including form 1120 2013. You will receive notifications regarding when a document is viewed, signed, and completed, ensuring you stay informed throughout the process.

Get more for form 1120 2015 instructions

- Defining the organizational values of the howell area fire department r125 usfa fema form

- Meeting goals and expectations us fire administration form

- Establishing quantitative performance goals for the west hartford fire department company inspection program r123

- Developing an effective employee performance appraisal for part time personnel within the beach park fire department r123

- Providing survivor and member support for line of duty death guidelines r123 form

- Low income energy assistance lieap application form

- K 120 form

- 1st quarter form newark payroll tax statement

Find out other 2015 instructions for 1120

- Sign Alaska Car Dealer Rental Application Free

- Sign Alaska Car Dealer Rental Application Secure

- Sign Wyoming Business Operations Permission Slip Now

- Sign Alaska Car Dealer Rental Application Fast

- Sign Alaska Car Dealer Rental Application Simple

- Sign Alaska Car Dealer Rental Application Easy

- Sign Wyoming Business Operations Permission Slip Later

- Sign Alaska Car Dealer Rental Application Safe

- How To Sign Wyoming Business Operations Permission Slip

- Sign Wyoming Business Operations Permission Slip Myself

- Sign Wyoming Business Operations Permission Slip Free

- How To Sign Alaska Car Dealer Rental Application

- How Do I Sign Wyoming Business Operations Permission Slip

- Sign Wyoming Business Operations Permission Slip Secure

- How Do I Sign Alaska Car Dealer Rental Application

- Help Me With Sign Alaska Car Dealer Rental Application

- How Can I Sign Alaska Car Dealer Rental Application

- Help Me With Sign Wyoming Business Operations Permission Slip

- Sign Wyoming Business Operations Permission Slip Fast

- Can I Sign Alaska Car Dealer Rental Application