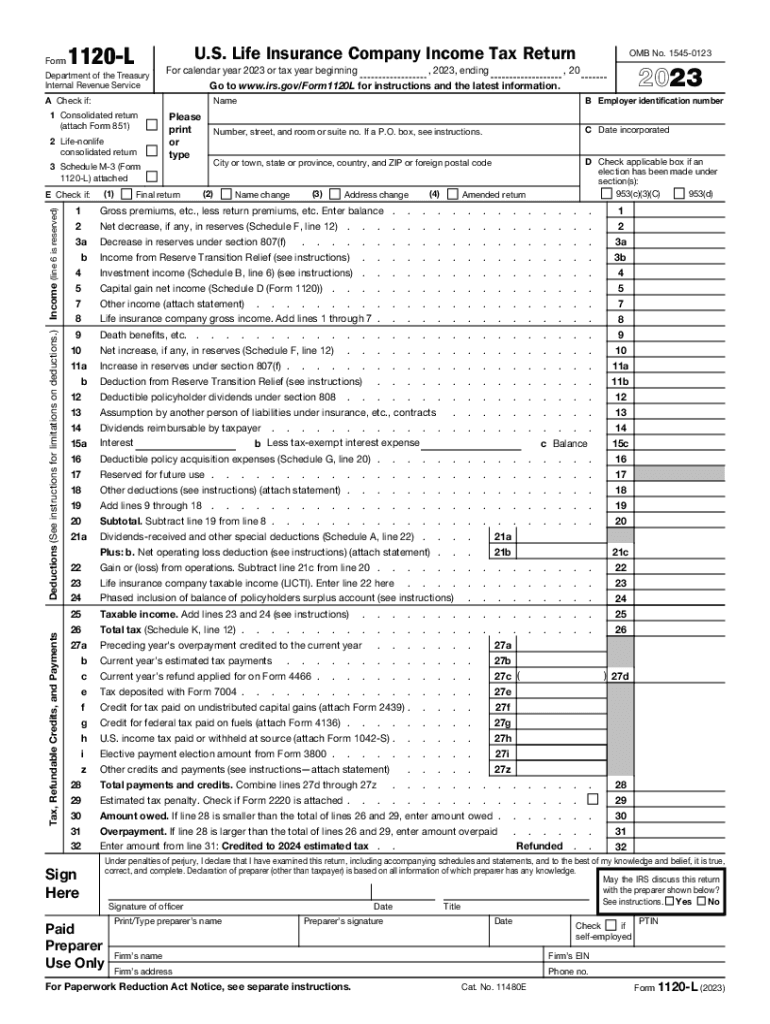

Treasury and IRS Propose New Tax Form for Corporate 2023

What is KY Form 725 for 2018?

KY Form 725 for 2018 is a tax form used by corporations in Kentucky to report their income, deductions, and tax liability. This form is essential for businesses operating within the state, as it helps ensure compliance with state tax laws. It provides a structured way to disclose financial information to the Kentucky Department of Revenue, including details about revenue, expenses, and applicable tax credits.

Steps to Complete KY Form 725 for 2018

Completing KY Form 725 for 2018 involves several key steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Fill out the form by entering your corporation’s total income, deductions, and credits.

- Calculate the total tax liability based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, ensuring that you keep a copy for your records.

Filing Deadlines for KY Form 725

The filing deadline for KY Form 725 typically aligns with the federal tax filing deadlines. For most corporations, this means the form is due on the fifteenth day of the fourth month following the end of the fiscal year. For corporations operating on a calendar year, this would be April 15. It is important to be aware of any extensions that may apply, as late submissions can incur penalties.

Required Documents for KY Form 725

To accurately complete KY Form 725, you will need the following documents:

- Income statements detailing all sources of revenue.

- Expense reports that outline all business-related costs.

- Balance sheets that reflect the corporation's assets and liabilities.

- Any relevant tax credit documentation that may apply to your corporation.

Who Issues KY Form 725?

KY Form 725 is issued by the Kentucky Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Kentucky. They provide resources and guidance to assist corporations in understanding their tax obligations and completing the required forms accurately.

Penalties for Non-Compliance with KY Form 725

Failure to file KY Form 725 by the deadline or inaccuracies in the form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is crucial for corporations to ensure timely and accurate submissions to avoid these penalties and maintain good standing with the Kentucky Department of Revenue.

Quick guide on how to complete treasury and irs propose new tax form for corporate

Complete Treasury And IRS Propose New Tax Form For Corporate effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Treasury And IRS Propose New Tax Form For Corporate on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Treasury And IRS Propose New Tax Form For Corporate with ease

- Obtain Treasury And IRS Propose New Tax Form For Corporate and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Treasury And IRS Propose New Tax Form For Corporate and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct treasury and irs propose new tax form for corporate

Create this form in 5 minutes!

How to create an eSignature for the treasury and irs propose new tax form for corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the KY Form 725 2018 and why is it important?

The KY Form 725 2018 is a crucial document for businesses operating in Kentucky, as it is used for tax reporting. Understanding how to properly fill out the KY Form 725 2018 can help avoid penalties and ensure compliance with state regulations.

-

How does airSlate SignNow simplify the signing process for KY Form 725 2018?

airSlate SignNow simplifies the signing process for KY Form 725 2018 by providing a user-friendly electronic signature platform. This enables businesses to collect signatures quickly and securely, eliminating the need for physical paperwork.

-

What are the pricing options for using airSlate SignNow for KY Form 725 2018?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Users can choose from monthly or annual subscriptions, with options that provide features specifically tailored for managing documents like the KY Form 725 2018 effectively.

-

Can I integrate airSlate SignNow with other software for handling KY Form 725 2018?

Yes, airSlate SignNow supports numerous integrations with popular business applications. This allows seamless workflows, enabling users to manage documents like the KY Form 725 2018 alongside their existing systems, enhancing overall efficiency.

-

What security features does airSlate SignNow provide for KY Form 725 2018?

airSlate SignNow prioritizes security with features such as encryption, secure cloud storage, and comprehensive access controls. These measures ensure that your KY Form 725 2018 and other sensitive documents are protected throughout the signing process.

-

Is it possible to track the status of my KY Form 725 2018 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your KY Form 725 2018 in real-time. You can see when the document has been viewed, signed, and completed, providing full visibility into the signing process.

-

What benefits can I expect from using airSlate SignNow for KY Form 725 2018?

Using airSlate SignNow for KY Form 725 2018 brings numerous benefits, including faster turnaround times, improved accuracy, and reduced paper usage. These advantages can signNowly streamline your workflow and enhance productivity.

Get more for Treasury And IRS Propose New Tax Form For Corporate

- Letter from tenant to landlord containing request for permission to sublease maine form

- Maine landlord tenant form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent maine form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable maine form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration maine form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497310820 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement maine form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase maine form

Find out other Treasury And IRS Propose New Tax Form For Corporate

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation