Payment Coupon 2019

What is the Payment Coupon

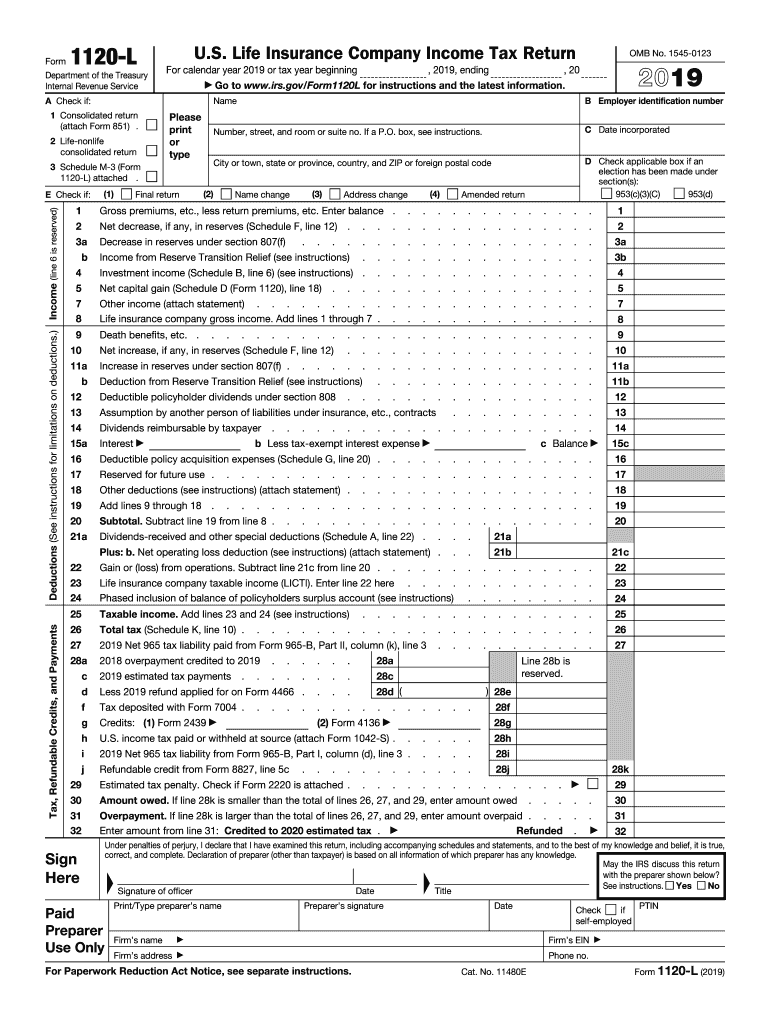

The Payment Coupon is a document used by businesses to facilitate the payment of taxes owed to the IRS. Specifically associated with the 1120L form, it allows corporations to submit their tax payments in a structured manner. This coupon serves as a record of payment and helps ensure that the funds are properly credited to the taxpayer's account.

How to use the Payment Coupon

To use the Payment Coupon effectively, a taxpayer must complete the coupon with accurate information including the business name, address, and tax identification number. It is essential to indicate the tax period for which the payment is being made. After filling out the coupon, it should be submitted along with the payment, either by mail or electronically, depending on the chosen submission method.

Steps to complete the Payment Coupon

Completing the Payment Coupon involves several straightforward steps:

- Obtain the Payment Coupon from the IRS or your tax software.

- Fill in your business name, address, and Employer Identification Number (EIN).

- Specify the tax period for which you are making the payment.

- Indicate the amount being paid.

- Review all information for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Payment Coupon. It is crucial to follow these guidelines to avoid delays or penalties. The coupon must be submitted with the appropriate payment method, and all required fields must be completed accurately. The IRS also recommends keeping a copy of the completed coupon for your records.

Filing Deadlines / Important Dates

Filing deadlines for the 1120L form and associated Payment Coupon are critical for compliance. Generally, the due date for filing the 1120L is the fifteenth day of the fourth month following the end of the corporation's tax year. Late submissions may incur penalties, so it is important to mark your calendar with these key dates to ensure timely filing.

Required Documents

When submitting the Payment Coupon, certain documents may be required to accompany the payment. Typically, these include:

- The completed Payment Coupon.

- The 1120L tax return form.

- Any additional schedules or forms relevant to your tax situation.

Penalties for Non-Compliance

Failure to submit the Payment Coupon on time or inaccuracies in the information provided can lead to penalties imposed by the IRS. These penalties may include fines and interest on unpaid taxes. It is essential to understand the implications of non-compliance and to take steps to ensure that all payments and forms are submitted accurately and on time.

Quick guide on how to complete us life insurance company income tax return internal

Complete Payment Coupon effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents rapidly without holdups. Manage Payment Coupon on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The most effective way to alter and eSign Payment Coupon without hassle

- Find Payment Coupon and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only a few seconds and holds the same legal validity as a customary wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Payment Coupon and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us life insurance company income tax return internal

Create this form in 5 minutes!

How to create an eSignature for the us life insurance company income tax return internal

How to generate an electronic signature for your Us Life Insurance Company Income Tax Return Internal in the online mode

How to make an electronic signature for your Us Life Insurance Company Income Tax Return Internal in Google Chrome

How to generate an eSignature for signing the Us Life Insurance Company Income Tax Return Internal in Gmail

How to create an electronic signature for the Us Life Insurance Company Income Tax Return Internal straight from your smart phone

How to make an eSignature for the Us Life Insurance Company Income Tax Return Internal on iOS devices

How to generate an electronic signature for the Us Life Insurance Company Income Tax Return Internal on Android OS

People also ask

-

What is the 1120l form and how can airSlate SignNow help with it?

The 1120l form is designed for life insurance companies to report their income, deductions, and taxes. airSlate SignNow simplifies the process of completing and submitting the 1120l form by allowing users to eSign and send documents securely and efficiently.

-

How does airSlate SignNow pricing work for businesses needing to file the 1120l?

airSlate SignNow offers various pricing plans that can fit any budget, making it cost-effective for businesses that need to handle the 1120l form. Each plan includes features like unlimited eSigning, document templates, and other tools that streamline the filing process.

-

What features does airSlate SignNow offer for managing the 1120l form?

With airSlate SignNow, you can utilize features such as customizable templates, bulk sending, and real-time tracking that specifically streamline the management of the 1120l form. This ensures a more organized approach to handling your tax filings, enhancing efficiency.

-

Can airSlate SignNow assist with reminders related to the 1120l filing deadlines?

Yes, airSlate SignNow offers automated reminders for important tax deadlines, including those for the 1120l form. This feature helps businesses stay on track and ensures timely submissions, reducing the risk of penalties associated with late filings.

-

Is airSlate SignNow secure for signing and sending my 1120l documents?

Absolutely, airSlate SignNow employs advanced encryption and security protocols to safeguard your documents during the eSigning process. You can confidently send and store your 1120l documents knowing that they are protected against unauthorized access.

-

Does airSlate SignNow integrate with other tools for managing the 1120l process?

Yes, airSlate SignNow integrates seamlessly with various accounting and productivity tools, which aids in the efficient handling of the 1120l process. This allows you to manage your documents and workflows more effectively by connecting with platforms you already use.

-

What benefits do businesses experience when using airSlate SignNow for the 1120l?

Businesses using airSlate SignNow for the 1120l experience faster turnaround times, increased accuracy, and reduced paperwork. By simplifying the eSigning process, companies can focus more on their core operations and less on administrative tasks.

Get more for Payment Coupon

- Where to send sc isp 1200 form

- Penndot form p 329

- Medication consent form 606 cmr 7112b

- Surelc setup packet download jurs montgomery form

- Sgi code of conduct form

- Reward redemption form bank alfalah credit cards

- Grass roots grant application waha hockey interactive form

- Ospi intends that this document will serve as guidance to schools for compliance with fire code changes and ssb 5097 form

Find out other Payment Coupon

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy