Www Irs Govpubirs Pdf2021 Form 1120 L IRS Tax Forms 2021

Understanding Form 1120 L

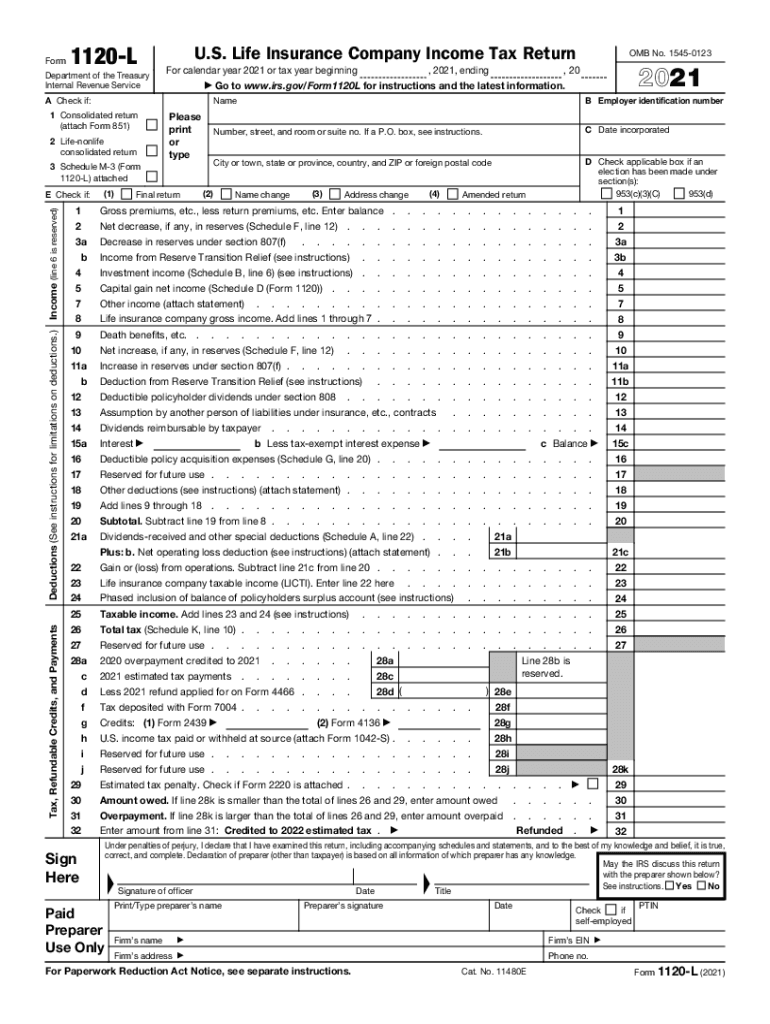

Form 1120 L is a tax form used by insurance companies to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). This form is specifically designed for life insurance companies and is part of the U.S. corporate tax system. The form requires detailed financial information, including premiums collected, losses incurred, and expenses related to the insurance business. Understanding this form is crucial for compliance and accurate reporting.

Steps to Complete Form 1120 L

Completing Form 1120 L involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the basic information section, including the company name, address, and Employer Identification Number (EIN).

- Report income from premiums, investment income, and other sources in the appropriate sections.

- Detail deductions for claims paid, operating expenses, and taxes.

- Calculate the taxable income and the tax due based on the applicable corporate tax rate.

- Sign and date the form before submission.

Legal Use of Form 1120 L

Form 1120 L is legally binding when completed accurately and submitted to the IRS. It must be filed by the due date to avoid penalties. The form serves as an official document that reflects the financial health of the insurance company and its compliance with federal tax laws. Accurate reporting is essential to maintain good standing with the IRS and to avoid legal issues.

Filing Deadlines for Form 1120 L

The filing deadline for Form 1120 L is typically the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is important to file on time to avoid penalties and interest on any unpaid tax liability.

Required Documents for Form 1120 L

To complete Form 1120 L, the following documents are generally required:

- Financial statements, including income statements and balance sheets.

- Records of premiums collected and claims paid.

- Documentation of deductions, such as operating expenses and taxes.

- Previous tax returns for reference.

Form Submission Methods

Form 1120 L can be submitted to the IRS through various methods:

- Online: Many companies choose to e-file their tax returns using approved software.

- Mail: The form can be printed and mailed to the appropriate IRS address.

- In-Person: Some businesses may opt to deliver their forms directly to an IRS office.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 1120 l irs tax forms

Effortlessly Prepare Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms on Any Device

The management of online documents has become increasingly popular among organizations and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the tools you need to quickly create, edit, and eSign your documents without delays. Manage Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms with Ease

- Find Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms and click Get Form to begin the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 1120 l irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 1120 l irs tax forms

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is a schedule L 1120S?

A schedule L 1120S is a part of the IRS Form 1120S, which is used by S corporations to report their financial information. Specifically, schedule L provides a balance sheet that reflects the company’s assets, liabilities, and equity at the beginning and end of the tax year.

-

How can airSlate SignNow assist with creating schedule L 1120S?

AirSlate SignNow streamlines the document signing process, making it easy to eSign important forms like schedule L 1120S. Our platform allows you to securely collect signatures and keep everything organized, ensuring your tax documents are filed accurately and on time.

-

What features does airSlate SignNow offer for tax-related documents?

AirSlate SignNow provides several features tailored for tax-related documents, including customizable templates, document tracking, and secure storage. These features make it simpler to manage all necessary documents, including schedule L 1120S, ensuring efficiency and compliance.

-

Is airSlate SignNow cost-effective for small businesses needing to file schedule L 1120S?

Yes, airSlate SignNow is a cost-effective solution for small businesses. Our pricing plans are designed to accommodate various budgets, allowing you to easily manage eSigning needs for your schedule L 1120S without overspending.

-

Can airSlate SignNow integrate with accounting software for filing schedule L 1120S?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software solutions, allowing for a smooth workflow when preparing documents like schedule L 1120S. This integration helps gather necessary financial data directly from your accounting platform, simplifying the filing process.

-

How secure is airSlate SignNow when handling sensitive documents like schedule L 1120S?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security measures to protect sensitive documents, including schedule L 1120S. This ensures that your information remains confidential and secure during the eSigning process.

-

What are the benefits of using airSlate SignNow for schedule L 1120S?

Using airSlate SignNow for your schedule L 1120S can enhance efficiency and reduce the time spent on paperwork. Our user-friendly interface allows for quick uploads and eSigning, ensuring that you can meet tax deadlines while keeping your business operations streamlined.

Get more for Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms

Find out other Www irs govpubirs pdf2021 Form 1120 L IRS Tax Forms

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation