Form 1120 L U S Life Insurance Company Income Tax Return 2010

What is the Form 1120 L U S Life Insurance Company Income Tax Return

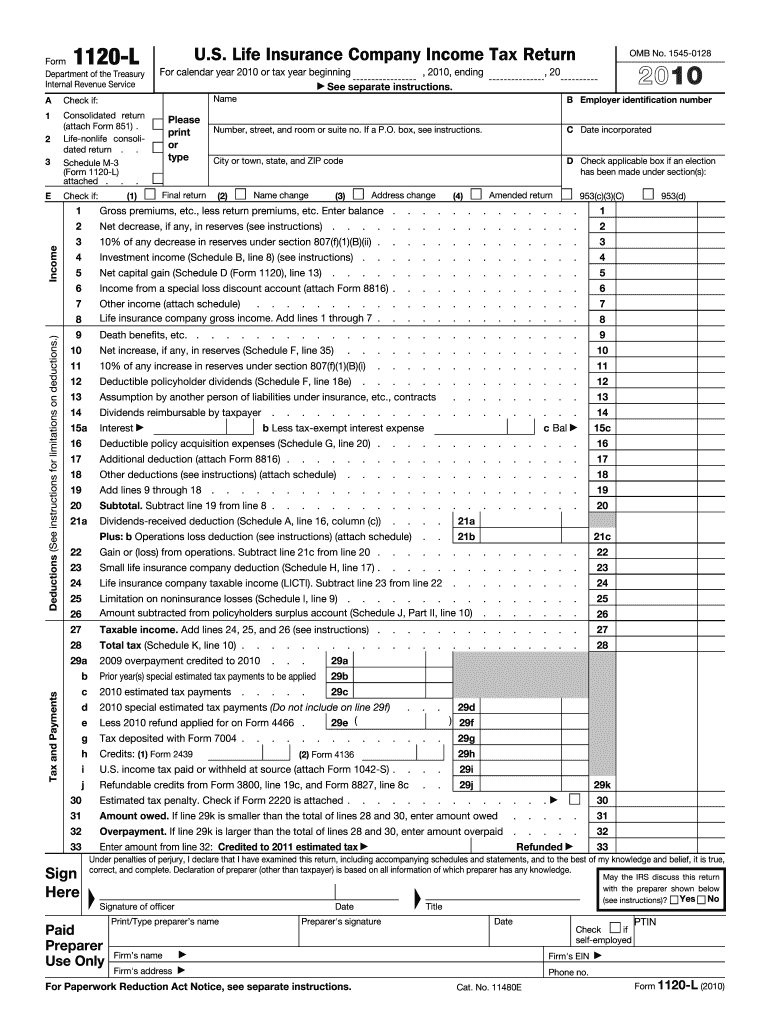

The Form 1120 L U S Life Insurance Company Income Tax Return is a specialized tax form used by life insurance companies operating in the United States. This form is essential for reporting income, deductions, and tax liabilities specific to life insurance operations. It is designed to meet the unique regulatory requirements that govern life insurance companies, ensuring compliance with federal tax laws. By accurately completing this form, companies can determine their tax obligations and maintain good standing with the Internal Revenue Service (IRS).

Steps to complete the Form 1120 L U S Life Insurance Company Income Tax Return

Completing the Form 1120 L involves several critical steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, follow these steps:

- Begin by entering the company’s identifying information, including name, address, and Employer Identification Number (EIN).

- Report total income, including premiums collected and investment income.

- Detail deductible expenses, such as claims paid, commissions, and administrative costs.

- Calculate taxable income by subtracting total deductions from total income.

- Complete the tax computation section to determine the tax owed.

- Review all entries for accuracy before signing and dating the form.

How to obtain the Form 1120 L U S Life Insurance Company Income Tax Return

The Form 1120 L can be obtained directly from the IRS website or through authorized tax preparation software. It is also available at various tax offices and libraries across the United States. Ensure that you are using the most current version of the form to comply with the latest tax regulations. If you prefer a digital format, many tax software solutions provide easy access to this form for electronic filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 L are crucial for compliance. Typically, the form is due on the fifteenth day of the third month following the end of the tax year. For calendar year taxpayers, this means the due date is March 15. If additional time is needed, companies can file for an extension, which allows for an additional six months to submit the return. It is important to keep track of these dates to avoid penalties for late filing.

Legal use of the Form 1120 L U S Life Insurance Company Income Tax Return

The legal use of the Form 1120 L is governed by IRS regulations. This form must be completed accurately and submitted on time to ensure compliance with federal tax laws. Failure to file or inaccuracies in the form can result in penalties, including fines and interest on unpaid taxes. The form serves as a legal document that reflects the financial status of the life insurance company and its adherence to tax obligations.

Key elements of the Form 1120 L U S Life Insurance Company Income Tax Return

Key elements of the Form 1120 L include sections for reporting income, deductions, and tax computations. Essential components are:

- Company identification details, including name and EIN.

- Income reporting, including premiums and investment income.

- Deductions for claims, administrative expenses, and other allowable costs.

- Tax calculation based on taxable income.

- Signature and date to validate the submission.

Quick guide on how to complete 2010 form 1120 l us life insurance company income tax return

Effortlessly complete Form 1120 L U S Life Insurance Company Income Tax Return on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the needed form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without interruptions. Manage Form 1120 L U S Life Insurance Company Income Tax Return on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and electronically sign Form 1120 L U S Life Insurance Company Income Tax Return effortlessly

- Locate Form 1120 L U S Life Insurance Company Income Tax Return and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Draft your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management demands in just a few clicks from any device you prefer. Modify and electronically sign Form 1120 L U S Life Insurance Company Income Tax Return to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1120 l us life insurance company income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1120 l us life insurance company income tax return

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Form 1120 L U S Life Insurance Company Income Tax Return?

The Form 1120 L U S Life Insurance Company Income Tax Return is a specialized tax return designed for domestic life insurance companies operating in the United States. It helps these companies report their income, expenses, and tax liability to the IRS efficiently. Understanding this form is crucial for compliance and accurate financial reporting.

-

How does airSlate SignNow assist with the Form 1120 L U S Life Insurance Company Income Tax Return?

AirSlate SignNow offers a streamlined platform for preparing, signing, and sending the Form 1120 L U S Life Insurance Company Income Tax Return. Our solution simplifies document management, allowing users to eSign and send their tax returns quickly and securely. This ensures that your filing process is both convenient and compliant with IRS regulations.

-

Is airSlate SignNow a cost-effective solution for businesses filing the Form 1120 L U S Life Insurance Company Income Tax Return?

Yes, airSlate SignNow is designed to be a budget-friendly option for businesses needing to file the Form 1120 L U S Life Insurance Company Income Tax Return. With flexible pricing plans, companies can select the option that best fits their needs, ensuring affordability without sacrificing quality or functionality in document management.

-

What features does airSlate SignNow offer for managing Form 1120 L U S Life Insurance Company Income Tax Returns?

AirSlate SignNow provides essential features for managing the Form 1120 L U S Life Insurance Company Income Tax Return, including easy document creation, secure eSigning, and automated workflows. These features enhance user efficiency and ensure that all documents are properly filled out and ready for submission, reducing the risk of errors.

-

Can airSlate SignNow integrate with other accounting software for Form 1120 L U S Life Insurance Company Income Tax Return preparation?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to prepare the Form 1120 L U S Life Insurance Company Income Tax Return. This integration allows users to transfer financial data smoothly, ensuring that all necessary information is accurately reflected in their tax returns.

-

What benefits does airSlate SignNow offer for filing tax forms like the Form 1120 L U S Life Insurance Company Income Tax Return?

One of the key benefits of using airSlate SignNow for filing the Form 1120 L U S Life Insurance Company Income Tax Return is increased efficiency. Our platform reduces processing time and minimizes paperwork through digital solutions, enabling businesses to focus on their core activities while ensuring timely compliance with tax regulations.

-

Is it secure to use airSlate SignNow for sensitive documents like the Form 1120 L U S Life Insurance Company Income Tax Return?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to ensure that all sensitive documents, including the Form 1120 L U S Life Insurance Company Income Tax Return, are kept safe from unauthorized access or data bsignNowes, providing peace of mind for users.

Get more for Form 1120 L U S Life Insurance Company Income Tax Return

- Letter from landlord to tenant returning security deposit less deductions idaho form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return idaho form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return idaho form

- Letter from tenant to landlord containing request for permission to sublease idaho form

- Idaho landlord form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent idaho form

- Idaho letter landlord form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration idaho form

Find out other Form 1120 L U S Life Insurance Company Income Tax Return

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free