Form 1120 L Taxable Income for Life Insurers 2024

Understanding Form 1120 L for Life Insurers

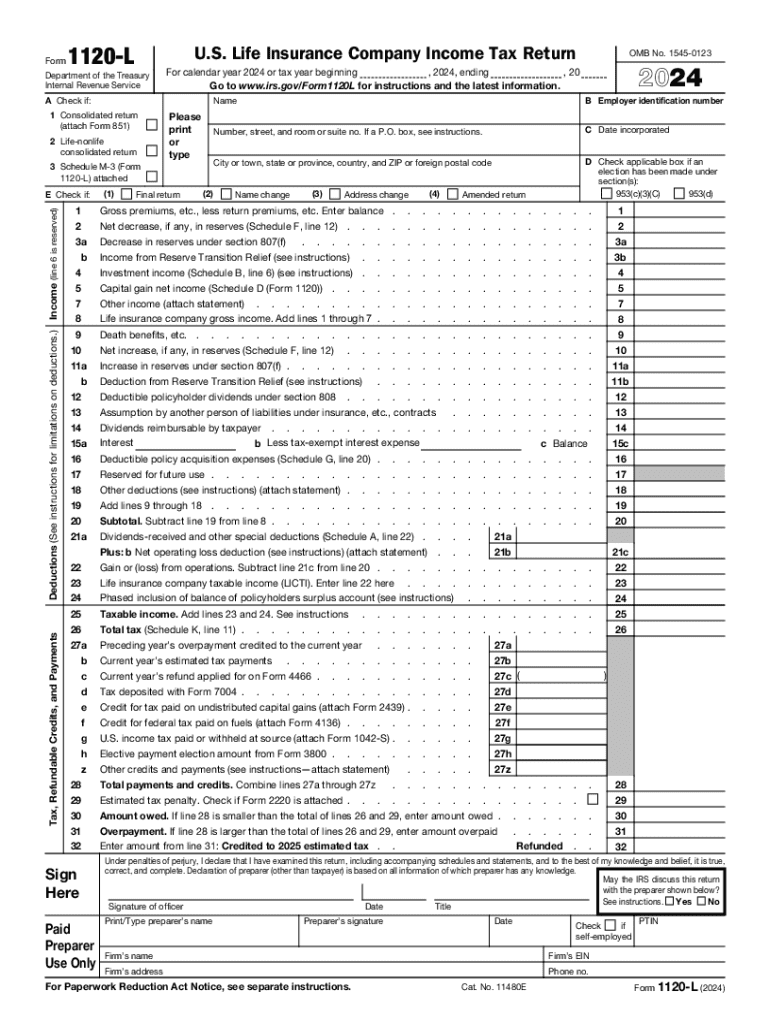

The Form 1120 L is specifically designed for life insurance companies to report their taxable income. This form is essential for life insurers as it accommodates the unique aspects of their business operations and taxation requirements. The taxable income reported on this form is calculated based on premiums received, investment income, and other relevant financial activities. Understanding the nuances of this form is crucial for compliance with IRS regulations.

Steps to Complete Form 1120 L

Completing Form 1120 L involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and records of premiums collected. Next, enter the total premiums received and investment income on the appropriate lines of the form. Deduct allowable expenses, such as claims paid and administrative costs, to arrive at the taxable income. Review all entries for accuracy before submission. It is advisable to consult IRS instructions for specific line-item guidance.

Obtaining Form 1120 L

Form 1120 L can be obtained directly from the IRS website or through tax preparation software that supports this form. It is important to ensure that you are using the correct version for the tax year, as forms can change annually. Additionally, tax professionals may provide access to the form as part of their services. Make sure to have the latest version to avoid any compliance issues.

Key Elements of Form 1120 L

Form 1120 L includes several key elements that are critical for accurate reporting. These elements comprise sections for reporting premiums received, investment income, and various deductions. The form also requires detailed information about the life insurance company's financial status, including assets and liabilities. Understanding these components is vital for life insurers to ensure they report their financials correctly and comply with tax regulations.

Legal Use of Form 1120 L

The legal use of Form 1120 L is mandated by the IRS for life insurance companies operating in the United States. This form must be filed annually to report taxable income and ensure compliance with federal tax laws. Failure to file or inaccuracies in the form can result in penalties and interest on unpaid taxes. It is essential for life insurers to understand their legal obligations regarding this form to avoid potential legal issues.

Filing Deadlines for Form 1120 L

Filing deadlines for Form 1120 L are crucial for life insurance companies to adhere to in order to avoid penalties. Generally, the form is due on the fifteenth day of the third month following the end of the tax year. For most life insurers operating on a calendar year basis, this means the form is typically due by March 15. If additional time is needed, an extension can be requested, but it is important to understand the implications of late filing.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 l taxable income for life insurers

Create this form in 5 minutes!

How to create an eSignature for the form 1120 l taxable income for life insurers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are fillable l 2021 forms?

Fillable l 2021 forms are digital documents that allow users to input information directly into designated fields. These forms streamline the process of collecting data, making it easier for businesses to manage and process information efficiently. With airSlate SignNow, you can create and customize fillable l 2021 forms to suit your specific needs.

-

How can I create fillable l 2021 forms using airSlate SignNow?

Creating fillable l 2021 forms with airSlate SignNow is simple and user-friendly. You can start by uploading your document and then use our intuitive editor to add fillable fields. This allows you to tailor the form to your requirements, ensuring that all necessary information is captured accurately.

-

What are the pricing options for airSlate SignNow's fillable l 2021 features?

airSlate SignNow offers competitive pricing plans that include access to fillable l 2021 features. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality and support. This ensures that you can find a plan that fits your budget while still benefiting from our powerful tools.

-

What benefits do fillable l 2021 forms provide for businesses?

Fillable l 2021 forms enhance efficiency by reducing the time spent on manual data entry and paperwork. They also improve accuracy, as users can only input information in designated fields, minimizing errors. Additionally, these forms can be easily shared and signed electronically, streamlining the entire document workflow.

-

Can I integrate fillable l 2021 forms with other software?

Yes, airSlate SignNow allows for seamless integration of fillable l 2021 forms with various third-party applications. This means you can connect your forms with CRM systems, cloud storage solutions, and other tools to enhance your workflow. Our integration capabilities ensure that you can work efficiently across different platforms.

-

Are fillable l 2021 forms secure?

Absolutely! airSlate SignNow prioritizes the security of your fillable l 2021 forms. We implement advanced encryption and security protocols to protect your data during transmission and storage. This ensures that your sensitive information remains confidential and secure at all times.

-

How can fillable l 2021 forms improve customer experience?

Fillable l 2021 forms simplify the process for customers by allowing them to complete documents quickly and easily online. This convenience leads to faster turnaround times and enhances overall satisfaction. By using airSlate SignNow, businesses can provide a more efficient and user-friendly experience for their clients.

Get more for Form 1120 L Taxable Income For Life Insurers

- Abet registration forms 389585949

- Preference questionnaire for housing choice voucher section 8 form

- Bible fill in the blanks worksheets pdf form

- Dr36072007 texas department of public safety txdps state tx form

- Renewal application for license for assisted care living facility health state tn form

- Standard security deposit agreement california form

- Nscad transcript request form

- Navres officer incentive agreement form

Find out other Form 1120 L Taxable Income For Life Insurers

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF