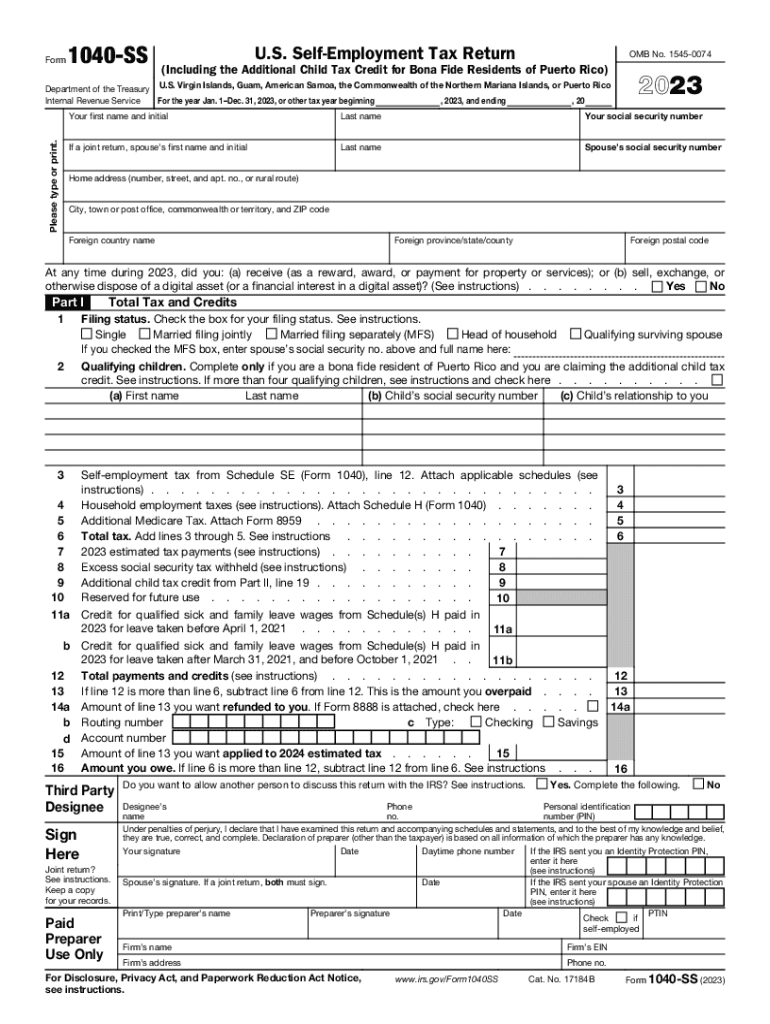

IRS Addresses Tax Questions Related to U S Possessions 2023

IRS Guidelines

The IRS provides comprehensive guidelines for completing the form. These guidelines include detailed instructions on how to report income, claim deductions, and calculate tax liabilities. Taxpayers should carefully review the instructions to ensure compliance with federal tax laws. It is essential to understand the specific requirements for various income sources, such as wages, dividends, and self-employment earnings.

Additionally, the IRS outlines the necessary documentation needed to support claims and deductions. This includes W-2 forms, 1099 forms, and receipts for deductible expenses. Familiarity with these guidelines helps taxpayers avoid errors that could lead to penalties or delays in processing their returns.

Filing Deadlines / Important Dates

For the form, the primary filing deadline is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of the deadlines for estimated tax payments, which are usually due quarterly. Missing these deadlines can result in penalties and interest on unpaid taxes.

It is advisable to mark important dates on a calendar and set reminders to ensure timely filing and payment. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To accurately complete the form, taxpayers need to gather several key documents. These include:

- W-2 forms from employers

- 1099 forms for freelance work or other income

- Records of deductible expenses, such as medical bills and charitable contributions

- Statements for interest and dividends

- Any other relevant financial documents, such as investment statements

Having these documents organized and readily available simplifies the filing process and helps ensure accuracy in reporting income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The form can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online filing through IRS-approved software

- Mailing a paper form to the appropriate IRS address

- In-person submission at designated IRS offices

Online filing is often the quickest and most efficient method, allowing for immediate confirmation of receipt. However, some taxpayers may prefer to mail their forms or submit them in person for added peace of mind. It is important to choose the method that best suits individual preferences and circumstances.

Penalties for Non-Compliance

Failure to comply with the IRS regulations regarding the form can result in significant penalties. Common penalties include:

- Failure-to-file penalty, which can be a percentage of the unpaid tax amount

- Failure-to-pay penalty for not paying taxes owed by the deadline

- Interest on unpaid taxes, which accrues daily until the balance is paid

Taxpayers are encouraged to file even if they cannot pay the full amount owed, as this can help reduce penalties. Understanding these potential penalties underscores the importance of timely and accurate tax filing.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can affect how the form is completed. For example:

- Self-employed individuals may need to report additional income and expenses, and they should be aware of self-employment taxes.

- Retired individuals may have different income sources, such as pensions or Social Security, which require specific reporting.

- Students may qualify for education-related tax credits or deductions that can reduce their tax liability.

Each scenario presents unique considerations that taxpayers should understand to ensure compliance and optimize their tax situation.

Quick guide on how to complete irs addresses tax questions related to u s possessions

Complete IRS Addresses Tax Questions Related To U S Possessions effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage IRS Addresses Tax Questions Related To U S Possessions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign IRS Addresses Tax Questions Related To U S Possessions with ease

- Find IRS Addresses Tax Questions Related To U S Possessions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages your document administration needs in just a few clicks from any device of your selection. Modify and eSign IRS Addresses Tax Questions Related To U S Possessions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs addresses tax questions related to u s possessions

Create this form in 5 minutes!

How to create an eSignature for the irs addresses tax questions related to u s possessions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 2023 form and why is it important?

The 1040 2023 form is the standard document used by U.S. taxpayers to file their annual income tax returns. It is crucial because it helps the IRS assess your tax obligations and ensures compliance with tax laws, possibly impacting your refunds or payments. Understanding the 1040 2023 form can simplify the filing process and help you avoid costly mistakes.

-

How can airSlate SignNow help with the 1040 2023 form?

airSlate SignNow enables you to easily send and eSign the 1040 2023 form, eliminating the need for physical paperwork. Our platform allows you to securely collect signatures, ensuring your tax documents are signed in a timely manner. This streamlines the filing process, so you can focus more on your finances and less on the paperwork.

-

What features should I look for in a platform that handles the 1040 2023 form?

When looking for a platform to manage the 1040 2023 form, consider features like eSignature capabilities, document tracking, and security measures. Additionally, user-friendliness and integration with accounting software can greatly enhance your experience. airSlate SignNow offers all these features, making it a top choice for managing your tax documents.

-

Is airSlate SignNow cost-effective for managing the 1040 2023 form?

Yes, airSlate SignNow provides a cost-effective solution for eSigning and managing the 1040 2023 form. With flexible pricing plans tailored to various business sizes and needs, you can choose a package that fits your budget. This way, you can save on printing, shipping, and other traditional costs associated with document handling.

-

What integrations does airSlate SignNow offer for the 1040 2023 form?

airSlate SignNow seamlessly integrates with popular applications such as Google Workspace, Salesforce, and Dropbox, enhancing your workflow for managing the 1040 2023 form. These integrations allow you to import and export documents easily, ensuring that your tax documents are always accessible. This connectivity helps you stay organized and efficient.

-

Can I store my completed 1040 2023 form securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the completed 1040 2023 form. Our platform uses industry-leading encryption and compliance measures to ensure your sensitive tax information is protected, giving you peace of mind when storing and accessing your forms.

-

Is there customer support available for questions about the 1040 2023 form?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any queries regarding the 1040 2023 form. Whether you need help with the eSigning process or have questions about document management, our support team is available to guide you. You can signNow out via chat, email, or phone for timely assistance.

Get more for IRS Addresses Tax Questions Related To U S Possessions

- Fillable online tdi texas what is addendum form fax email

- Rates rules and forms manual south carolina wind and hail

- Form dwc 22 required medical examination notice or request for order formulario dwc 22 aviso de examen mdico requerido o

- Benefit dispute settlement benefit dispute settlement form

- Twcc no form

- Dwc form 032 texas department of insurance texasgov

- Federal register vol 81 no137 form

- Thorogood steel toe work boots8ampquot moc safety toe usa form

Find out other IRS Addresses Tax Questions Related To U S Possessions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors