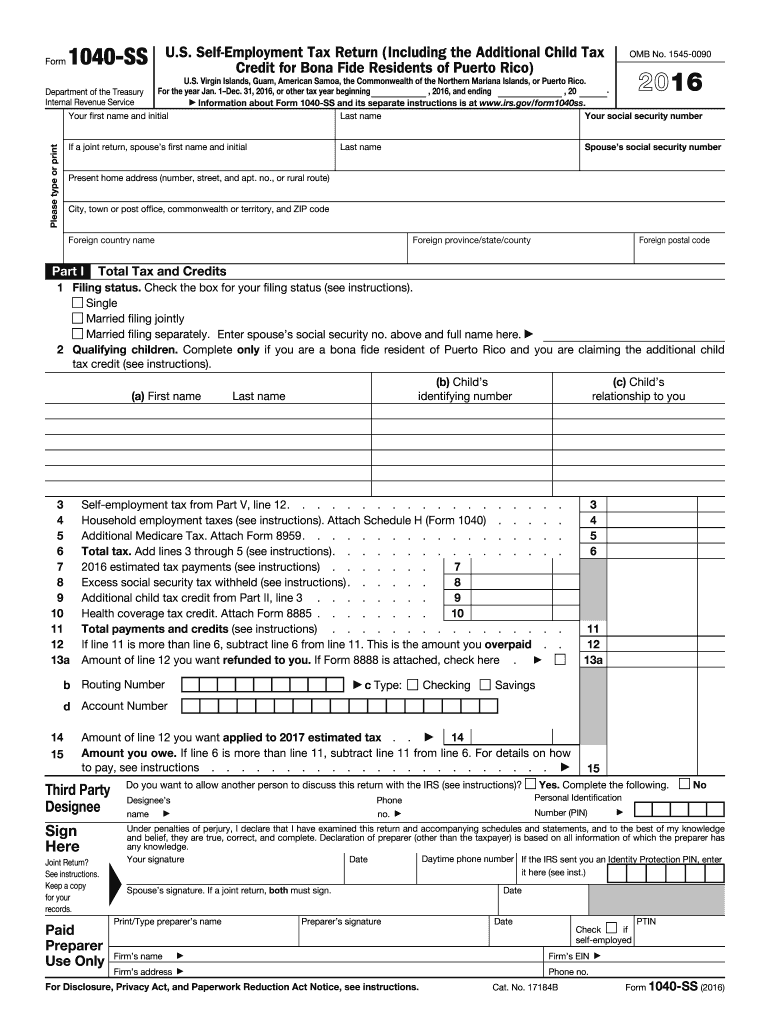

Form 1040 2016

What is the Form 1040

The Form 1040 is the standard individual income tax return form used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to calculate their taxable income, determine their tax liability, and claim any applicable deductions and credits. It is essential for filing federal taxes and is used by a wide range of taxpayers, including those who are self-employed, retired, or have multiple income sources.

How to use the Form 1040

Using the Form 1040 involves several steps to ensure accurate reporting of income and deductions. Taxpayers should begin by gathering necessary financial documents, such as W-2s, 1099s, and any records of other income. Next, complete the form by entering personal information, income details, and applicable deductions. Taxpayers can choose to file electronically or submit a paper version of the form. It is crucial to double-check all entries for accuracy before submission to avoid potential issues with the IRS.

Steps to complete the Form 1040

Completing the Form 1040 can be broken down into a series of straightforward steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest.

- Claim deductions and credits that apply to your situation, such as the standard deduction or itemized deductions.

- Calculate your total tax liability based on the information provided.

- Sign and date the form, and ensure all required attachments are included.

- Submit the completed form either electronically or by mailing it to the appropriate IRS address.

Legal use of the Form 1040

The Form 1040 is legally binding when completed and submitted according to IRS regulations. To ensure its validity, taxpayers must provide accurate information and sign the form. Electronic submissions are also legally recognized, provided that they comply with eSignature laws, such as the ESIGN Act and UETA. Using a reliable eSignature solution can help maintain the integrity of the submission process and ensure compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 are critical to avoid penalties. Typically, individual tax returns must be filed by April 15 each year. If that date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension, which allows additional time to file but does not extend the deadline for payment of any taxes owed. It is essential to stay informed about these dates to ensure timely compliance.

Required Documents

To accurately complete the Form 1040, taxpayers need to gather several key documents:

- W-2 forms from employers detailing annual wages.

- 1099 forms for other income sources, such as freelance work or interest payments.

- Records of deductible expenses, including medical expenses, mortgage interest, and charitable contributions.

- Any relevant tax credits documentation, such as education credits or child tax credits.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 can be submitted through various methods to accommodate different preferences:

- Online filing through the IRS e-file system or authorized e-file providers is a popular choice for its convenience and speed.

- Mailing a paper version of the form to the appropriate IRS address is another option, but it may take longer for processing.

- In-person submissions are generally not available, as the IRS does not accept walk-in filings at its offices.

Quick guide on how to complete 2016 form 1040

Prepare Form 1040 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1040 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form 1040 seamlessly

- Find Form 1040 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of submitting the form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1040 and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1040

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1040

How to generate an electronic signature for your 2016 Form 1040 in the online mode

How to generate an eSignature for the 2016 Form 1040 in Google Chrome

How to make an eSignature for signing the 2016 Form 1040 in Gmail

How to create an eSignature for the 2016 Form 1040 from your mobile device

How to create an eSignature for the 2016 Form 1040 on iOS devices

How to make an electronic signature for the 2016 Form 1040 on Android devices

People also ask

-

What is Form 1040 and how can airSlate SignNow help with it?

Form 1040 is the standard IRS form used by individuals to file their annual income tax returns. airSlate SignNow offers an easy-to-use platform for electronically signing and sending Form 1040 documents securely. With airSlate SignNow, you can streamline the filing process, making it faster and more efficient.

-

Is airSlate SignNow suitable for preparing and filing Form 1040?

While airSlate SignNow doesn't prepare tax returns, it is an excellent tool for managing and signing your completed Form 1040. You can easily collect signatures from multiple parties, ensuring your tax documents are signed quickly and securely.

-

What are the pricing options for using airSlate SignNow with Form 1040?

airSlate SignNow offers several pricing plans to suit different business needs, including a free trial for new users. Depending on your usage, you can choose from monthly or annual subscriptions, making it an affordable option for managing Form 1040 and other documents.

-

Can I integrate airSlate SignNow with other tax software for Form 1040?

Yes, airSlate SignNow integrates seamlessly with various tax software platforms, which can enhance your experience when managing Form 1040. This integration allows you to import documents, send them for eSignature, and keep everything organized in one place.

-

What security measures does airSlate SignNow provide for Form 1040 documents?

airSlate SignNow prioritizes the security of your documents, including Form 1040, with advanced encryption protocols and secure cloud storage. This ensures that your sensitive tax information remains protected throughout the signing process.

-

How does airSlate SignNow improve the efficiency of handling Form 1040?

By using airSlate SignNow, you can signNowly reduce the time it takes to handle Form 1040. The platform enables you to send documents for signature in minutes, track their status, and ensure compliance, which streamlines your tax filing process.

-

Can I access my signed Form 1040 documents from any device with airSlate SignNow?

Absolutely! airSlate SignNow is cloud-based, allowing you to access your signed Form 1040 documents from any device with internet access. This flexibility ensures that you can manage your tax documents on the go.

Get more for Form 1040

- Fill in pdf single member llc in state of nj form

- Florida will form

- Texas limited power of attorney for sale of real estate form

- Washington statutory equivalent of living will health care directive form

- Oregon notice of right to lien sect 87023 individual form

- Virginia warranty deed from individual to corporation form

- Mississippi quit claim deed form

- Real estate contract form

Find out other Form 1040

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template