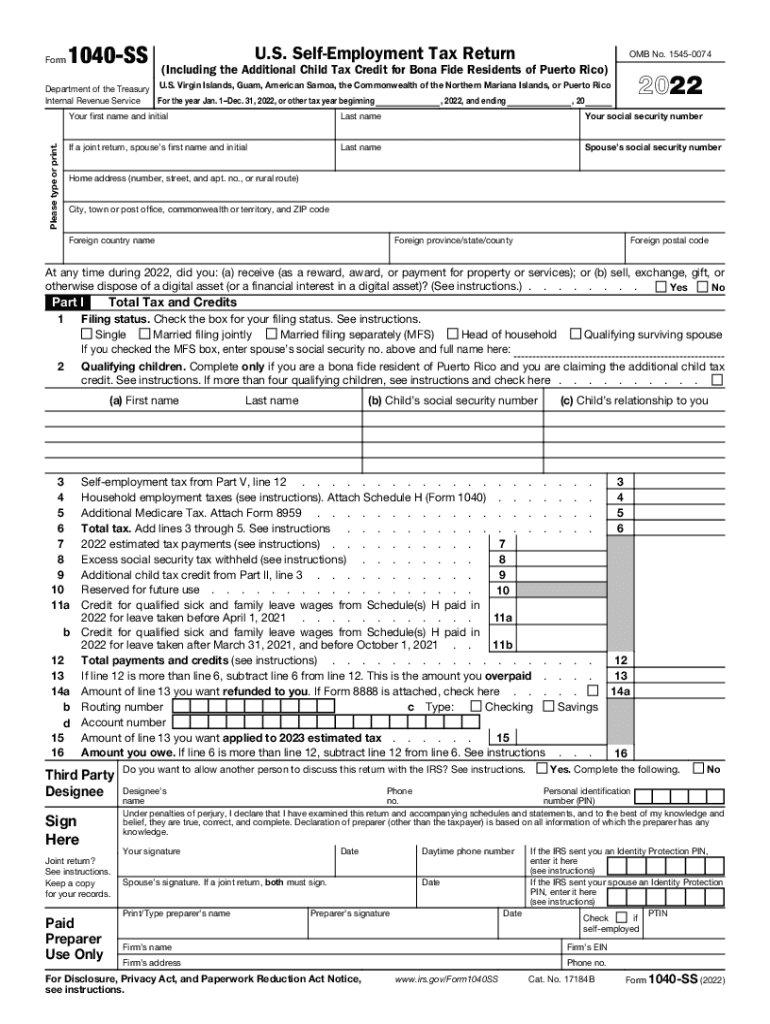

U S Territories Self Employment Tax IRS Video Portal 2022

IRS Guidelines

The IRS guidelines for the 2021 form 1040 provide essential information for taxpayers to accurately report their income and calculate their tax obligations. It is crucial to understand the specific requirements outlined by the IRS to ensure compliance and avoid potential penalties. Taxpayers should familiarize themselves with the latest updates and changes to tax laws that may affect their filing. The guidelines detail the necessary forms, schedules, and documentation required for various income types, deductions, and credits.

Filing Deadlines / Important Dates

For the 2021 form 1040, the primary filing deadline was April 15, 2022. However, taxpayers could request an extension, allowing them to file by October 15, 2022. It is important to keep track of these dates to avoid late filing penalties. Additionally, certain taxpayers may have different deadlines based on specific circumstances, such as those residing in disaster areas or serving in combat zones.

Required Documents

When completing the 2021 form 1040, taxpayers must gather several key documents to ensure accurate reporting. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of deductible expenses, such as receipts for medical expenses and charitable contributions

- Documentation for any tax credits claimed, such as education credits or child tax credits

Having these documents ready will streamline the filing process and help ensure that all income and deductions are accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The 2021 form 1040 can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online: Taxpayers can file electronically using IRS-approved tax software, which often simplifies the process and reduces errors.

- Mail: For those who prefer paper filing, the completed form can be mailed to the appropriate IRS address, depending on the taxpayer's location and whether a payment is included.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices or through authorized tax professionals.

Each method has its advantages, and taxpayers should choose the one that best suits their needs and preferences.

Penalties for Non-Compliance

Failure to comply with the requirements for the 2021 form 1040 can result in various penalties. Common penalties include:

- Late Filing Penalty: Taxpayers who do not file their return by the deadline may incur a penalty based on the amount of tax owed.

- Late Payment Penalty: If taxes are not paid by the due date, additional penalties may apply.

- Accuracy-Related Penalties: Errors or omissions on the tax return can lead to further penalties if the IRS determines that the taxpayer did not exercise reasonable care.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can significantly impact how the 2021 form 1040 is filled out. For instance:

- Self-Employed: Individuals who are self-employed must report their income differently and may need to file additional schedules, such as Schedule C, to detail their business income and expenses.

- Retired: Retirees may have unique income sources, such as pensions or Social Security benefits, which must be reported accurately on the form.

- Students: Students may qualify for education-related credits and deductions, which can affect their overall tax liability.

Each scenario requires careful consideration of the specific tax implications and available credits or deductions.

Quick guide on how to complete us territories self employment tax irs video portal

Effortlessly prepare U S Territories Self Employment Tax IRS Video Portal on any device

The management of online documents has gained considerable traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle U S Territories Self Employment Tax IRS Video Portal on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and eSign U S Territories Self Employment Tax IRS Video Portal with ease

- Find U S Territories Self Employment Tax IRS Video Portal and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form hunting, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign U S Territories Self Employment Tax IRS Video Portal and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us territories self employment tax irs video portal

Create this form in 5 minutes!

How to create an eSignature for the us territories self employment tax irs video portal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2021 Form 1040, and why is it important?

The 2021 Form 1040 is the standard individual income tax form used by Americans to file their annual tax returns. It is essential as it determines your tax liability and eligibility for various tax credits and deductions, directly impacting your financial standing for the year.

-

How can airSlate SignNow help with 2021 Form 1040 filing?

airSlate SignNow simplifies the process of preparing and submitting your 2021 Form 1040 by allowing you to securely eSign and send documents electronically. Its user-friendly interface makes it easy to manage forms and collaborate with tax professionals, ensuring your filing is both efficient and compliant.

-

What pricing options are available for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. You can access competitive pricing options that allow seamless handling of the 2021 Form 1040 and other documents without breaking the bank.

-

Is airSlate SignNow compliant with tax regulations for 2021 Form 1040?

Yes, airSlate SignNow is fully compliant with federal regulations regarding electronic signatures and documents. This compliance ensures that your submissions, including the 2021 Form 1040, are legally valid and recognized by the IRS.

-

What features does airSlate SignNow offer for managing the 2021 Form 1040?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking of document statuses. These tools streamline the completion and submission of your 2021 Form 1040, allowing for a hassle-free filing experience.

-

Can I integrate airSlate SignNow with other accounting software for my 2021 Form 1040 needs?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing your workflow for managing the 2021 Form 1040. This integration allows for easy importation of data and ensures your documents are always up-to-date.

-

How does airSlate SignNow ensure the security of my 2021 Form 1040?

Security is a top priority for airSlate SignNow, which employs advanced encryption and authentication measures to protect your documents. This high level of security ensures that your sensitive information on the 2021 Form 1040 remains confidential and secure throughout the signing process.

Get more for U S Territories Self Employment Tax IRS Video Portal

Find out other U S Territories Self Employment Tax IRS Video Portal

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation