26 USC 7530 Application of Earned Income Tax Credit to 2024-2026

Understanding the Independent Contractor Tax Calculator

An independent contractor tax calculator is a valuable tool for freelancers and self-employed individuals to estimate their tax obligations. This calculator typically considers various factors, including income, deductions, and applicable tax rates. By inputting your earnings and expenses, you can gain insights into how much you should set aside for taxes, helping you avoid surprises during tax season.

How to Use an Independent Contractor Tax Calculator

To effectively use an independent contractor tax calculator, follow these steps:

- Gather your income information, including all sources of revenue.

- Compile your business expenses, such as office supplies, travel, and any other deductible costs.

- Input your total income and expenses into the calculator.

- Review the estimated tax amount provided by the calculator, which may include federal, state, and self-employment taxes.

Using this tool helps you plan your finances and ensures you are prepared for quarterly tax payments.

Filing Deadlines and Important Dates

Independent contractors must be aware of key filing deadlines to remain compliant with tax regulations. Typically, the following dates are crucial:

- January 15: Deadline for the fourth quarter estimated tax payment for the previous year.

- April 15: Deadline for filing your annual tax return, including the 1040 form.

- June 15: Deadline for the second quarter estimated tax payment.

- September 15: Deadline for the third quarter estimated tax payment.

Missing these deadlines can result in penalties and interest charges, so it is essential to stay organized and informed.

Required Documents for Filing Taxes as an Independent Contractor

When filing taxes, independent contractors should prepare several key documents to ensure accuracy and compliance:

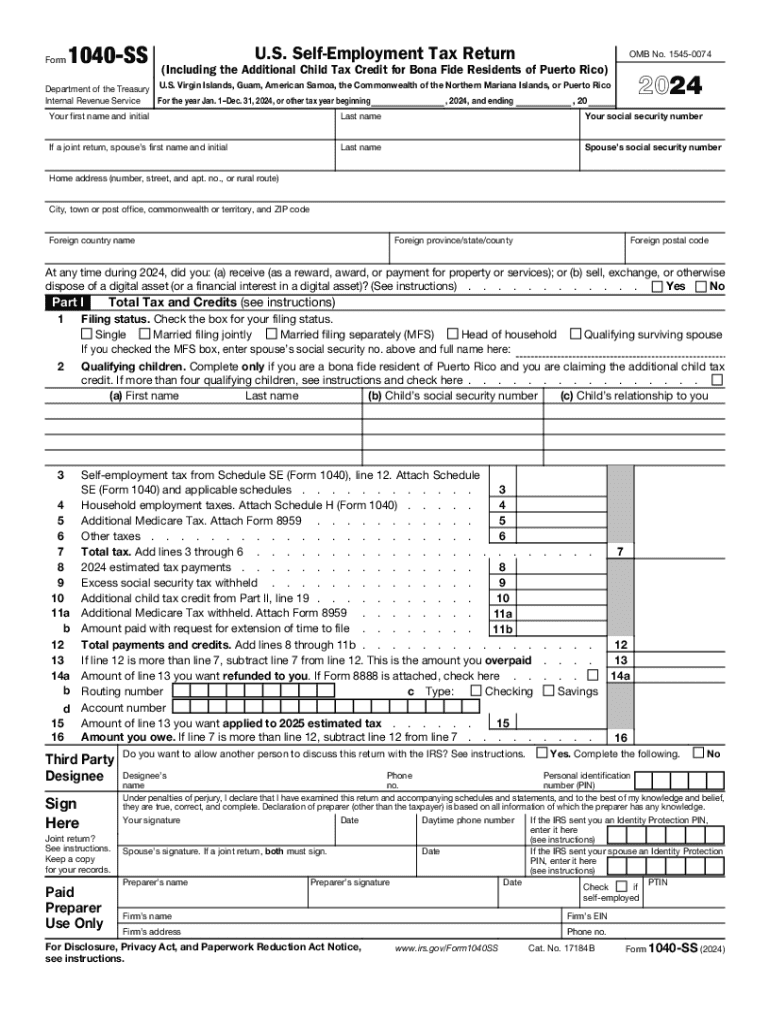

- Form 1040: The primary tax form for individual income tax returns.

- Schedule C: Used to report income or loss from a business operated as a sole proprietorship.

- Form 1099-NEC: Reports payments made to independent contractors.

- Receipts and records of business expenses: Essential for claiming deductions.

Having these documents ready will streamline the filing process and help maximize deductions.

Eligibility Criteria for Tax Deductions

Independent contractors can take advantage of various tax deductions, but eligibility depends on specific criteria:

- The expense must be ordinary and necessary for your business.

- You must have documentation to support the expense, such as receipts or invoices.

- The expense should be directly related to your business activities.

Understanding these criteria helps ensure that you can claim all eligible deductions and reduce your taxable income effectively.

IRS Guidelines for Independent Contractors

The IRS provides specific guidelines that independent contractors must follow to comply with tax laws. Key points include:

- Independent contractors are responsible for paying their own taxes, including self-employment tax.

- Quarterly estimated tax payments are required if you expect to owe $1,000 or more in taxes.

- Keep accurate records of all income and expenses to support your tax return.

Staying informed about IRS guidelines ensures that you meet your obligations and avoid potential issues during audits.

Create this form in 5 minutes or less

Find and fill out the correct 26 usc 7530 application of earned income tax credit to

Create this form in 5 minutes!

How to create an eSignature for the 26 usc 7530 application of earned income tax credit to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an independent contractor tax calculator?

An independent contractor tax calculator is a tool designed to help freelancers and self-employed individuals estimate their tax obligations. By inputting income and expenses, users can get a clearer picture of their potential tax liabilities, making it easier to plan ahead.

-

How does the independent contractor tax calculator work?

The independent contractor tax calculator works by allowing users to enter their income, deductible expenses, and other relevant financial information. It then calculates estimated taxes owed, taking into account federal and state tax rates, ensuring that users have a comprehensive understanding of their tax situation.

-

Is the independent contractor tax calculator free to use?

Many independent contractor tax calculators are available for free, while some may offer premium features for a fee. It's important to review the specific calculator you choose to understand any associated costs and the value of the features provided.

-

What features should I look for in an independent contractor tax calculator?

When selecting an independent contractor tax calculator, look for features such as user-friendly interfaces, the ability to input various income sources, expense tracking, and integration with accounting software. These features can enhance your experience and provide more accurate tax estimates.

-

Can the independent contractor tax calculator help with quarterly tax payments?

Yes, an independent contractor tax calculator can assist in estimating quarterly tax payments. By calculating your expected annual tax liability, it can help you determine how much to set aside for each quarter, ensuring you stay compliant and avoid penalties.

-

How can I integrate the independent contractor tax calculator with my accounting software?

Many independent contractor tax calculators offer integration options with popular accounting software. Check the calculator's documentation or support resources to find out how to connect it with your existing tools for seamless financial management.

-

What are the benefits of using an independent contractor tax calculator?

Using an independent contractor tax calculator can save you time and reduce stress by providing accurate tax estimates. It helps you stay organized, plan for tax payments, and maximize deductions, ultimately leading to better financial management.

Get more for 26 USC 7530 Application Of Earned Income Tax Credit To

- Batch plant operator training form

- Lone wolf character sheet pdf form

- Icmje form for disclosure of potential conflicts of interest

- Waiver of liability and hold harmless agreement form

- American psycho book pdf form

- Senior project independent study time log vernon regional adult form

- Gestational surrogate application form the center for egg options

- Chapelgate counseling form

Find out other 26 USC 7530 Application Of Earned Income Tax Credit To

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free