Form 720 2020

What is the Form 720

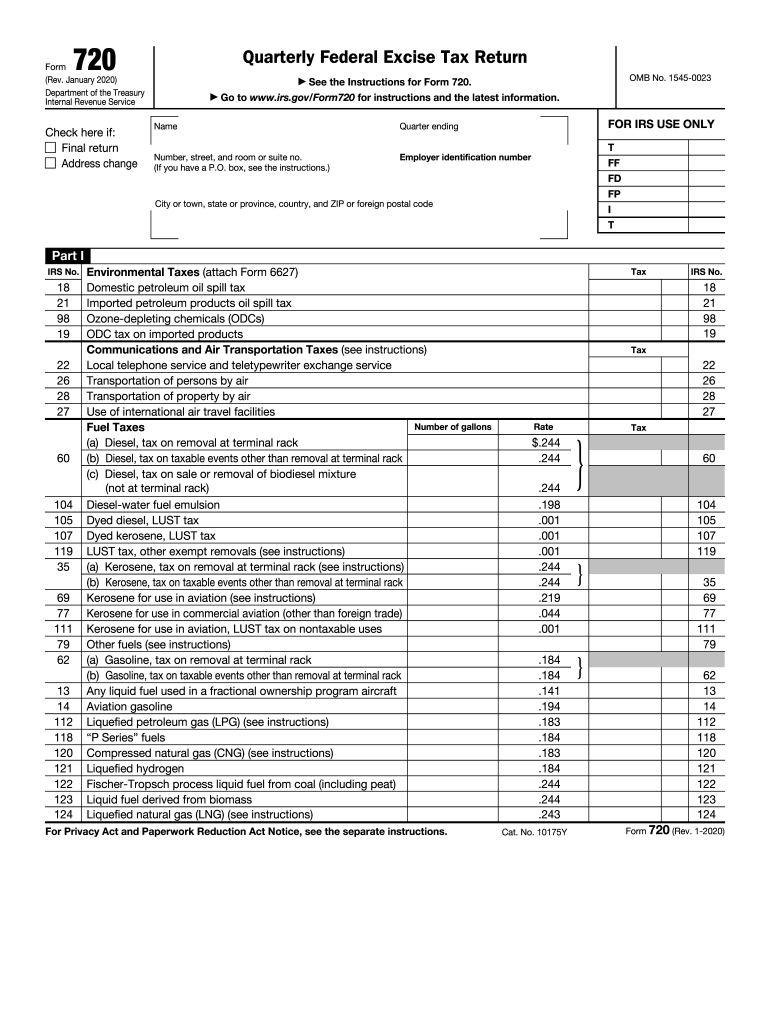

The Form 720, officially known as the IRS Form 720, is a tax form used by businesses to report and pay certain federal excise taxes. This form is primarily utilized for reporting taxes on specific goods and services, such as environmental taxes or taxes on the sale of certain products. The 2018 version of the Form 720 includes various schedules for different types of excise taxes, making it essential for businesses to understand their obligations under U.S. tax law.

How to use the Form 720

To effectively use the Form 720, businesses must first determine if they are liable for any excise taxes. This involves identifying the specific products or services that fall under the excise tax category. Once liability is established, the business should complete the appropriate sections of the form, ensuring all required information is accurately reported. It is crucial to review IRS guidelines for the specific excise taxes applicable to your business to ensure compliance.

Steps to complete the Form 720

Completing the Form 720 involves several key steps:

- Gather necessary information about your business and the specific excise taxes applicable.

- Download the Form 720 from the IRS website or access it through a reliable eSigning platform.

- Fill out the required sections, including identifying the type of excise tax and calculating the total amount owed.

- Review the form for accuracy, ensuring all calculations are correct and all necessary schedules are included.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Legal use of the Form 720

The legal use of the Form 720 is governed by IRS regulations, which require accurate reporting of excise taxes. When completed correctly, the form serves as a legally binding document that confirms a business's tax obligations. It is essential to maintain compliance with all IRS guidelines to avoid penalties. Utilizing an electronic signature solution can enhance the legal standing of the document, ensuring that it meets all requirements for eSignature validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 are typically quarterly, with specific due dates for each quarter. Businesses must be aware of these dates to ensure timely submission and avoid penalties. The deadlines for the 2018 tax year are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The Form 720 can be submitted in several ways, providing flexibility for businesses. Options include:

- Online: Businesses can file electronically using IRS-approved e-filing software, which often streamlines the process.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, as indicated in the form instructions.

- In-Person: Some businesses may choose to submit the form in person at designated IRS offices, though this option is less common.

Quick guide on how to complete get the 720 quarterly federal excise tax return form rev

Effortlessly finalize Form 720 on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form 720 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to edit and electronically sign Form 720 with ease

- Locate Form 720 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 720 to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the 720 quarterly federal excise tax return form rev

Create this form in 5 minutes!

How to create an eSignature for the get the 720 quarterly federal excise tax return form rev

How to make an eSignature for your Get The 720 Quarterly Federal Excise Tax Return Form Rev online

How to generate an electronic signature for your Get The 720 Quarterly Federal Excise Tax Return Form Rev in Google Chrome

How to generate an eSignature for signing the Get The 720 Quarterly Federal Excise Tax Return Form Rev in Gmail

How to generate an eSignature for the Get The 720 Quarterly Federal Excise Tax Return Form Rev from your mobile device

How to generate an electronic signature for the Get The 720 Quarterly Federal Excise Tax Return Form Rev on iOS

How to generate an eSignature for the Get The 720 Quarterly Federal Excise Tax Return Form Rev on Android

People also ask

-

What is form 720 2018 and why is it important?

Form 720 2018 is the IRS form used to report and pay the federal excise tax on certain goods and services. Understanding this form is crucial for businesses engaging in taxable activities to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with completing form 720 2018?

airSlate SignNow streamlines the completion and submission of form 720 2018 by providing an intuitive eSignature platform. You can easily fill out the form, obtain signatures, and send it securely, making the process efficient and hassle-free.

-

What features does airSlate SignNow offer for managing form 720 2018?

With airSlate SignNow, users benefit from features like customizable templates, real-time tracking, and secure storage. These functionalities enhance the management of form 720 2018, ensuring faster completion and compliance.

-

Is there a pricing model for using airSlate SignNow for form 720 2018?

Yes, airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose a plan that best fits your budget, allowing for efficient handling of documents, including form 720 2018.

-

Can I integrate airSlate SignNow with other tools for form 720 2018 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and more. This integration allows for a smoother workflow when handling documents like form 720 2018.

-

What are the benefits of using airSlate SignNow for form 720 2018 eSigning?

Using airSlate SignNow for eSigning form 720 2018 provides numerous benefits, including enhanced security, faster turnaround times, and improved tracking. This ensures that you maintain compliance while saving time and resources.

-

Is airSlate SignNow secure for handling sensitive information in form 720 2018?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect your data. You can trust that sensitive information related to form 720 2018 is handled with the utmost care and security.

Get more for Form 720

- Supervising pharmacist agreement form 409901 emedny

- Blumberg apartment form

- Ntip individual strategy form

- Sg1 girl guides form

- Demat ac closing form india bull

- Answer and counterclaim clerk of the court alachuaclerk form

- Nsctng 001 homeport us naval sea cadet corps form

- Specialty player action form utah youth soccer association spartaunited

Find out other Form 720

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template