1099 Int Irs Form 2024

What is the 1099 Int IRS Form

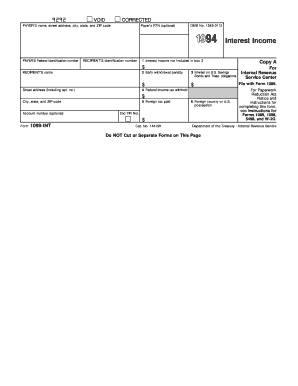

The 1099 Int IRS Form is a tax document used in the United States to report interest income. Financial institutions, such as banks and credit unions, issue this form to individuals who have earned more than ten dollars in interest during the tax year. The form provides essential details, including the amount of interest earned, the payer's information, and the recipient's taxpayer identification number. It is crucial for taxpayers to accurately report this income when filing their federal tax returns to ensure compliance with IRS regulations.

How to use the 1099 Int IRS Form

To use the 1099 Int IRS Form, individuals must first receive it from their financial institution or entity that paid the interest. Once received, taxpayers should review the information for accuracy. The total interest reported on the form must be included on the individual's tax return, typically on Schedule B of Form 1040. It is important to keep a copy of the form for personal records and to ensure that the reported income matches what is filed with the IRS.

Steps to complete the 1099 Int IRS Form

Completing the 1099 Int IRS Form involves several steps. First, gather all relevant information, including the payer's name, address, and taxpayer identification number. Next, enter the total amount of interest earned in the designated box on the form. Ensure that the recipient's information is accurate, including their name and Social Security number. Finally, submit the form to the IRS by the required deadline, and provide a copy to the recipient for their records.

Filing Deadlines / Important Dates

The filing deadlines for the 1099 Int IRS Form are critical for compliance. Typically, the form must be sent to the IRS by the end of February if filed on paper and by the end of March if filed electronically. Recipients should receive their copies by January 31. It is essential for both payers and recipients to adhere to these deadlines to avoid potential penalties and ensure accurate reporting of interest income.

Key elements of the 1099 Int IRS Form

Key elements of the 1099 Int IRS Form include the payer's information, the recipient's information, and the total interest income earned. The form also includes boxes for reporting federal income tax withheld, if applicable. Each section must be filled out accurately to reflect the financial transaction. Understanding these elements is vital for both the issuer and the recipient to ensure proper reporting and compliance with IRS regulations.

Who Issues the Form

The 1099 Int IRS Form is typically issued by financial institutions, such as banks, credit unions, and other entities that pay interest to individuals. These organizations are responsible for reporting the interest payments made to their customers to the IRS. It is important for taxpayers to keep track of the forms they receive from these institutions, as they play a crucial role in accurately reporting income on tax returns.

Quick guide on how to complete 1099 int irs form

Prepare 1099 Int Irs Form effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without obstacles. Manage 1099 Int Irs Form on any device using airSlate SignNow apps available for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign 1099 Int Irs Form with ease

- Find 1099 Int Irs Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 Int Irs Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 int irs form

Create this form in 5 minutes!

How to create an eSignature for the 1099 int irs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 Int IRS Form?

The 1099 Int IRS Form is a tax document used to report interest income earned by individuals and businesses. It is essential for accurately reporting earnings to the IRS and ensuring compliance with tax regulations. Understanding this form is crucial for anyone receiving interest payments.

-

How can airSlate SignNow help with the 1099 Int IRS Form?

airSlate SignNow simplifies the process of sending and eSigning the 1099 Int IRS Form. Our platform allows users to easily create, send, and manage these forms electronically, ensuring a smooth and efficient workflow. This helps businesses save time and reduce errors associated with manual processing.

-

What are the pricing options for using airSlate SignNow for the 1099 Int IRS Form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while providing access to features for managing the 1099 Int IRS Form. Check our website for detailed pricing information.

-

Are there any integrations available for the 1099 Int IRS Form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage the 1099 Int IRS Form. These integrations help streamline your workflow by allowing you to import data directly from your accounting system. This reduces manual entry and minimizes errors.

-

What features does airSlate SignNow offer for managing the 1099 Int IRS Form?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure eSigning for the 1099 Int IRS Form. These tools enhance efficiency and ensure that your documents are completed accurately and on time. Additionally, you can track the status of your forms in real-time.

-

Is airSlate SignNow secure for handling the 1099 Int IRS Form?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your 1099 Int IRS Form and other sensitive documents are protected. We use advanced encryption and secure storage solutions to safeguard your data, giving you peace of mind when managing your tax documents.

-

Can I access the 1099 Int IRS Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the 1099 Int IRS Form on the go. Whether you are using a smartphone or tablet, you can easily send, sign, and track your documents from anywhere. This flexibility enhances productivity for busy professionals.

Get more for 1099 Int Irs Form

- Dwc form 153 569697630

- 009 information online

- Kentucky search warrant form

- 60 day involuntary latest form

- Illinois secretary of state spanish edition form

- Corporation x washington state department of transportation form

- Form hsmv96020 ampquotrequest to withhold personal informationampquot florida templateroller

- Adult literacy classes illinois secretary of state form

Find out other 1099 Int Irs Form

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament