Form 4835 Farm Rental Income and Expenses 2023

What is Form 4835 Farm Rental Income And Expenses

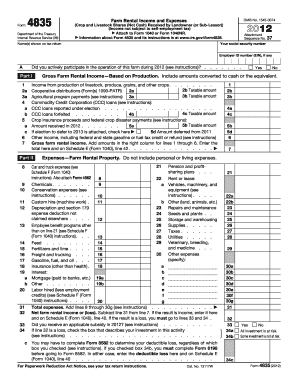

Form 4835 is a tax form used by individuals who receive rental income from farming activities. This form is specifically designed for reporting income and expenses related to renting out farm property. It is essential for taxpayers who operate farms as sole proprietors or those who rent out farmland but do not materially participate in the farming operations. The information reported on Form 4835 is used to calculate taxable income from farm rental activities, which is then reported on the taxpayer's individual income tax return.

How to use Form 4835 Farm Rental Income And Expenses

To effectively use Form 4835, taxpayers should gather all relevant financial information regarding their farm rental income and associated expenses. This includes details about rental agreements, income received, and any costs incurred in maintaining the property. The form consists of sections for reporting income, expenses, and the net profit or loss from the rental activity. It is important to accurately complete each section to ensure compliance with IRS regulations and to maximize potential deductions.

Steps to complete Form 4835 Farm Rental Income And Expenses

Completing Form 4835 involves several key steps:

- Begin by entering your personal information, including your name and Social Security number.

- Report total rental income received from farming activities in the appropriate section.

- List all allowable expenses related to the rental property, such as repairs, maintenance, and property taxes.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Transfer the net figure to your individual income tax return.

Key elements of Form 4835 Farm Rental Income And Expenses

Form 4835 includes several key elements that are crucial for accurate reporting:

- Rental Income: This section captures all income received from renting out farm property.

- Expenses: Taxpayers can deduct various expenses, including depreciation, repairs, and utilities.

- Net Profit or Loss: This is the final calculation that determines the taxable amount from farm rental income.

Filing Deadlines / Important Dates

Form 4835 must be filed by the tax deadline, which is typically April 15 for most individual taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure they file on time to avoid penalties and interest on any unpaid taxes.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 4835. Taxpayers should refer to the IRS instructions for the form to understand eligibility criteria, allowable expenses, and any changes to tax laws that may affect their reporting. Following these guidelines helps ensure compliance and reduces the risk of audits or penalties.

Quick guide on how to complete form 4835 farm rental income and expenses

Effortlessly Prepare Form 4835 Farm Rental Income And Expenses on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form 4835 Farm Rental Income And Expenses on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and Electronically Sign Form 4835 Farm Rental Income And Expenses With Ease

- Obtain Form 4835 Farm Rental Income And Expenses and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, hassle-prone form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4835 Farm Rental Income And Expenses and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4835 farm rental income and expenses

Create this form in 5 minutes!

How to create an eSignature for the form 4835 farm rental income and expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4835 Farm Rental Income And Expenses?

Form 4835 Farm Rental Income And Expenses is a tax form used by individuals who receive rental income from farming activities. It helps in reporting income and expenses related to farming operations, ensuring compliance with IRS regulations. Understanding this form is crucial for accurate tax reporting and maximizing deductions.

-

How can airSlate SignNow assist with Form 4835 Farm Rental Income And Expenses?

airSlate SignNow provides a seamless platform for eSigning and managing documents, including Form 4835 Farm Rental Income And Expenses. With our user-friendly interface, you can easily prepare, send, and sign your tax forms electronically, saving time and reducing paperwork. This ensures that your tax documents are handled efficiently and securely.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, from individuals to large businesses. Our plans include features that support the management of documents like Form 4835 Farm Rental Income And Expenses at competitive rates. You can choose a plan that fits your budget while enjoying the benefits of our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features designed to enhance document management, such as customizable templates, secure cloud storage, and real-time tracking. These features make it easy to manage important documents like Form 4835 Farm Rental Income And Expenses efficiently. Additionally, our platform supports collaboration, allowing multiple users to work on documents simultaneously.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that documents like Form 4835 Farm Rental Income And Expenses are legally binding and secure. You can trust our platform to handle your sensitive tax documents with the utmost integrity.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. Whether you need to connect with accounting software or other document management tools, our platform can easily integrate to streamline the handling of Form 4835 Farm Rental Income And Expenses and other important documents.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like Form 4835 Farm Rental Income And Expenses provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform simplifies the signing process, allowing you to complete your tax forms quickly and accurately. Additionally, you can access your documents anytime, anywhere, ensuring you stay organized and compliant.

Get more for Form 4835 Farm Rental Income And Expenses

- See rules 132 and 26 of registration of electors rule 1960 form

- Preferred homecare cpap order form 405250997

- Key bank ach form

- St louis county certificate of value form

- Dbpr freab 16 change of status form doc

- Level b application for renewal skilled trades bc form

- Term sheet template for angel investment form

- Truck dispatch service agreement template form

Find out other Form 4835 Farm Rental Income And Expenses

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document