Form 8829 2004

What is the Form 8829

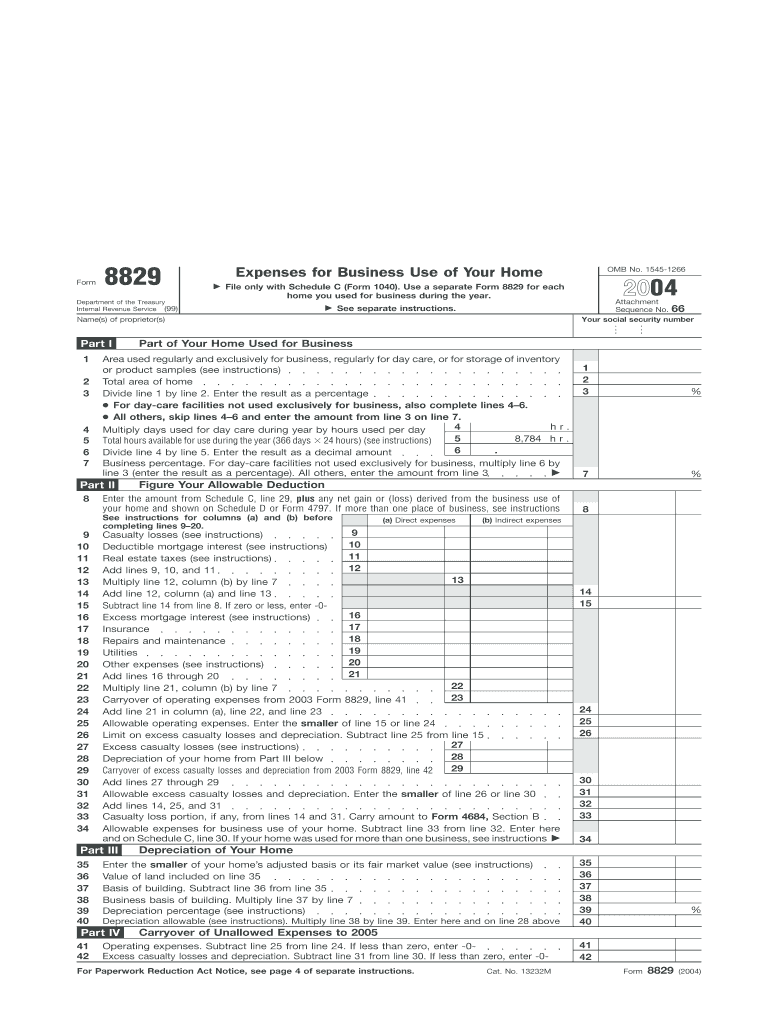

The Form 8829, officially known as the "Expenses for Business Use of Your Home," is a tax form used by individuals who qualify for home office deductions. This form allows taxpayers to calculate the allowable expenses related to the business use of their home, which can significantly reduce taxable income. The IRS requires this form to ensure that individuals are accurately reporting their home office expenses in compliance with tax regulations.

How to use the Form 8829

To utilize the Form 8829 effectively, taxpayers must first determine their eligibility for home office deductions. This involves confirming that a specific area of the home is used exclusively and regularly for business purposes. Once eligibility is established, individuals can fill out the form by providing details about the home office space, including its size and associated costs such as mortgage interest, utilities, and repairs. Accurate completion of the form is essential for maximizing deductions and ensuring compliance with IRS guidelines.

Steps to complete the Form 8829

Completing the Form 8829 involves several key steps:

- Determine the total area of your home and the area used for business.

- Calculate the percentage of your home used for business by dividing the business area by the total home area.

- Gather documentation for all relevant expenses, including mortgage interest, property taxes, and utility bills.

- Fill out the form by entering the calculated percentages and expenses in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the Form 8829

The legal use of the Form 8829 is governed by IRS regulations. Taxpayers must ensure that the home office meets specific criteria, such as being the principal place of business or a location where clients are met. Additionally, the expenses claimed must be directly related to the business use of the home. Compliance with IRS guidelines is crucial to avoid penalties or disallowance of deductions during an audit.

Eligibility Criteria

To qualify for using the Form 8829, taxpayers must meet certain eligibility criteria. The home office must be used exclusively for business activities, which means it cannot serve any personal purposes. Furthermore, the space must be the principal place of business or a location where significant business activities take place. Self-employed individuals, freelancers, and small business owners typically qualify, but it is essential to review IRS guidelines to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8829 align with the standard tax filing deadlines for individual income tax returns. Typically, this means that the form must be submitted by April 15 of the following tax year. If taxpayers require additional time, they may file for an extension, which grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 2004 form 8829

Effortlessly Prepare Form 8829 on Any Device

Managing documents online has gained signNow traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form 8829 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related tasks today.

How to Modify and Electronically Sign Form 8829 with Ease

- Obtain Form 8829 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 8829 to ensure seamless communication throughout the entirety of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2004 form 8829

Create this form in 5 minutes!

How to create an eSignature for the 2004 form 8829

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 8829 and how does it relate to airSlate SignNow?

Form 8829 is used by self-employed individuals to claim expenses for business use of their home. With airSlate SignNow, completing and eSigning Form 8829 is hassle-free, allowing you to efficiently manage your tax documents and stay organized.

-

How can airSlate SignNow help me fill out Form 8829?

airSlate SignNow provides templates that simplify the process of filling out Form 8829. With our easy-to-use interface, you'll be guided through the necessary fields, ensuring your form is accurately completed and ready for submission.

-

Is there a cost associated with using airSlate SignNow for Form 8829?

Yes, airSlate SignNow offers competitive pricing plans that provide access to its eSigning features, including the ability to manage Form 8829. The cost is designed to be cost-effective for businesses of all sizes, ensuring you get great value for your document management needs.

-

What features does airSlate SignNow offer for managing Form 8829?

airSlate SignNow offers a range of features for Form 8829, including customizable templates, secure eSignatures, and document sharing options. These features streamline the completion and submission process, saving you time and reducing stress during tax season.

-

Can I integrate airSlate SignNow with other software to handle Form 8829?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easy to manage Form 8829 alongside your other financial documentation. This connectivity helps ensure that all your records are aligned and up-to-date.

-

What are the benefits of using airSlate SignNow for Form 8829?

Using airSlate SignNow for Form 8829 enhances efficiency and ensures accuracy in your tax filing process. Our platform also offers added security for your sensitive information, giving you peace of mind as you navigate your business finances.

-

Is airSlate SignNow user-friendly for first-time users filling out Form 8829?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for first-time users. The intuitive interface and step-by-step guidance make completing Form 8829 quick and straightforward.

Get more for Form 8829

- Non marital cohabitation living together agreement idaho form

- Paternity law and procedure handbook idaho form

- Bill of sale in connection with sale of business by individual or corporate seller idaho form

- Office lease agreement idaho form

- Commercial sublease idaho form

- Residential lease renewal agreement idaho form

- Idaho option form

- Assignment of lease and rent from borrower to lender idaho form

Find out other Form 8829

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online